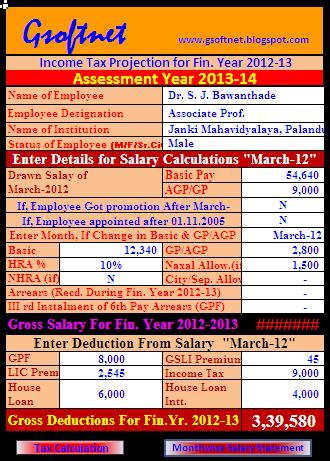

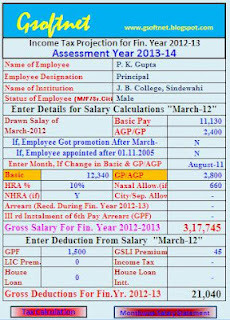

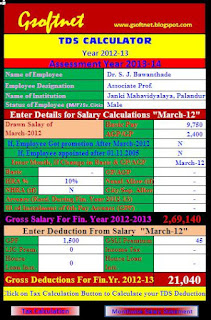

Download our Free Android App FinCalCto Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more. Rebate is maximum of 12,500/- for income up to 5,00,000 under section 87A. Mention the same accordingly.  The next step is to calculate the yearly tax liability. Read More: How to Calculate Interest on a Loan in Excel (5 Methods). Also, you can assess your income and investments and find ways to save income tax with Old tax regime if that helps you to pay less income tax in the financial year. The next step is to measure the education cess. Below is the data that is projected for complete financial year: So as seen above, the gross earnings for financial year is Rs. Budget 2020 had introduced the new Vs old tax slabs. This is an Excel based TDS Calculator for the FY 2021-22 and onwards. 25,272 as income tax that you have to pay. 4,37,200. The calculator is created using Microsoft excel. 7,00,350. 194O - Payment for sale of goods or provision of services by e-commerce operator. Automatically generated API Documentation that describes how to use our APIs. After the addition of 4% education and higher education cess, his net payable tax becomes Rs. In the screen that opens, select Financial year & employee. All the information in the blog is for educational and informational purpose only. 2340 per month (for 3 months), July to March period = Rs. How to Calculate TDS in Excel FY 2021-22 |TDS Calculator. Description: This is an Excel based TDS Calculation Utility, can be used for Calculating Step 1: Calculate Yearly Salary. Have you Explored all Options to Save Tax for FY 2021-22? Follow the Blog andSubscribe to YouTube Channelto stay updated about Personal Finance and Money Management topics. For more concerns related to data privacy write us at info@fintaxpro.inFintaxpro Advisory LLPThis Video will also help you to understand below topics-salary tds calculationincome tax salary tds calculationsalary tds calculation with exampleTDS ON SALARY FOR FY 2020-21salary tds calculationtds calculation on salarysalary tds calculationTDS RATE ON SALARYsalary tds calculation 2020-21TDS ON SALARY CALCULATIONsalary tds return filing onlinesalary tds calculation 2019-20salary tds deduction calculatorsalary tds calculation excel sheet fy 2019-20salary tds calculator in excelsalary tds calculation sheetsalary tds calculation onlinehow to salary tds deductionTDS ON SALARY FOR FY 2020-21 (AY 2021-22)| TDS RATE ON SALARY| TDS ON SALARY CALCULATION| Sec192tds for salary employeetds on salary journal entrytds calculation on salary in englishtds on salary in englishsalary tds filingtds from salarytds payment for salarytds for salary calculatortds in salary in hindisalary tds kaise nikaletds on salarytds calculation on salarytds on salary 2020-21tds on salary return filingtds on salary section 192salary tds payment due date for april 2020salary per tds ratesalary tds return 24qsalary tds return filingsalary tds returnsalary tds return form 24qsalary tds return proceduresalary tds rate fy 2020-21salary tds return form 24q excel formattds section 192 salarytds slab on salarytds other than salarysalary tds working in excel format 2019-20tds on salary 19-20salary on tds rate 2019-20how to salary tds deductionsalary tds in tally erp 9salary tds entry in tallysalary per tds ratesalary tds calculationtds calculation on salarytds calculation on salary for fy 2018-19tds calculation on salary for fy 2018-19 in exceltds calculation on salary for fy 2019-20 in excelsalary tds calculation 2018-19income tax salary tds calculationsalary tds calculator exceltds calculation on salary.xlstds calculation on gross salary Conclusion. The general formula is: Average Income Tax Rate = Income Tax Payable (computed through slab rates) / Estimated income for the financial year. 25,000 in April to May quarter, and lets say your Basic Salary is increased to Rs.

The next step is to calculate the yearly tax liability. Read More: How to Calculate Interest on a Loan in Excel (5 Methods). Also, you can assess your income and investments and find ways to save income tax with Old tax regime if that helps you to pay less income tax in the financial year. The next step is to measure the education cess. Below is the data that is projected for complete financial year: So as seen above, the gross earnings for financial year is Rs. Budget 2020 had introduced the new Vs old tax slabs. This is an Excel based TDS Calculator for the FY 2021-22 and onwards. 25,272 as income tax that you have to pay. 4,37,200. The calculator is created using Microsoft excel. 7,00,350. 194O - Payment for sale of goods or provision of services by e-commerce operator. Automatically generated API Documentation that describes how to use our APIs. After the addition of 4% education and higher education cess, his net payable tax becomes Rs. In the screen that opens, select Financial year & employee. All the information in the blog is for educational and informational purpose only. 2340 per month (for 3 months), July to March period = Rs. How to Calculate TDS in Excel FY 2021-22 |TDS Calculator. Description: This is an Excel based TDS Calculation Utility, can be used for Calculating Step 1: Calculate Yearly Salary. Have you Explored all Options to Save Tax for FY 2021-22? Follow the Blog andSubscribe to YouTube Channelto stay updated about Personal Finance and Money Management topics. For more concerns related to data privacy write us at info@fintaxpro.inFintaxpro Advisory LLPThis Video will also help you to understand below topics-salary tds calculationincome tax salary tds calculationsalary tds calculation with exampleTDS ON SALARY FOR FY 2020-21salary tds calculationtds calculation on salarysalary tds calculationTDS RATE ON SALARYsalary tds calculation 2020-21TDS ON SALARY CALCULATIONsalary tds return filing onlinesalary tds calculation 2019-20salary tds deduction calculatorsalary tds calculation excel sheet fy 2019-20salary tds calculator in excelsalary tds calculation sheetsalary tds calculation onlinehow to salary tds deductionTDS ON SALARY FOR FY 2020-21 (AY 2021-22)| TDS RATE ON SALARY| TDS ON SALARY CALCULATION| Sec192tds for salary employeetds on salary journal entrytds calculation on salary in englishtds on salary in englishsalary tds filingtds from salarytds payment for salarytds for salary calculatortds in salary in hindisalary tds kaise nikaletds on salarytds calculation on salarytds on salary 2020-21tds on salary return filingtds on salary section 192salary tds payment due date for april 2020salary per tds ratesalary tds return 24qsalary tds return filingsalary tds returnsalary tds return form 24qsalary tds return proceduresalary tds rate fy 2020-21salary tds return form 24q excel formattds section 192 salarytds slab on salarytds other than salarysalary tds working in excel format 2019-20tds on salary 19-20salary on tds rate 2019-20how to salary tds deductionsalary tds in tally erp 9salary tds entry in tallysalary per tds ratesalary tds calculationtds calculation on salarytds calculation on salary for fy 2018-19tds calculation on salary for fy 2018-19 in exceltds calculation on salary for fy 2019-20 in excelsalary tds calculation 2018-19income tax salary tds calculationsalary tds calculator exceltds calculation on salary.xlstds calculation on gross salary Conclusion. The general formula is: Average Income Tax Rate = Income Tax Payable (computed through slab rates) / Estimated income for the financial year. 25,000 in April to May quarter, and lets say your Basic Salary is increased to Rs.  So, employers are instructed to collect Tax at source, that is while transferring employees salary to their bank accounts. Useful for read and thanks for sharing.

