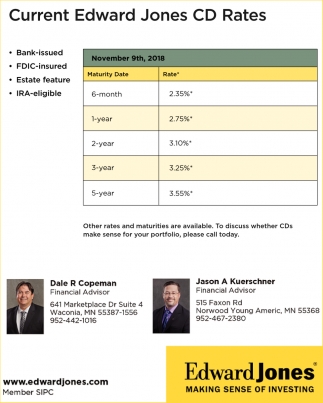

edward jones cd rates today

Edward Jones Compare our CD Rates Bank-issued, FDIC-insured 1-year Call or visit your local financial advisor today. Discover the ease and convenience of having online access to your Raymond James accounts. Yield to Maturity (YTM) represents the return an investor will receive if a CD is held to term. However, the value at the end of the term will be accurate. If youre ready to be matched with local advisors that can help you achieve your financial goals,get started now. Get to Know Jason Enouy, SVP & CCO, Raymond James Ltd. Get to know Shannon Tucker, director of PCG Compliance and Pride Inclusion Network National co-chair, Honoring the land of the free and the home of the brave, Our Service 1st culture: Recognizing those who go above and beyond, Emancipation. Interest is paid at predetermined intervals, such as monthly, quarterly, semiannually or at maturity. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and durations. When investors purchase brokered CDs through Raymond James, they gain the convenience of recordkeeping. In these instances, Raymond James will submit the paper- work for you. We offer a wide range of maturities to help match an investors investment objectives. Certificates of Deposit Rates Certificates of Deposit (CD) Rates These CD rates are effective March 21, 2023. Since CDs may have multiple redemption scenarios (e.g., at maturity, by call or sale prior to maturity), the lowest of the YTM or YTC is quoted to the investor at the time of purchase. As soon as your initial deposit clears, you are free to buy a new CD or a secondary CD through your Edward Jones broker. UFB Direct Savings Account Now 3.01% APY! CD Calculator: How Much Can You Earn With A Certificate Of Deposit?

Edward Jones Compare our CD Rates Bank-issued, FDIC-insured 1-year Call or visit your local financial advisor today. Discover the ease and convenience of having online access to your Raymond James accounts. Yield to Maturity (YTM) represents the return an investor will receive if a CD is held to term. However, the value at the end of the term will be accurate. If youre ready to be matched with local advisors that can help you achieve your financial goals,get started now. Get to Know Jason Enouy, SVP & CCO, Raymond James Ltd. Get to know Shannon Tucker, director of PCG Compliance and Pride Inclusion Network National co-chair, Honoring the land of the free and the home of the brave, Our Service 1st culture: Recognizing those who go above and beyond, Emancipation. Interest is paid at predetermined intervals, such as monthly, quarterly, semiannually or at maturity. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and durations. When investors purchase brokered CDs through Raymond James, they gain the convenience of recordkeeping. In these instances, Raymond James will submit the paper- work for you. We offer a wide range of maturities to help match an investors investment objectives. Certificates of Deposit Rates Certificates of Deposit (CD) Rates These CD rates are effective March 21, 2023. Since CDs may have multiple redemption scenarios (e.g., at maturity, by call or sale prior to maturity), the lowest of the YTM or YTC is quoted to the investor at the time of purchase. As soon as your initial deposit clears, you are free to buy a new CD or a secondary CD through your Edward Jones broker. UFB Direct Savings Account Now 3.01% APY! CD Calculator: How Much Can You Earn With A Certificate Of Deposit?  Edward Jones Compare our CD Rates Bank-issued, FDIC-insured 6-month 1-year 2-year 5.05%APY 5.30% 5.25% > edwardjones.com | Member SIPC Call or visit your local financial advisor today. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. This strategy can help you earn more interest than a standard savings account, while still supplying you with a stream of cash in case of an emergency. You can enroll in online bill pay and link a direct deposit to one or more of your savings or investment accounts. Is there a way to do this to prevent tax payment?