So, employers are instructed to collect Tax at source, that is while transferring employees salary to their bank accounts. Useful for read and thanks for sharing.  You can have the complete list in the post: Must have Tax Free components in Salary. Here I post articles related to Microsoft Excel. A significant difference is there is no more distinction between men and women as far as taxes are concerned. In the given scenario, two advance payments must made to vendor for INR 20,00,000 and 15,00,000 respectively, on which 0.10% TDS is applicable under TDS Section 194Q. 25,272 and based on New Tax Regime as Rs. Read More: How to Calculate Interest Between Two Dates Excel (2 Easy Ways). JOIN Telegram Group and stay updated with latest Personal Finance News and Topics. In case your employer contributes to NPS account on your behalf, you can claim up to 10% of your basic salary as tax deductible. (Applying Rs. Adhiban Group is a leading Financial Services in Coimbatore, India which offers Loans without/less Documents for Corporate Companies & Entrepreneurs. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income. Thank you. Read More: How to Calculate Monthly Interest Rate in Excel (3 Simple Methods). A web console right here to call our API In case you are new to taxes and investment do read our helpful guide on How to take maximum advantage of Section 80C and choose the best investment to save tax. This is an Excel based TDS Calculator for the FY 2021-22 and onwards. Salary income; Pension; House Property; Other Sources (Interest, Dividends etc.) Step 6: Measure Monthly TDS. TDS rates that apply to various forms of payments: With regard to processing TDS returns that include interest requests, this article intends to make interest calculation simpler.

You can have the complete list in the post: Must have Tax Free components in Salary. Here I post articles related to Microsoft Excel. A significant difference is there is no more distinction between men and women as far as taxes are concerned. In the given scenario, two advance payments must made to vendor for INR 20,00,000 and 15,00,000 respectively, on which 0.10% TDS is applicable under TDS Section 194Q. 25,272 and based on New Tax Regime as Rs. Read More: How to Calculate Interest Between Two Dates Excel (2 Easy Ways). JOIN Telegram Group and stay updated with latest Personal Finance News and Topics. In case your employer contributes to NPS account on your behalf, you can claim up to 10% of your basic salary as tax deductible. (Applying Rs. Adhiban Group is a leading Financial Services in Coimbatore, India which offers Loans without/less Documents for Corporate Companies & Entrepreneurs. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income. Thank you. Read More: How to Calculate Monthly Interest Rate in Excel (3 Simple Methods). A web console right here to call our API In case you are new to taxes and investment do read our helpful guide on How to take maximum advantage of Section 80C and choose the best investment to save tax. This is an Excel based TDS Calculator for the FY 2021-22 and onwards. Salary income; Pension; House Property; Other Sources (Interest, Dividends etc.) Step 6: Measure Monthly TDS. TDS rates that apply to various forms of payments: With regard to processing TDS returns that include interest requests, this article intends to make interest calculation simpler.  You can easily check TDS with a few clicks. Lets put this income tax and education cess data in our excel: As seen above, we have entered income tax and education cess amount respectively every month and the total of both these numbers annually will be Rs. 41,400 and annual in hand salary is Rs. This is tax deducted up to Rs 1.5 lakhs.Tax Exemption means the income is not taxable like interest earned on PPF. 12,500 max), due to which our calculated tax of Rs. Then, the total of each individual is shown last. But the total income tax throughout the financial year has to be deducted from your salary every month and is to be paid to the government of India according to Section 192. 7,41,750 respectively. There are components in salary which are fully or partially tax exempt. The calculator does not ask you to sign up or log in, all you would have to do is - provide some basic information, and the calculator will show you the final results within seconds. Featuring popular web formats including JSON and XML. Answer QUIZ. = 12.35%. The next step is to calculate the tax on the taxable income. 6,50,350 and Rs. This calculator will work for both old and new tax slab rate which were released in 2020. Read More: How to Calculate Monthly Salary in Excel (with Easy Steps). TDS for 30000 salary will be Rs. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. This video will guide you how to compute TDS on Salary for FY 2022-23. Do mention Any Other Exempted Receipts/ allowances like LTA, etc.

You can easily check TDS with a few clicks. Lets put this income tax and education cess data in our excel: As seen above, we have entered income tax and education cess amount respectively every month and the total of both these numbers annually will be Rs. 41,400 and annual in hand salary is Rs. This is tax deducted up to Rs 1.5 lakhs.Tax Exemption means the income is not taxable like interest earned on PPF. 12,500 max), due to which our calculated tax of Rs. Then, the total of each individual is shown last. But the total income tax throughout the financial year has to be deducted from your salary every month and is to be paid to the government of India according to Section 192. 7,41,750 respectively. There are components in salary which are fully or partially tax exempt. The calculator does not ask you to sign up or log in, all you would have to do is - provide some basic information, and the calculator will show you the final results within seconds. Featuring popular web formats including JSON and XML. Answer QUIZ. = 12.35%. The next step is to calculate the tax on the taxable income. 6,50,350 and Rs. This calculator will work for both old and new tax slab rate which were released in 2020. Read More: How to Calculate Monthly Salary in Excel (with Easy Steps). TDS for 30000 salary will be Rs. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. This video will guide you how to compute TDS on Salary for FY 2022-23. Do mention Any Other Exempted Receipts/ allowances like LTA, etc.  Subsequently, we will compute the total TDS amount. You will have to enter your payment in this section. TDS on Salary Calculator in Excel Format. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. In Option/alternative 2 (in New regime), the Taxable income calculates without any deductions except for 80CCD (NPS) & rebate u/s 87A. Lets follow the instructions to make TDS interest calculator in Excel. We use cookies to ensure that we give you the best experience on our website. According to Section 192, the TDS on your salary based on the current year's slab rates would be Rs. 1,48,200. The TDS will also depend on the nature of the payment, such as salary, FD, and more. 1,48,200/12,00,000*100. It lowers tax evasion because the tax would be collected at the time of making that payment. You can download the template of the calculator for free. Get FREE Weekly Newsletter to learn more about Personal Finance and become Financially Independent! 44,273 and based on New Tax Regime as Rs. Please send me excel utility on rental income, Business income calculator, please send me excel utility on rental income calculator, Pl. 1,48,200/12,00,000*100. Love Reading Books? In case you have home loan, fill up the columns to reflect the same. WebComplete calculation is done step by step for easy understanding. 20,000, and you also get other allowances and deductions according to below data: You can use your own salary payslip to know these numbers. The exemption on paying interest on Home Loan has been raised from Rs 1.5 Lakhs to Rs 2 Lakh. Step 2: Measure Total Taxable Income from Salary. 1400 per month. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. NRIs (Non-resident Indians) and foreigners have to pay income tax in India on income accrued in India. In Budget 2017, the finance minister has made little changes to this. Required fields are marked *, Notice: It seems you have Javascript disabled in your Browser. Click here to download free excel IT CalculatorIncome Tax Calculator FY 2022-23 (AY 2023-24). TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. TDS Calculator Excel Utility for FY 2021-22. Join millions of Indians who trust and love Groww, Tax deducted at source is a particular amount that is reduced when a certain payment - such as salary, rent, commission, interest, and more is made. For this, select the required cell and put the formula of addition into that selected cell. It looks like your browser does not have JavaScript enabled. The calculator is created using Microsoft excel. Note 2: Monetary limit for TDS applicability should be considered while determining TDS liability. Read More: How to Calculate Accrued Interest on Fixed Deposit in Excel (3 Methods). 4,87,200. Things to Remember. There. You can also include income from gifts received if its more than Rs 50,000 and from non-relatives. display: none !important; Step 1: Calculate Gross total income from salary: Step 5: Calculating using Income Tax Formula. 200 for each day that the delay persists. Will you please advice how to get and what is the Tax impact on this. 6,09,000. You get tax benefit on interest under section 24. https://taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html. 194J - Fees for technical service/call center. 6 Steps for Deduction of TDS on Salary Calculation in Excel. Calculation of TDS on payment of Salary and Wages to Individual Resident, HUF and Non-Resident payees for

Subsequently, we will compute the total TDS amount. You will have to enter your payment in this section. TDS on Salary Calculator in Excel Format. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. In Option/alternative 2 (in New regime), the Taxable income calculates without any deductions except for 80CCD (NPS) & rebate u/s 87A. Lets follow the instructions to make TDS interest calculator in Excel. We use cookies to ensure that we give you the best experience on our website. According to Section 192, the TDS on your salary based on the current year's slab rates would be Rs. 1,48,200. The TDS will also depend on the nature of the payment, such as salary, FD, and more. 1,48,200/12,00,000*100. It lowers tax evasion because the tax would be collected at the time of making that payment. You can download the template of the calculator for free. Get FREE Weekly Newsletter to learn more about Personal Finance and become Financially Independent! 44,273 and based on New Tax Regime as Rs. Please send me excel utility on rental income, Business income calculator, please send me excel utility on rental income calculator, Pl. 1,48,200/12,00,000*100. Love Reading Books? In case you have home loan, fill up the columns to reflect the same. WebComplete calculation is done step by step for easy understanding. 20,000, and you also get other allowances and deductions according to below data: You can use your own salary payslip to know these numbers. The exemption on paying interest on Home Loan has been raised from Rs 1.5 Lakhs to Rs 2 Lakh. Step 2: Measure Total Taxable Income from Salary. 1400 per month. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. NRIs (Non-resident Indians) and foreigners have to pay income tax in India on income accrued in India. In Budget 2017, the finance minister has made little changes to this. Required fields are marked *, Notice: It seems you have Javascript disabled in your Browser. Click here to download free excel IT CalculatorIncome Tax Calculator FY 2022-23 (AY 2023-24). TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. TDS Calculator Excel Utility for FY 2021-22. Join millions of Indians who trust and love Groww, Tax deducted at source is a particular amount that is reduced when a certain payment - such as salary, rent, commission, interest, and more is made. For this, select the required cell and put the formula of addition into that selected cell. It looks like your browser does not have JavaScript enabled. The calculator is created using Microsoft excel. Note 2: Monetary limit for TDS applicability should be considered while determining TDS liability. Read More: How to Calculate Accrued Interest on Fixed Deposit in Excel (3 Methods). 4,87,200. Things to Remember. There. You can also include income from gifts received if its more than Rs 50,000 and from non-relatives. display: none !important; Step 1: Calculate Gross total income from salary: Step 5: Calculating using Income Tax Formula. 200 for each day that the delay persists. Will you please advice how to get and what is the Tax impact on this. 6,09,000. You get tax benefit on interest under section 24. https://taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html. 194J - Fees for technical service/call center. 6 Steps for Deduction of TDS on Salary Calculation in Excel. Calculation of TDS on payment of Salary and Wages to Individual Resident, HUF and Non-Resident payees for  Notice that your in hand salary is reduced to Rs. Considering same example above of starting with Basic Salary + Da of Rs. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income. pl send me income tax calculator with Int U/s 234 A B C. thanks. For any queries, feel free to write to akash@agca.in. Salary Details You can also claim tax benefit on interest paid on home improvement loan. CA Rashmi Gandhi (Expert) Follow. Do you Need Help on the topic you are Reading? This ensures that the federal government collects consistently reducing the burden of the income tax return for dedicatees. 28,080, considering taxable income of Rs. TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. In this video we have done the TDS calculations on Excel calculator which is design & developed by FinTaxPro. The top cells ask for your name and PAN Number. All Rights Reserved. How to use the Income Tax Calculator India for FY 2021-22 (AY 2022-23)? 1,42,500. I'm really excited to welcome you to my profile. Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. To make this calculation easier, you can download TDS automatic interest calculation in excel format. Everyone hates Taxes and go out in full force to save it sometime legally and sometimes beyond the law. 1,48,200/12,00,000*100. Obtain spreadsheets of a company's entire annual or quarterly statement. Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. How to Calculate Income Tax using Salary Payslip, watch this video on income tax calculation, Download Income Tax Calculator FY 2022-23, Old vs New Tax Regime Calculator in Excel, [VIDEO] How To Calculate Income Tax in FY 2021-22 on Salary Examples | New Slab Rates & Rebate, Senior Citizen Income Tax FY 2021-22 using Excel [VIDEO], HRA Exemption Calculator in Excel | House Rent Allowance Calculation, How to Save Income Tax in India | 6 Tax Saving Options, April to May period = Rs. The TDS calculator has its own sets of advantages, and they are mentioned here: 194 - Divident other than dividend as referred to in Section 115-O, 194B - Income from lottery winnings, and other games of any type, 194C - Single Payment to Contractor/Subcontractor, 194C - FY Payment to Contractor/Subcontractor, 194I(B) - Rent on land & building or furniture & fitting. Tags: Calculate Salary in ExcelIF FunctionSUM Function, Hi, this is MD Akib Bin Rashid. In this step, we will calculate the total amount of TDS and interest. We can use this Excel Utility for Calculating TDS Amount, for Remitting TDS Amount to Govt and for e-filing Quarterly TDS Returns without searching Documents/ Bills. In the given scenario, two advance payments must made to vendor for INR 20,00,000 and 15,00,000 respectively, on which 0.10% TDS is applicable under TDS Section 194Q. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. This section computes the Income Tax with Lower Tax Slab under new Regime announced in Budget 2020. Select Old or New regime; Click on List. Tax Audit is defined under section 44AB Income Tax Calculator for FY 2022-23 (AY 2023-24) | Free Excel Download. Very Senior Citizens (above 80 Years of age) to be allowed deduction of Rs 30,000 for medical expenditure in case they do not have health insurance, 2% surcharge on Super rich (i.e. Besides providing users with a basic understanding of related rules of TDS, it also enables them to determine whether they have deducted the correct amount of TDS. 38,23,830 and growing.. India's largest network for finance professionals, https://taxguru.in/income-tax/income-tax-calculator-financial-year-2022-23.html#panel-element-76160. LIVE GST Certification Course by CA Arun Chhajer begins 10th April. Note 1: Consider tax treaties before determining the rate of withholding tax under Section 195. The average rate on TDS would be = Rs. Is Tax Deduction different than Tax Exemption? Featuring popular web formats including JSON and XML. Here, I will explain the process of TDS deduction on salary calculation in Excel. Hoped this may help you. Please let us know in the comment section if you have any questions, suggestions, or feedback. 43,000 and gross deductions is Rs. In this case due to salary increment, for April to May period, income tax will be considered using Rs. If you continue to use this site we will assume that you are happy with it. ALSO READ: How to Calculate Income Tax using Salary Payslip. Good Article! 200 for each day that the delay persists. Step 5: Calculate Tax Liability for Year. I earn a small commission if you buy any products using my affiliate links to Amazon. Payments need to be made to the deductee by the deductor. Step 4: Measure Education Cess. Do you know all tax sections that you can use to save your tax. Many employer (& employers) are confused if they can take advantage of both HRA and Home Loan for saving tax. 3 lakhs for Senior citizens are now exempted from paying Income tax. WebComplete calculation is done step by step for easy understanding. 