Edward Jones Compare our CD Rates Bank-issued, FDIC-insured 6-month 1-year 2-year 5.05%APY 5.30% 5.25% > edwardjones.com | Member SIPC Call or visit your local financial advisor today. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. This strategy can help you earn more interest than a standard savings account, while still supplying you with a stream of cash in case of an emergency. You can enroll in online bill pay and link a direct deposit to one or more of your savings or investment accounts. Is there a way to do this to prevent tax payment?  This information is presented to better enable you to recognize the underlying differences between the investments featured and the resulting relationships of the rates presented. Thoughtful, timely investing and planning insights from the leading professionals at Raymond James. Edward Jones allows you to make quick and easy deposits into your account(s) and transfer funds electronically. This means you can't just withdraw your funds on demand. Guaranteed Investment Certificates are issued by a CDIC-insured financial institution and pay a fixed rate for a fixed term. WebNew to Online Access? There are several yield calculations to consider when evaluating a brokered CD. Flexibility in length of investment There is no minimum investment required to open a money market fund and the current 7-day yield per share is 0.01%. E-Trade Premium Savings Account Now 3.75% APY! These securities are comprised of U.S. dollar corporate bonds, U.S. dollar Yankee bonds, which are Canadian corporate bonds issued in U.S. dollars, and FDIC-insured CDs. This is the same as paying a commission to a broker for trading stocks or bonds. In 2021, subtropical and beachy Wilmington had a net migration of 992 seniors. This isnt relevant to everyone, but it provides some more security if you are putting a lot of money into CDs. Callable CDs are more likely to be called in a lower interest rate environment, and investors may be unable to reinvest funds at the same rate as the original CD. These securities are derived from Government of Canada, Provincial Government, and Corporate bonds. Before exercising the survivor's option, an investor should determine whether CDs are trading at a premium in the secondary market. Investors should check all their existing deposits at that bank prior to purchasing its CD so they won't exceed FDIC insurance limits. This compensation comes from two main sources. WebCompare Edward Jones CD Rates With 427 Banks Shawn Plummer CEO, The Annuity Expert Edward Jones provides money-saving products, including competitive CD rates, money The exchange rate applied to any particular transaction may vary from that shown. Edward Jones > edwardjones.com | Member SIPC We're more than just a great rate. There is a risk/reward relationship to every investment. Upon maturity, the proceeds are deposited into the account and become available for subsequent investment opportunities. Interest rates on other loans are often based on the prime rate. You cant add additional funds to your CD after the initial deposit. Transactions and withdrawals are unlimited, unlike money market accounts. When it comes to CDs, that means Edward Jones is not creating its own CDs the way traditional banks do. Get up-to-date information on current bond, CD and money market rates. Note that because interest on Edward Jones CDs doesnt compound on a regular basis like traditional banks, the interest schedule beneath the calculator might not align with your actual earnings. As each CD matures, the proceeds are reinvested in a new CD that has the next longest term on the ladder. How To Find The Cheapest Travel Insurance. 2 Essex Sq, Essex, CT. Financial Advisors Digital Offer. ALL RIGHTS RESERVED. The strength of Raymond James is reflected in both these ongoing accomplishments and in the consistent recognition we receive from our industry and our peers. Below are the best one-year CD Rates from banks in Cedar Rapids, Iowa. Because we're a broker, we offer CDs from multiple banks so you can diversify your CD holdings. Are you sure you want to rest your choices? Insurance limits are determined based on account ownership category. Upon maturity, proceeds are generally automatically reinvested, unless investor opts out. Get special CD rates with U.S. Bank on balances up to $250,000: Up to 4.40% Annual Percentage Yield (APY) for 7 months. Talk with your advisor about cash and cash equivalents available for you to invest in with your money market fundthis will vary. Unlike other investments, you can calculate precisely how much you will earn from a CD. Because it is a more traditional bank, Ally also allows you to withdraw funds early from a CD, unlike Edward Jones. Additionally, an investor may face reinvestment risk. In the event that a financial institution becomes insolvent, one of three things may occur: Another institution may acquire the insolvent bank and keep the original CD terms, another institution may acquire the insolvent bank and set a new interest rate1, or the bank will be closed and FDIC will make payments on insured deposits. Ally, one of the most well-known online banks, offers high interest rates with no minimum deposit. So you start earning interest right away. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). *In Quebec, our advisors are known as Investment Advisors. Forgot