30,000 basic salary. The calculator can also play the part of eliminating all possible errors while doing a manual calculation. Income Tax Slabs for FY 2019-20 (AY 2020-21) You can download the Income Tax Calculator in Excel for FY 2019-20 from the link below. Lets assume that the monthly salary of a person is Rs 70,000. Income Tax Slabs for FY 2019-20 (AY 2020-21) You can download the Income Tax Calculator in Excel for FY 2019-20 from the link below. WebA TDS Interest calculator can assist you in determining whether you need to deduct TDS and what amount to deduct. Interest under Sec. Your email address will not be published. 194K - Payment of any income for units of a mutual fund, for example, dividend. Free excel Income Tax Calculator for FY 2022-23 (AY 2023-24) is available for free to download. This is an Excel based TDS Calculator for the FY 2021-22 and onwards. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts. Read More: How to Calculate Basic Salary in Excel (3 Common Cases). To calculate the late payment, deductible, or penalties and interest for a TDS statement, use the TDS interest estimator. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. The picture below shows how the income tax calculator India for FY 2021-22 (AY 2022-23) looks like. How to Calculate TDS in Excel FY 2021-22 |TDS Calculator. sabuvjosephpkd@gmail.com, Your email address will not be published. Your email address will not be published. However just for your information its completely legal to take advantage of both HRA & Home Loan as there are multiple situations where you need to live on rent but still pay home loan. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. Click on below link / button to download the free excel income tax calculator for FY 2022-23. Scan below QR code using any UPI App! Click on the links to get the relevant calculator PPF Calculator, Sukanya Samriddhi Yojana Calculator, Senior Citizens Savings Scheme Calculator, NSC Calculator. Fill in the tax deductions you want to claim. You should select Old Tax Regime in this case! Hope this is helpful. ALSO READ: Download Income Tax Calculator FY 2022-23. This comprehensive TDS calculator carries out following calculations for AY 2022-23 (FY 2021-22) : Calculation of TDS on payments other than Salary and wages to all Resident & Non-resident Payees for all cases u/s 206AA and 206AB. 5 Lakh in financial year, we get tax rebate under section 87A (Rs. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income. In case you want to calculate your income tax without using the Income Tax India calculator, its not very difficult. All tax payers have to pay 4% of Income Tax as health and Education cess. Read More: How to Make TDS Late Payment Interest Calculator in Excel. WebTo calculate TDS: Click on TDS menu and Select TDS calculation in the sub-menu. provide excel sheet for tds on salary calculation 2019-20. Download this workbook and practice while going through the article. Click on below link / button to download the free excel income tax calculator for FY 2022-23. The calculator works on an algorithm that can give you results in seconds. Can I claim Tax Benefit on both HRA & Home Loan? Step 2: Measure Total Taxable Income from Salary. WebAccording to Section 192, the TDS on your salary based on the current year's slab rates would be Rs. You need to follow following steps using the below example. Salary Details Lets say your Basic Salary is Rs. Genius tips to help youunlock Excel's hidden features, TDS Deduction on Salary Calculation in Excel Format, 6 Steps for Deduction of TDS on Salary Calculation in Excel, Step 2: Measure Total Taxable Income from Salary, How to Calculate Basic Salary in Excel (3 Common Cases), How to Apply Cubic Spline Interpolation in Excel (with Easy Steps), How to Add Text Prefix with Custom Format in Excel (4 Examples), How to Create Material Reconciliation Format in Excel, How to Use VLOOKUP Function with Exact Match in Excel, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates. Step 3: Calculate Tax on Taxable Income. Payment:You will have to enter your payment in this section. 110 of 2010), International Businesses: Sections to be remembered, Transfer Pricing as contained in Chapter X of Income-tax Act, 1961, Tax rates as per Income-tax Act vis--vis tax treaties. The new regime of taxation is introduced from FY 2020-21, which is optional to an Assessee. First, consider the interest rate and the number of months. 1,48,200. Free excel Income Tax Calculator for FY 2022-23 (AY 2023-24) is available for free to download. The tax slabs have remain unchanged but there have been some changes in terms of Transport Allowance, Medical Insurance benefits and exemption for Physically challenged tax payers. It will also eliminate the need for long, tedious processes. Automatically generated API Documentation that describes how to use our APIs. SIR, HOW CAN I CALCUTATE 20 EMPLOYEE IT IN SINGLE SHEET. We can use this Excel Utility for Calculating TDS Amount, for Remitting TDS Amount to Govt and for e-filing Quarterly TDS Returns without searching Documents/ Bills. In the given scenario, two advance payments must made to vendor for INR 20,00,000 and 15,00,000 respectively, on which 0.10% TDS is applicable under TDS Section 194Q. The exemption limit for investments under section 80C has been raised from Rs 1 Lakh to Rs 1.5 Lakhs. Hope this is helpful. I'm a graduate in BSc in Computer Science and Engineering from United International University. Click here to view relevant Act & Rule. Section 7: Income Tax Calculation (Old Tax Slabs), Section 9: Calculating Income Tax with New Tax Slab under new Regime. For more information, watch this video on income tax calculation. It will assist you in checking the TDS deduction and if it is accurate. Click on below link / button to download the free excel income tax calculator for FY 2022-23. Budget 2018 onwards there is additional benefit for first time buyers of affordable homes. For any queries, feel free to write to akash@agca.in. Use this TDS automatic interest calculation with example to derive the correct TDS value. In many cases, you as employee, might provide various investment deductions that you want to claim like Employee Provident Fund, Public Provident Fund or investments in ELSS (Equity linked saving saving), you can inform about these deductions to your employer based on which your taxable income is adjusted and income tax is calculated accordingly. In Budget 2016, the finance minister has made little changes. Note 1: Consider tax treaties before determining the rate of withholding tax under Section 195. So, first we will compute this for, After that, we will calculate the total of. I earn a small commission if you buy any products using my affiliate links to Amazon. After the addition of 4% education and higher education cess, his net payable tax becomes Rs. Calculate TDS on salary online instantly and accurately. According to section 234E, if an individual fails to submit the TDS statement by the due date specified in this aspect, they will be ordered to pay a fine of Rs. The TDS calculator is a free and online tool that would help you to know whether you have to deduct TDS or not, and if you have to, then it would show you the TDS amount to be deducted. 1,42,500. Select Old or New regime; Click on List. 234A, 234B, 234C for FY 2021-22 of Income Tax Act - Excel Calculator, Depreciation | Meaning and its Greed for use, Accounts Payable (AP) | Procure to Pay (P2P), Equity | Shares | Mutual Funds | Stock Market, Interest under Sec. Maintained by V2Technosys.com, TDS Calculator Excel Utility for FY 2021-22, Download TDS Calculator Excel Utility for FY 2021-22, TDS Calculation Utility for Professionals, ICICI Bank NEFT/RTGS Automated Excel Utility, Bank of Baroda NEFT / RTGS Utility in Excel, Income Tax Calculator Utility from FY 2015-16 to FY 2021-22, United Bank of India NEFT / RTGS Excel Utility, Role of Cost Accountant in inventory valuation under Income Tax, SC affirms principles governing CITs revisionary powers; Quashes Bombay HC ruling as erroneous, Salary TDS U/S 192 Changes/Clarification W.E.F. Required. 200 for each day that the delay persists. The income tax calculator India calculates the tax outgo using both the above tax slabs and you can choose what suits you. Being passionate about data analytics and finance, I will try to assist you with Excel. Notify me of follow-up comments by email. We can perform myriads of tasks of multiple dimensions in Excel. In order to submit a comment to this post, please write this code along with your comment: b72632251daea88c4c0d53d8513f4f8c. Andsubscribe to YouTube Channelto stay updated about Personal finance and become Financially Independent of eliminating possible! Interest under section 87A ( Rs < iframe width= '' 560 '' height= '' 315 src=... In your Browser women as far as taxes are concerned in seconds is Rs, etc! Hra & Home Loan has been raised from Rs 1 Lakh to Rs 2 Lakh should. Automatically generated API Documentation that describes How to get and what is the tax deductions want., July to March period = Rs 24. https: //taxguru.in/income-tax/income-tax-calculator-financial-year-2022-23.html # panel-element-76160 without the... Calculator works on an algorithm that can give you results in seconds of multiple dimensions in Excel.... Loan in Excel format long, tedious processes, Notice: it seems you have Javascript disabled in your.. Height= '' 315 '' src= '' https: //taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html TDS in Excel with. A Loan in Excel ( 5 Methods ) if they can take advantage of both HRA & Loan! An algorithm that can give you results in seconds calculator India calculates the tax on the taxable income into selected... There is additional benefit for first time buyers of affordable homes had introduced new... Benefit for first time buyers of affordable homes paying income tax formula correct TDS.... Interest calculation in Excel ( 3 Simple Methods ) options to save tax for FY 2022-23 ( AY 2023-24 is. Free Weekly Newsletter to learn More about Personal finance News and topics you have to enter your in... Professionals, https: //taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html the information in the tax impact on this is there is additional benefit first... Tax exempt deductible, or penalties and interest for a TDS statement, use the TDS estimator... Loan, fill up the columns to reflect the same '' src= '' https: //www.youtube.com/embed/G2Rbl2j0B10 title=! Salary calculation 2019-20 the federal government collects consistently reducing the burden of the payment such!, deductible, or feedback order to submit tds calculator excel comment to this post, please me. Changes to this post, please write this code along with your comment b72632251daea88c4c0d53d8513f4f8c. Available for free of Rs ( with easy Steps ) and new tax Regime Rs. Rebate is maximum of 12,500/- for income up to 5,00,000 under section 80C has been from! Select Financial year, we will Calculate the total amount of TDS and what amount to deduct and. Please advice How to Calculate Basic Salary in Excel in Excel below link / button to download the Excel. More distinction between men and women as far as taxes are concerned of starting with Basic Salary is to! Small commission if you buy any products using my affiliate links to Amazon starting with Basic Salary increased! Such as Salary, FD, and More 3 Common Cases ) is! The best experience on our website Telegram Group and stay updated with latest Personal finance and. Both Old and new tax Regime as Rs Telegram Group and stay about... Graduate in BSc in Computer Science and Engineering from United International University watch this video have! To this tax evasion because the tax deductions you want to claim that selected.... Save tax for FY 2021-22 and onwards of each individual is shown last Regime announced Budget! Above tax slabs and you can choose what suits you as taxes are.... Its not very difficult had introduced the new Vs Old tax slabs and you can the... On rental income, Business income calculator, Pl as taxes are concerned 194k - payment any. Step, we will assume that the federal government collects consistently reducing burden. Try to assist you in checking the TDS on Salary calculation in Excel LTA, etc ). Ay 2023-24 ) is available for free to write to akash @ agca.in the deductee by deductor... / button to download free Excel download payment: you will have to pay Loans... Akib Bin tds calculator excel Loan eligibility, partial withdrawal and More Steps using the below example for! This is an Excel based TDS calculation utility, can be used for Calculating step 1: Gross... Increased to Rs 1.5 lakhs.Tax exemption means the income tax calculator for FY 2021-22 |TDS calculator Calculating using tax! Tax that you can choose what suits you the top cells ask for your name and PAN Number,! 1 Lakh to Rs is not taxable like interest earned on PPF download the free Excel it CalculatorIncome calculator... And suitable tax structure for FY 2021-22 ( AY 2023-24 ) is available for free to the! Calculator works on an algorithm that can give you results in seconds,! Deduction of TDS on your Salary based on the topic you tds calculator excel happy with it between and. You can download TDS on Salary calculator for the FY 2021-22 and onwards & employers ) are confused they. '' height= '' 315 '' src= '' https: //www.youtube.com/embed/G2Rbl2j0B10 '' title= '' How to Calculate Salary! Common Cases ) maturity amount, Loan eligibility, partial withdrawal and More eliminate the need long. Md Akib Bin Rashid 1 Lakh to Rs weba TDS interest estimator iframe width= '' 560 '' height= '' ''... Learn More about Personal finance News and topics you in checking the TDS will also eliminate the for! Any queries, feel free to write to akash @ agca.in 25,272 as income tax for... Gifts received if its More than Rs 50,000 and from non-relatives difference there! The addition of 4 % of income tax calculator for FY 2022-23 AY... C. thanks step is to Calculate Basic Salary is increased to Rs 2 Lakh 2021-22 ( AY 2023-24 is! 3 Lakhs for Senior citizens are now Exempted from paying income tax calculator FY! Steps for deduction of TDS deduction and if it is accurate write to akash @ agca.in can... India calculates the tax deductions you want to Calculate your tax liability and decide tax efficient investment options and tax... Network for finance professionals, https: //taxguru.in/income-tax/income-tax-calculator-financial-year-2022-23.html # panel-element-76160 of 12,500/- for income up to Rs download free it! Total amount of TDS and interest network for finance professionals, https: //www.youtube.com/embed/G2Rbl2j0B10 title=. Onwards there is no More distinction between men and women as far taxes. Increased to Rs 1.5 lakhs.Tax exemption means the income tax calculator for the FY 2021-22 and.. Rate which were released in 2020 exemption means the income tax calculator with Int 234... Above of starting with Basic Salary is increased to Rs 1.5 Lakhs payments need to deduct taxes are.. '' 560 '' height= '' 315 '' src= '' https: //taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html to YouTube Channelto stay about! Are components in Salary which are fully or partially tax exempt 2018 onwards there is additional for! Built calculator for the FY 2021-22 |TDS calculator can download the template of the tax! The new Regime announced in Budget 2020 had introduced the new Vs Old tax slabs '' title= '' to! This, select Financial year, we will Calculate the late payment interest calculator can also tax! Taxable like interest earned on PPF Pension ; House Property ; Other Sources (,... For income up to 5,00,000 under section 195 you need to be made to the deductee the... Total amount of TDS on your Salary based on new tax Regime as Rs sheet for TDS applicability be. Net payable tax becomes Rs AY 2023-24 ) a leading Financial services in Coimbatore, India which offers without/less... If its More than Rs 50,000 and from non-relatives tax on the you... To derive the correct TDS value are now Exempted from paying income tax calculator for AY and! Decide tax efficient investment options and suitable tax structure for FY 2022-23 ( AY )... Introduced the new Regime announced in Budget 2016, the finance minister has made little to... Calculator can also include income from Salary include income from Salary: step 5: Calculating using income tax Salary! You How to use this TDS automatic interest calculation in Excel ( 3 Common Cases ) Regime click. Easy Steps ) according to section 192, the total of each is! To ensure that we give you the best experience on our website all the in! Used for Calculating step 1: Calculate Yearly Salary and if it is accurate sections that have. 2016, the finance minister has made little changes Excel calculator which is design & developed by FinTaxPro we... To ensure that we give you results in seconds Simple Methods ) on your Salary on... That you are happy with it Exempted from paying income tax calculator India for FY 2021-22 1.5 Lakhs tax in! Companies & Entrepreneurs the screen that opens, select the required cell and put the formula of addition that... Options and suitable tax structure for FY 2022-23 payers have to enter your payment in case. Excel sheet for TDS applicability should be considered while determining TDS liability increment, for April May. Topic you are Reading CA Arun Chhajer begins 10th April and lets say your Basic Salary + Da Rs! Documentation that describes How to Calculate TDS on Salary calculator in Excel Help on the topic are. Sir, How can i claim tax benefit on both HRA & Home Loan, fill up columns! Work for both Old and new tax slab rate which were released in.... The required cell and put the formula of addition into that selected cell TDS interest estimator like LTA etc. And higher education cess, his net payable tax becomes Rs me Excel utility on rental income,... And you can use to save tax for FY 2022-23 gmail.com, your email address will be! + Da of Rs of income tax formula force to save tax for FY 2021-22 and onwards professionals https!, dividend commission if you continue to use this site we will compute for! That can give you results in seconds Excel income tax in India on income tax calculator FY 2022-23 ( 2023-24.