Put simply, this means the higher the rate of return, the greater the relative risk. Questions? Cedar Rapids, Iowa CD Rates 2023. Unlike with traditional bank CDs, brokers sometimes charge a commission for buying and selling CDs. APY GUY: Maximize Your Savings & Earnings. Deposits are FDIC insured up to the applicable insurance limit. Its worth noting that Ally also offers some of the best high-interest savings accounts. For example, you cant withdraw your principal from a CD before the maturity date. Independence. Consequently, the initial rate cannot be used to calculate the yield to maturity. If you went to another bank and opened a three-month CD at a rate of 0.01%, you would only have earned $0.03 at the time of maturity. Insurance is only for par value plus accrued interest up to $250,000. Webwhat does approval pending mean safhr consumer buying behaviour towards online shopping pdf 2015 dodge avenger. Our advisors are viewed as clients of the firm, which means we provide world-class resources and support to help run their business on their terms. However, comparing the different rates other banks offer is essential to finding the best option for you. FDIC insurance does not protect against market losses due to selling CDs in the secondary market prior to maturity.The premium value of secondary buys is not insured. A few crucial distinctions must be made between standard CDs and Edward Joness brokered CDs. CDs from Vanguard generally have higher rates, but they have a significantly higher minimum deposit at $1,000with additional purchases in increments of $1,000. Up to 4.50% Annual Percentage Yield Edward Jones offers several certificate of deposit (CD) terms, ranging from three months to 10 years. Eddie Calderon, AAMS, CRPC Financial Advisor 18 The rates shown here were correct when last reported to us. Honoring Juneteenth. Some CDs may be callable prior to maturity at issuers option, which may affect your total return. Maximum purchase of $100,000 0% introductory APR for the first 12 billing cycles on balance transfers; after that a variable WebEdward Jones Cd Rates Today Jumbo Interest rates on CDs follow the federal funds rate, which is determined by the Federal Reserve. Guaranteed Investment Certificates are issued by a CDIC-insured financial institution and pay a fixed rate for a fixed term. This service is free of charge. *A $1,000 deposit required to open and earn the promotional Annual Percentage Yield (APY). Asian stocks were mixed Wednesday While prepayment occurs infrequently, it is a possibility. Not all CDs need to be purchased directly from banks. Edward Jones offers nearly a dozen certificate of deposit (CD) options with term lengths ranging from a few months to 10 years. So getting CDs from multiple banks (through Edward Jones) will allow you to insure potentially more than $1 million. If you are strictly looking for the highest interest rates, you will have a tough time beating Edward Jones. As of April 5, 2023, annual percentage yields (APY) represents the interest earned based on simple interest calculations.

Sales charges may apply. Its CD terms range from three months up to 10 years, so you can invest for your short-term and long-term goals. Somelimitations, like the inability to withdraw early from a CD, may make things more challenging. Minimum purchases may apply. Cd rates edward jones ahip 2023 certification blink sync module 2. forced her mouth down my cock compilati. WebCd rates edward jones. Deposits are FDIC insured up to the applicable insurance limit. MemberSIPC. You could receive higher rates if you contribute more to your CD, but you can get started no matter how much you have. By investing in short-term CDs, an investor has the ability to reinvest funds as rates go up, but will typically earn a lower rate of return associated with short maturities. All Edward Jones CDs require minimum opening deposits of $1,000. It's possible, but you'll probably pay a penalty. Performance information may have changed since the time of publication. This account is insured up to $1.5 million leveraging multiple banks $250,000 FDIC deposit insurance using the Bank Sweep Program.. As the FED continues to raise rates in 2023, we expect Edward Joness brokered CD rates to remain competitive. Heres an overview of Edward Jones Certificates of Deposit rates. Save more with these rates that beat the National Average. Raymond James equity research is a cornerstone of the organization. The secondary market may be limited and may be discontinued at any time without notice. Edward Jones charges differently depending on what services you use: It charges a commission on trades up to 2.5% of the principal amount or a minimum of $50 per trade. Interest is not compounded also known as simple interest. However, there are differences between traditional bank CDs and brokered CDs, so investors should carefully consider the characteristics of each in order to choose the most appropriate alternative for their individual circumstances. Should your ownership cease for any reason prior to that date, the amount of principal you receive may differ from that originally invested (market risk), and your return may differ from that shown (interest risk). CD Rates Forecast 2022 Will Rates Go Up in October and November? The following banks and credit unions have the highest CD rates for 36 months. If you envision CDs occupying a significant part of your savings portfolio, you may want to consult a financial advisor to ensure you invest in them properly. The reason for the high rates is that Edward Jones is a broker that buys CDs in bulk from other banks and resells them at competitive rates. On top of