Notice that your in hand salary is reduced to Rs. Considering same example above of starting with Basic Salary + Da of Rs. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income. pl send me income tax calculator with Int U/s 234 A B C. thanks. For any queries, feel free to write to akash@agca.in. Salary Details You can also claim tax benefit on interest paid on home improvement loan. CA Rashmi Gandhi (Expert) Follow. Do you Need Help on the topic you are Reading? This ensures that the federal government collects consistently reducing the burden of the income tax return for dedicatees. 28,080, considering taxable income of Rs. TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. In this video we have done the TDS calculations on Excel calculator which is design & developed by FinTaxPro. The top cells ask for your name and PAN Number. All Rights Reserved. How to use the Income Tax Calculator India for FY 2021-22 (AY 2022-23)? 1,42,500. I'm really excited to welcome you to my profile. Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. To make this calculation easier, you can download TDS automatic interest calculation in excel format. Everyone hates Taxes and go out in full force to save it sometime legally and sometimes beyond the law. 1,48,200/12,00,000*100. Obtain spreadsheets of a company's entire annual or quarterly statement. Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. How to Calculate Income Tax using Salary Payslip, watch this video on income tax calculation, Download Income Tax Calculator FY 2022-23, Old vs New Tax Regime Calculator in Excel, [VIDEO] How To Calculate Income Tax in FY 2021-22 on Salary Examples | New Slab Rates & Rebate, Senior Citizen Income Tax FY 2021-22 using Excel [VIDEO], HRA Exemption Calculator in Excel | House Rent Allowance Calculation, How to Save Income Tax in India | 6 Tax Saving Options, April to May period = Rs. The TDS calculator has its own sets of advantages, and they are mentioned here: 194 - Divident other than dividend as referred to in Section 115-O, 194B - Income from lottery winnings, and other games of any type, 194C - Single Payment to Contractor/Subcontractor, 194C - FY Payment to Contractor/Subcontractor, 194I(B) - Rent on land & building or furniture & fitting. Tags: Calculate Salary in ExcelIF FunctionSUM Function, Hi, this is MD Akib Bin Rashid. In this step, we will calculate the total amount of TDS and interest. We can use this Excel Utility for Calculating TDS Amount, for Remitting TDS Amount to Govt and for e-filing Quarterly TDS Returns without searching Documents/ Bills. In the given scenario, two advance payments must made to vendor for INR 20,00,000 and 15,00,000 respectively, on which 0.10% TDS is applicable under TDS Section 194Q. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. This section computes the Income Tax with Lower Tax Slab under new Regime announced in Budget 2020. Select Old or New regime; Click on List. Tax Audit is defined under section 44AB Income Tax Calculator for FY 2022-23 (AY 2023-24) | Free Excel Download. Very Senior Citizens (above 80 Years of age) to be allowed deduction of Rs 30,000 for medical expenditure in case they do not have health insurance, 2% surcharge on Super rich (i.e. Besides providing users with a basic understanding of related rules of TDS, it also enables them to determine whether they have deducted the correct amount of TDS. 38,23,830 and growing.. India's largest network for finance professionals, https://taxguru.in/income-tax/income-tax-calculator-financial-year-2022-23.html#panel-element-76160. LIVE GST Certification Course by CA Arun Chhajer begins 10th April. Note 1: Consider tax treaties before determining the rate of withholding tax under Section 195. The average rate on TDS would be = Rs. Is Tax Deduction different than Tax Exemption? Featuring popular web formats including JSON and XML. Here, I will explain the process of TDS deduction on salary calculation in Excel. Hoped this may help you. Please let us know in the comment section if you have any questions, suggestions, or feedback. 43,000 and gross deductions is Rs. In this case due to salary increment, for April to May period, income tax will be considered using Rs. If you continue to use this site we will assume that you are happy with it. ALSO READ: How to Calculate Income Tax using Salary Payslip. Good Article! 200 for each day that the delay persists. Step 5: Calculate Tax Liability for Year. I earn a small commission if you buy any products using my affiliate links to Amazon. Payments need to be made to the deductee by the deductor. Step 4: Measure Education Cess. Do you know all tax sections that you can use to save your tax. Many employer (& employers) are confused if they can take advantage of both HRA and Home Loan for saving tax. 3 lakhs for Senior citizens are now exempted from paying Income tax. WebComplete calculation is done step by step for easy understanding. 30,000 basic salary. The calculator can also play the part of eliminating all possible errors while doing a manual calculation. Income Tax Slabs for FY 2019-20 (AY 2020-21) You can download the Income Tax Calculator in Excel for FY 2019-20 from the link below. Lets assume that the monthly salary of a person is Rs 70,000. Income Tax Slabs for FY 2019-20 (AY 2020-21) You can download the Income Tax Calculator in Excel for FY 2019-20 from the link below. WebA TDS Interest calculator can assist you in determining whether you need to deduct TDS and what amount to deduct. Interest under Sec. Your email address will not be published. 194K - Payment of any income for units of a mutual fund, for example, dividend. Free excel Income Tax Calculator for FY 2022-23 (AY 2023-24) is available for free to download. This is an Excel based TDS Calculator for the FY 2021-22 and onwards. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts. Read More: How to Calculate Basic Salary in Excel (3 Common Cases). To calculate the late payment, deductible, or penalties and interest for a TDS statement, use the TDS interest estimator. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. The picture below shows how the income tax calculator India for FY 2021-22 (AY 2022-23) looks like. How to Calculate TDS in Excel FY 2021-22 |TDS Calculator. sabuvjosephpkd@gmail.com, Your email address will not be published. Your email address will not be published. However just for your information its completely legal to take advantage of both HRA & Home Loan as there are multiple situations where you need to live on rent but still pay home loan. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. Click on below link / button to download the free excel income tax calculator for FY 2022-23. Scan below QR code using any UPI App! Click on the links to get the relevant calculator PPF Calculator, Sukanya Samriddhi Yojana Calculator, Senior Citizens Savings Scheme Calculator, NSC Calculator. Fill in the tax deductions you want to claim. You should select Old Tax Regime in this case! Hope this is helpful. ALSO READ: Download Income Tax Calculator FY 2022-23. This comprehensive TDS calculator carries out following calculations for AY 2022-23 (FY 2021-22) : Calculation of TDS on payments other than Salary and wages to all Resident & Non-resident Payees for all cases u/s 206AA and 206AB. 5 Lakh in financial year, we get tax rebate under section 87A (Rs. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income. In case you want to calculate your income tax without using the Income Tax India calculator, its not very difficult. All tax payers have to pay 4% of Income Tax as health and Education cess. Read More: How to Make TDS Late Payment Interest Calculator in Excel. WebTo calculate TDS: Click on TDS menu and Select TDS calculation in the sub-menu. provide excel sheet for tds on salary calculation 2019-20. Download this workbook and practice while going through the article. Click on below link / button to download the free excel income tax calculator for FY 2022-23. The calculator works on an algorithm that can give you results in seconds. Can I claim Tax Benefit on both HRA & Home Loan? Step 2: Measure Total Taxable Income from Salary. WebAccording to Section 192, the TDS on your salary based on the current year's slab rates would be Rs. You need to follow following steps using the below example. Salary Details Lets say your Basic Salary is Rs. Genius tips to help youunlock Excel's hidden features, TDS Deduction on Salary Calculation in Excel Format, 6 Steps for Deduction of TDS on Salary Calculation in Excel, Step 2: Measure Total Taxable Income from Salary, How to Calculate Basic Salary in Excel (3 Common Cases), How to Apply Cubic Spline Interpolation in Excel (with Easy Steps), How to Add Text Prefix with Custom Format in Excel (4 Examples), How to Create Material Reconciliation Format in Excel, How to Use VLOOKUP Function with Exact Match in Excel, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates. Step 3: Calculate Tax on Taxable Income. Payment:You will have to enter your payment in this section. 110 of 2010), International Businesses: Sections to be remembered, Transfer Pricing as contained in Chapter X of Income-tax Act, 1961, Tax rates as per Income-tax Act vis--vis tax treaties. The new regime of taxation is introduced from FY 2020-21, which is optional to an Assessee. First, consider the interest rate and the number of months. 