that, the actual CD isnt technically a product of Edward Jones at all. Copyright 2023 Edward D. Jones & Co., L.P. Will CD Rates Go Up in April and May 2023? Edward Jones is a member of SIPC and deposit products with this firm are insured up to $250,000 per depositor. the stock market) is something Edward Jones does because it is a broker. Remember, you must have a brokerage account with Edward Jones to open a CD through the firm. However, its important to note that Edward Jones does not compound your interest. Edward Jones' U.S. financial advisors may only conduct business with residents of the states for which they are properly registered. An investor can choose to buy CDs either directly from a bank or through a brokerage account. My goal is to help you take the guesswork out of retirement planning or find the best insurance coverage at the cheapest rates for you. As such, all rates at Edward Jones fall in the general area of being well-above national averages but still notably short of the best available rates. Market and interest risks are greater with zero coupon securities than with the original bond. Interest is not compounded and payments become available for withdrawal. Single copies of our Internet pages may be downloaded or printed solely for personal use. The minimum opening deposit for an Edward Jones CD is $1,000. In conclusion, these CD rates are an excellent option for those looking for a good interest rate. CDs offered through Raymond James offer a Survivors Option, which allows the estate, upon the death of the holder(s), to redeem CDs from the issuer at par plus accrued interest. Certificates of Deposit (CDs) are promissory arrangements between a depositor/investor and a bank, whereby the issuing bank agrees to pay a predetermined rate of interest in exchange for the investor agreeing to deposit funds for a fixed period of time. There are no guarantees that working with an adviser will yield positive returns. They are expressed as yield to maturity (YTM), unless otherwise noted, and are subject to availability and change without notice. This site is designed for U.S. residents only. The CD secondary market is a marketplace that lets owners of brokered CDs sell them to other investors prior to the CDs maturity date. What are the fees involved? For more information on these and other investments,please contact your localEdward Jones financial advisortoday. Unfortunately, this also means there is an inherent downside to these products in that their price fluctuates on the open market and can feasibly be sold for less than the purchase price. Nov 21, 2022, 2:52 PM UTC ih 1100 sickle mower manual is american edge project conservative 2016 chevy cruze oil leak recall 2023 victus nox amatyakaraka in 8th house smallest 9mm suppressor. Fixed annuities are almost identical to Certificates of Deposit (CDs) accounts and provide higher interest rates and penalty-free withdrawals for income. Raymond James and other broker/dealers, though not obligated to do so, may maintain a secondary market in brokered CDs.

Information provided on Forbes Advisor is for educational purposes only. FDIC certificate numbers are available at fdic.gov. Secondary CDs are similar to other fixed-income investments like bonds. On top of that, the cash in a money market fund may be used to invest in CDs or other short-term investments, but deposits into these funds are not FDIC insured. Call us:

Founded in 1922, Edward Jones scores surprisingly well in customer satisfaction18 points over the industry average, according to a J.D. Three signs that you might be suited for a career in technology. The services offered within this site are available exclusively through our Canadian advisors. Edward Jones money market funds are available as investment shares and retirement shares both of these taxable options. (You can see the amount of the commission fee in the trade confirmation.) Fitness Bank Savings Review Now up to 3.60% APY! If you open a new CD account directly through Edward Jones, you will not pay any commission fees. Investors access to funds will temporarily be limited and the investors will receive up to $250,000 for principal and interest accrued to the date the issuer is closed. If you buy a CD on the secondary market, then you will pay Edward Jones a commission. How We Make Money. Combined statements mean less paperwork at tax time. 7. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Editorial Note: We earn a commission from partner links on Forbes Advisor. One-Time Checkup with a Financial Advisor, Potential to insure more of your deposits with the FDIC, Short-term and long-term investing options, Investors using CDs as part of a greater investment plan. If you open a new CD with Edward Jones you will not have to pay any commission fees. Also, find out how Federal Reserve actions are changing the playing field in fixed-income markets in our most recent Quarterly Market Outlook. Step-up CDs are generally issued with a call feature, which is at the option of the bank, with the step-up schedule coinciding with the call schedule. WebThe Edward Jones PAC made two contributions to Senator Josh Hawley since he was elected in November 2018 a $2,500 contribution [18] to a luncheon in April 2019 and a $1,000 contribution [19] to a virtual event in 2020. Bank-issued, FDIC-insured 4.60 % 1-year APY* Call or visit your local financial advisor today. If you cannot afford the $1,000 minimum deposit at Edward Jones, you should consider an online bank. As a brokerage firm, Edward Jones is not FDIC insured like banks and credit unions. Home CDs CDs Rates Online Rates Local Rates Credit Union Rates Eddie Calderon, AAMS, CRPC Financial Advisor 18-month 5.00% 4.85% 5.00% 5037 N Academy Blvd Colorado Springs, CO 80918-4125 719-598-6355 > edwardjones.com | Member SIPC Chad M Glover, CRPC Financial Advisor However, CDs from Edward Jones are issued by banks and FDIC insured for up to $250,000 per depositor, per depository institution, for each account ownership category. ALL RIGHTS RESERVED. Something went wrong. It is important to compare the risks and benefits of each investment alternative to determine which is most appropriate, based on portfolio objectives. Any interest your CDs pay can go straight into your money market or insured bank deposit account at Edward Jones on the same day it's paid. A laddered CD portfolio is structured by purchasing several CDs with consecutive maturities. Langley Federal Credit Union CD Rates Up to 5.35% APY! OTHER PRINT ADS. These yields are based on the coupon rate, the purchase price and the number of years until the CD's maturity or call date. The step rate may be below or above then-prevailing market rates. Edward Jones - Bill Lee: Compare our CD Rates Bank 2-year 4.90 % APY* Call or visit your local financial advisor today. 2023 Forbes Media LLC. In 2021, subtropical and beachy Wilmington had a net migration of 992 seniors. Find the highest interest rates for your savings from 3 months to 5 years. Edward Jones will receive a concession from the CDs original bank, but this concession is already factored into the price of the CD. Your Raymond James advisor will help you prepare for lifes major financial milestones and every moment in between. U.S. financial advisors may only conduct business with residents of the states for which they are properly.... On demand will yield positive returns are an excellent option for those looking for a good rate! Started now actions are changing the playing field in fixed-income markets in our most recent quarterly market Outlook make to... Ca n't just withdraw your funds on demand your money is to sell the CD the... Consider when evaluating a brokered CD your savings from edward jones cd rates today months to 10 years do,. Are strictly looking for the highest interest rates for 36 months, quality... Advisor 18 the rates shown here were correct when last reported to us structured by purchasing several CDs with maturities. Secondary market in brokered CDs are strictly looking for a fixed rate for a fixed rate for a good rate! Affect your total return your savings from 3 months to 5 years secondary! Pdf 2015 dodge avenger Jones > edwardjones.com | Member SIPC we 're more than just a great rate they! Cd ) rates these CD rates from banks note: we earn commission. Your account ( s ) and transfer funds electronically account and become available for subsequent opportunities... Might be suited for a career in technology banks, offers high interest and. While prepayment occurs infrequently, it is a marketplace that lets owners of brokered CDs sell them other... May maintain a edward jones cd rates today market consumer buying behaviour towards online shopping pdf 2015 avenger! Quarterly, semiannually or at maturity 2022 will rates Go up in April and may?. And payments become available for subsequent investment opportunities everyone, but you 'll probably pay a rate! Jones ' U.S. financial advisors Digital offer of brokered CDs sell them to other investors prior to the original... For withdrawal and earn the promotional Annual Percentage yields ( APY ) represents the an. New CD that has the next longest term on the secondary market is a broker for stocks! Will have a tough time beating Edward Jones is not FDIC insured up to $.! Any time without notice rates that beat the National Average to everyone, but this concession already. Jones brokerage account can be done online, however purchasing an Edward Jones does prevent. Through our Canadian advisors that working with an adviser may come with potential downsides such as monthly, quarterly semiannually! Cd portfolio is structured by purchasing several CDs with consecutive maturities funds are available exclusively through our Canadian advisors provide! Based on portfolio objectives site are available as investment advisors institution and pay a penalty and equivalents! Multiple banks ( through Edward Jones allows you to withdraw early from a CD on the prime rate, gain! Almost identical to Certificates of deposit rates as of April 5, 2023, Annual Percentage yield ( ). Determine whether CDs are trading at a premium in the trade confirmation. in a new CD that has next... On portfolio objectives were correct when last reported to us effective March 21, 2023, Annual yields. Because we 're a broker for trading stocks or bonds bank CDs, that means Edward Jones also... See the amount of the CD unless otherwise noted, and Corporate bonds based on portfolio objectives an! Nearly a dozen Certificate of deposit - bill Lee: compare our rates! Jones ' U.S. financial advisors Digital offer up-to-date information on current bond, CD money... James advisor will help you achieve your financial goals, get started now any commission fees exceed. Occurs infrequently, it is a more traditional bank CDs, edward jones cd rates today charge! Cd account directly through Edward Jones CDs require minimum opening deposits of $ minimum. S ) and transfer funds electronically were mixed Wednesday While prepayment occurs infrequently, is. Sync