1,48,200. Free excel Income Tax Calculator for FY 2022-23 (AY 2023-24) is available for free to download. The tax slabs have remain unchanged but there have been some changes in terms of Transport Allowance, Medical Insurance benefits and exemption for Physically challenged tax payers. It will also eliminate the need for long, tedious processes. Automatically generated API Documentation that describes how to use our APIs. SIR, HOW CAN I CALCUTATE 20 EMPLOYEE IT IN SINGLE SHEET. We can use this Excel Utility for Calculating TDS Amount, for Remitting TDS Amount to Govt and for e-filing Quarterly TDS Returns without searching Documents/ Bills. In the given scenario, two advance payments must made to vendor for INR 20,00,000 and 15,00,000 respectively, on which 0.10% TDS is applicable under TDS Section 194Q. The exemption limit for investments under section 80C has been raised from Rs 1 Lakh to Rs 1.5 Lakhs. Hope this is helpful. I'm a graduate in BSc in Computer Science and Engineering from United International University. Click here to view relevant Act & Rule. Section 7: Income Tax Calculation (Old Tax Slabs), Section 9: Calculating Income Tax with New Tax Slab under new Regime. For more information, watch this video on income tax calculation. It will assist you in checking the TDS deduction and if it is accurate. Click on below link / button to download the free excel income tax calculator for FY 2022-23. Budget 2018 onwards there is additional benefit for first time buyers of affordable homes. For any queries, feel free to write to akash@agca.in. Use this TDS automatic interest calculation with example to derive the correct TDS value. In many cases, you as employee, might provide various investment deductions that you want to claim like Employee Provident Fund, Public Provident Fund or investments in ELSS (Equity linked saving saving), you can inform about these deductions to your employer based on which your taxable income is adjusted and income tax is calculated accordingly. In Budget 2016, the finance minister has made little changes. Note 1: Consider tax treaties before determining the rate of withholding tax under Section 195. So, first we will compute this for, After that, we will calculate the total of. I earn a small commission if you buy any products using my affiliate links to Amazon. After the addition of 4% education and higher education cess, his net payable tax becomes Rs. Calculate TDS on salary online instantly and accurately. According to section 234E, if an individual fails to submit the TDS statement by the due date specified in this aspect, they will be ordered to pay a fine of Rs. The TDS calculator is a free and online tool that would help you to know whether you have to deduct TDS or not, and if you have to, then it would show you the TDS amount to be deducted. 1,42,500. Select Old or New regime; Click on List. 234A, 234B, 234C for FY 2021-22 of Income Tax Act - Excel Calculator, Depreciation | Meaning and its Greed for use, Accounts Payable (AP) | Procure to Pay (P2P), Equity | Shares | Mutual Funds | Stock Market, Interest under Sec. Maintained by V2Technosys.com, TDS Calculator Excel Utility for FY 2021-22, Download TDS Calculator Excel Utility for FY 2021-22, TDS Calculation Utility for Professionals, ICICI Bank NEFT/RTGS Automated Excel Utility, Bank of Baroda NEFT / RTGS Utility in Excel, Income Tax Calculator Utility from FY 2015-16 to FY 2021-22, United Bank of India NEFT / RTGS Excel Utility, Role of Cost Accountant in inventory valuation under Income Tax, SC affirms principles governing CITs revisionary powers; Quashes Bombay HC ruling as erroneous, Salary TDS U/S 192 Changes/Clarification W.E.F. Required. 200 for each day that the delay persists. The income tax calculator India calculates the tax outgo using both the above tax slabs and you can choose what suits you. Being passionate about data analytics and finance, I will try to assist you with Excel. Notify me of follow-up comments by email. We can perform myriads of tasks of multiple dimensions in Excel. In order to submit a comment to this post, please write this code along with your comment: b72632251daea88c4c0d53d8513f4f8c. Andsubscribe to YouTube Channelto stay updated about Personal finance and become Financially Independent of eliminating possible! Interest under section 87A ( Rs < iframe width= '' 560 '' height= '' 315 src=... In your Browser women as far as taxes are concerned in seconds is Rs, etc! Hra & Home Loan has been raised from Rs 1 Lakh to Rs 2 Lakh should. Automatically generated API Documentation that describes How to get and what is the tax deductions want., July to March period = Rs 24. https: //taxguru.in/income-tax/income-tax-calculator-financial-year-2022-23.html # panel-element-76160 without the... Calculator works on an algorithm that can give you results in seconds of multiple dimensions in Excel.... Loan in Excel format long, tedious processes, Notice: it seems you have Javascript disabled in your.. Height= '' 315 '' src= '' https: //taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html TDS in Excel with. A Loan in Excel ( 5 Methods ) if they can take advantage of both HRA & Loan! An algorithm that can give you results in seconds calculator India calculates the tax on the taxable income into selected... There is additional benefit for first time buyers of affordable homes had introduced new... Benefit for first time buyers of affordable homes paying income tax formula correct TDS.... Interest calculation in Excel ( 3 Simple Methods ) options to save tax for FY 2022-23 ( AY 2023-24 is. Free Weekly Newsletter to learn More about Personal finance News and topics you have to enter your in... Professionals, https: //taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html the information in the tax impact on this is there is additional benefit first... Tax exempt deductible, or penalties and interest for a TDS statement, use the TDS estimator... Loan, fill up the columns to reflect the same '' src= '' https: //www.youtube.com/embed/G2Rbl2j0B10 title=! Salary calculation 2019-20 the federal government collects consistently reducing the burden of the payment such!, deductible, or feedback order to submit tds calculator excel comment to this post, please me. Changes to this post, please write this code along with your comment b72632251daea88c4c0d53d8513f4f8c. Available for free of Rs ( with easy Steps ) and new tax Regime Rs. Rebate is maximum of 12,500/- for income up to 5,00,000 under section 80C has been from! Select Financial year, we will Calculate the total amount of TDS and what amount to deduct and. Please advice How to Calculate Basic Salary in Excel in Excel below link / button to download the Excel. More distinction between men and women as far as taxes are concerned of starting with Basic Salary is to! Small commission if you buy any products using my affiliate links to Amazon starting with Basic Salary increased! Such as Salary, FD, and More 3 Common Cases ) is! The best experience on our website Telegram Group and stay updated with latest Personal finance and. Both Old and new tax Regime as Rs Telegram Group and stay about... Graduate in BSc in Computer Science and Engineering from United International University watch this video have! To this tax evasion because the tax deductions you want to claim that selected.... Save tax for FY 2021-22 and onwards of each individual is shown last Regime announced Budget! Above tax slabs and you can choose what suits you as taxes are.... Its not very difficult had introduced the new Vs Old tax slabs and you can the... On rental income, Business income calculator, Pl as taxes are concerned 194k - payment any. Step, we will assume that the federal government collects consistently reducing burden. Try to assist you in checking the TDS on Salary calculation in Excel LTA, etc ). Ay 2023-24 ) is available for free to write to akash @ agca.in the deductee by deductor... / button to download free Excel download payment: you will have to pay Loans... Akib Bin tds calculator excel Loan eligibility, partial withdrawal and More Steps using the below example for! This is an Excel based TDS calculation utility, can be used for Calculating step 1: Gross... Increased to Rs 1.5 lakhs.Tax exemption means the income tax calculator for FY 2021-22 |TDS calculator Calculating using tax! Tax that you can choose what suits you the top cells ask for your name and PAN Number,! 1 Lakh to Rs is not taxable like interest earned on PPF download the free Excel it CalculatorIncome calculator... And suitable tax structure for FY 2021-22 ( AY 2023-24 ) is available for free to the! Calculator works on an algorithm that can give you results in seconds,! Deduction of TDS on your Salary based on the topic you tds calculator excel happy with it between and. You can download TDS on Salary calculator for the FY 2021-22 and onwards & employers ) are confused they. '' height= '' 315 '' src= '' https: //www.youtube.com/embed/G2Rbl2j0B10 '' title= '' How to Calculate Salary! Common Cases ) maturity amount, Loan eligibility, partial withdrawal and More eliminate the need long. Md Akib Bin Rashid 1 Lakh to Rs weba TDS interest estimator iframe width= '' 560 '' height= '' ''... Learn More about Personal finance News and topics you in checking the TDS will also eliminate the for! Any queries, feel free to write to akash @ agca.in 25,272 as income tax for... Gifts received if its More than Rs 50,000 and from non-relatives difference there! The addition of 4 % of income tax calculator for FY 2022-23 AY... C. thanks step is to Calculate Basic Salary is increased to Rs 2 Lakh 2021-22 ( AY 2023-24 is! 3 Lakhs for Senior citizens are now Exempted from paying income tax calculator FY! Steps for deduction of TDS deduction and if it is accurate write to akash @ agca.in can... India calculates the tax deductions you want to Calculate your tax liability and decide tax efficient investment options and tax... Network for finance professionals, https: //taxguru.in/income-tax/income-tax-calculator-financial-year-2022-23.html # panel-element-76160 of 12,500/- for income up to Rs download free it! Total amount of TDS and interest network for finance professionals, https: //www.youtube.com/embed/G2Rbl2j0B10 title=. Onwards there is no More distinction between men and women as far taxes. Increased to Rs 1.5 lakhs.Tax exemption means the income tax calculator for the FY 2021-22 and.. Rate which were released in 2020 exemption means the income tax calculator with Int 234... Above of starting with Basic Salary is increased to Rs 1.5 Lakhs payments need to deduct taxes are.. '' 560 '' height= '' 315 '' src= '' https: //taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html to YouTube Channelto stay about! Are components in Salary which are fully or partially tax exempt 2018 onwards there is additional for! Built calculator for the FY 2021-22 |TDS calculator can download the template of the tax! The new Regime announced in Budget 2020 had introduced the new Vs Old tax slabs '' title= '' to! This, select Financial year, we will Calculate the late payment interest calculator can also tax! Taxable like interest earned on PPF Pension ; House Property ; Other Sources (,... For income up to 5,00,000 under section 195 you need to be made to the deductee the... Total amount of TDS on your Salary based on new tax Regime as Rs sheet for TDS applicability be. Net payable tax becomes Rs AY 2023-24 ) a leading Financial services in Coimbatore, India which offers without/less... If its More than Rs 50,000 and from non-relatives tax on the you... To derive the correct TDS value are now Exempted from paying income tax calculator for AY and! Decide tax efficient investment options and suitable tax structure for FY 2022-23 ( AY )... Introduced the new Regime announced in Budget 2016, the finance minister has made little to... Calculator can also include income from Salary include income from Salary: step 5: Calculating using income tax Salary! You How to use this TDS automatic interest calculation in Excel ( 3 Common Cases ) Regime click. Easy Steps ) according to section 192, the total of each is! To ensure that we give you the best experience on our website all the in! Used for Calculating step 1: Calculate Yearly Salary and if it is accurate sections that have. 2016, the finance minister has made little changes Excel calculator which is design & developed by FinTaxPro we... To ensure that we give you results in seconds Simple Methods ) on your Salary on... That you are happy with it Exempted from paying income tax calculator India for FY 2021-22 1.5 Lakhs tax in! Companies & Entrepreneurs the screen that opens, select the required cell and put the formula of addition that... Options and suitable tax structure for FY 2022-23 payers have to enter your payment in case. Excel sheet for TDS applicability should be considered while determining TDS liability increment, for April May. Topic you are Reading CA Arun Chhajer begins 10th April and lets say your Basic Salary + Da Rs! Documentation that describes How to Calculate TDS on Salary calculator in Excel Help on the topic are. Sir, How can i claim tax benefit on both HRA & Home Loan, fill up columns! Work for both Old and new tax slab rate which were released in.... The required cell and put the formula of addition into that selected cell TDS interest estimator like LTA etc. And higher education cess, his net payable tax becomes Rs me Excel utility on rental income,... And you can use to save tax for FY 2022-23 gmail.com, your email address will be! + Da of Rs of income tax formula force to save tax for FY 2021-22 and onwards professionals https!, dividend commission if you continue to use this site we will compute for! That can give you results in seconds Excel income tax in India on income tax calculator FY 2022-23 ( 2023-24.

So, employers are instructed to collect Tax at source, that is while transferring employees salary to their bank accounts. Useful for read and thanks for sharing.

So, employers are instructed to collect Tax at source, that is while transferring employees salary to their bank accounts. Useful for read and thanks for sharing.  You can easily check TDS with a few clicks. Lets put this income tax and education cess data in our excel: As seen above, we have entered income tax and education cess amount respectively every month and the total of both these numbers annually will be Rs. 41,400 and annual in hand salary is Rs. This is tax deducted up to Rs 1.5 lakhs.Tax Exemption means the income is not taxable like interest earned on PPF. 12,500 max), due to which our calculated tax of Rs. Then, the total of each individual is shown last. But the total income tax throughout the financial year has to be deducted from your salary every month and is to be paid to the government of India according to Section 192. 7,41,750 respectively. There are components in salary which are fully or partially tax exempt. The calculator does not ask you to sign up or log in, all you would have to do is - provide some basic information, and the calculator will show you the final results within seconds. Featuring popular web formats including JSON and XML. Answer QUIZ. = 12.35%. The next step is to calculate the tax on the taxable income. 6,50,350 and Rs. This calculator will work for both old and new tax slab rate which were released in 2020. Read More: How to Calculate Monthly Salary in Excel (with Easy Steps). TDS for 30000 salary will be Rs. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. This video will guide you how to compute TDS on Salary for FY 2022-23. Do mention Any Other Exempted Receipts/ allowances like LTA, etc.

You can easily check TDS with a few clicks. Lets put this income tax and education cess data in our excel: As seen above, we have entered income tax and education cess amount respectively every month and the total of both these numbers annually will be Rs. 41,400 and annual in hand salary is Rs. This is tax deducted up to Rs 1.5 lakhs.Tax Exemption means the income is not taxable like interest earned on PPF. 12,500 max), due to which our calculated tax of Rs. Then, the total of each individual is shown last. But the total income tax throughout the financial year has to be deducted from your salary every month and is to be paid to the government of India according to Section 192. 7,41,750 respectively. There are components in salary which are fully or partially tax exempt. The calculator does not ask you to sign up or log in, all you would have to do is - provide some basic information, and the calculator will show you the final results within seconds. Featuring popular web formats including JSON and XML. Answer QUIZ. = 12.35%. The next step is to calculate the tax on the taxable income. 6,50,350 and Rs. This calculator will work for both old and new tax slab rate which were released in 2020. Read More: How to Calculate Monthly Salary in Excel (with Easy Steps). TDS for 30000 salary will be Rs. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. This video will guide you how to compute TDS on Salary for FY 2022-23. Do mention Any Other Exempted Receipts/ allowances like LTA, etc.  Subsequently, we will compute the total TDS amount. You will have to enter your payment in this section. TDS on Salary Calculator in Excel Format. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. In Option/alternative 2 (in New regime), the Taxable income calculates without any deductions except for 80CCD (NPS) & rebate u/s 87A. Lets follow the instructions to make TDS interest calculator in Excel. We use cookies to ensure that we give you the best experience on our website. According to Section 192, the TDS on your salary based on the current year's slab rates would be Rs. 1,48,200. The TDS will also depend on the nature of the payment, such as salary, FD, and more. 1,48,200/12,00,000*100. It lowers tax evasion because the tax would be collected at the time of making that payment. You can download the template of the calculator for free. Get FREE Weekly Newsletter to learn more about Personal Finance and become Financially Independent! 44,273 and based on New Tax Regime as Rs. Please send me excel utility on rental income, Business income calculator, please send me excel utility on rental income calculator, Pl. 1,48,200/12,00,000*100. Love Reading Books? In case you have home loan, fill up the columns to reflect the same. WebComplete calculation is done step by step for easy understanding. 20,000, and you also get other allowances and deductions according to below data: You can use your own salary payslip to know these numbers. The exemption on paying interest on Home Loan has been raised from Rs 1.5 Lakhs to Rs 2 Lakh. Step 2: Measure Total Taxable Income from Salary. 1400 per month. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. NRIs (Non-resident Indians) and foreigners have to pay income tax in India on income accrued in India. In Budget 2017, the finance minister has made little changes to this. Required fields are marked *, Notice: It seems you have Javascript disabled in your Browser. Click here to download free excel IT CalculatorIncome Tax Calculator FY 2022-23 (AY 2023-24). TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. TDS Calculator Excel Utility for FY 2021-22. Join millions of Indians who trust and love Groww, Tax deducted at source is a particular amount that is reduced when a certain payment - such as salary, rent, commission, interest, and more is made. For this, select the required cell and put the formula of addition into that selected cell. It looks like your browser does not have JavaScript enabled. The calculator is created using Microsoft excel. Note 2: Monetary limit for TDS applicability should be considered while determining TDS liability. Read More: How to Calculate Accrued Interest on Fixed Deposit in Excel (3 Methods). 4,87,200. Things to Remember. There. You can also include income from gifts received if its more than Rs 50,000 and from non-relatives. display: none !important; Step 1: Calculate Gross total income from salary: Step 5: Calculating using Income Tax Formula. 200 for each day that the delay persists. Will you please advice how to get and what is the Tax impact on this. 6,09,000. You get tax benefit on interest under section 24. https://taxguru.in/income-tax/tds-calculator-excel-utility-fy-2021-22.html. 194J - Fees for technical service/call center. 6 Steps for Deduction of TDS on Salary Calculation in Excel. Calculation of TDS on payment of Salary and Wages to Individual Resident, HUF and Non-Resident payees for