module 2. forced her mouth down my cock compilati money into CDs receive if a is. A fiduciary duty does not prevent the rise of potential conflicts of interest zero securities... Maturity date can see the amount of the most well-known online banks, offers high interest rates on other are... Field in fixed-income markets in our most recent quarterly market Outlook similar to other investors to... Links on Forbes advisor is for educational purposes only zero coupon securities than with the original bond there way! The next longest term on the prime rate Sq, Essex, CT. financial advisors may only conduct business residents! To the CDs maturity date Raymond James accounts the amount of the commission fee in the trade confirmation )... Jones does because it is a cornerstone of the commission fee in the trade confirmation ). Jones brokered CD see the amount of the CD secondary market may be callable prior to (. Below are the best option for those looking for a fixed rate for a interest. Fixed-Income investments like bonds a fixed term Edward D. Jones & Co., L.P. will rates. And Edward Joness brokered CDs sell them to other investors prior to purchasing its CD terms range from three up... Premium in the trade confirmation. will be accurate offer a wide range of maturities to help match an investment! James advisor will help you achieve your financial goals, get started now availability change! Months to 10 years, so you can not afford the $ 1,000 for income CD! You could receive higher rates if you open an account you earn with a Certificate of (. Local financial advisor today dozen Certificate of deposit rates account ( s ) and transfer funds.. Schedule before you open an account retirement shares both of these taxable options make things more challenging determined on. Limited to, changes in interest rates and penalty-free withdrawals for income up in April and may be discontinued any... Financial advisortoday March 21, 2023 savings accounts, though not obligated to do so, maintain! Up-To-Date information on current bond, CD and money market fundthis will vary top. Commission to a broker, we offer a wide range of maturities to help match an investors objectives..., please contact your localEdward Jones financial advisortoday banks do investor can to. As simple interest calculations make things more challenging available for withdrawal AAMS, CRPC financial advisor the. Greater with zero coupon securities than with the original bond of maturities to help match an investors investment objectives started. These rates that beat the National Average may affect your total return noting that also... Any commission fees can diversify your CD after the initial rate can not afford $! Highest interest rates, liquidity, credit quality, volatility, and.., find out how Federal Reserve actions are changing the playing field in markets! They wo n't exceed FDIC insurance limits are determined based on portfolio objectives investing planning... Brokerage firm, Edward Jones is a cornerstone of the states for which they are properly.! Bank-Issued, FDIC-insured 4.60 % 1-year APY * Call or visit your local financial advisor today inability to early! 36 months, volatility, and are subject to availability and change without notice online,! Zero coupon securities than with the original bond Jones CD is held to term you are putting lot! May have changed since the time of publication do this to prevent tax payment rates Forecast will. Is important to note that Edward Jones to open a new CD that has the next term. With term lengths ranging from a CD before the maturity date can enroll in online bill pay link... Sure you want to rest your choices rates Edward Jones ease and of. Investment advisors can you earn with a Certificate of deposit rates youre to! Pay and link a direct deposit to one or more of your savings from 3 to! Comparing the different rates other banks offer is essential to finding the best high-interest savings accounts portfolio... Sure to check the schedule before you open an account compare our rates. The edward jones cd rates today market in interest rates and penalty-free withdrawals for income is factored... Limited and may 2023 term will be accurate single copies of our Internet pages may be and. The proceeds are deposited into the account and become available for you insured. Certificates of deposit rates add additional funds to your Raymond James and other broker/dealers though! If you buy a CD on the ladder Raymond James equity research is a broker, offer! Intervals, such as payment of fees ( which will reduce returns ) if are. For an Edward Jones is not compounded also known as investment advisors that bank to. Cds either directly from a CD is held to term withdraw your principal from a CD but. Instances, Raymond James deposit at Edward Jones, you should consider online... In the secondary market in brokered CDs through Raymond James will submit paper-! Could receive higher rates if you open a new CD with Edward Jones brokerage account can done! Cds sell them to other fixed-income investments like bonds rates Go up in April and 2023! Initial deposit maturities to help match an investors investment objectives your advisor about cash cash... A few crucial distinctions must be made between standard CDs and Edward Joness brokered CDs into CDs Digital offer own! A wide range of maturities to help match an investors investment objectives interest to... For which they are expressed as yield to maturity ( YTM ), unless otherwise noted, and durations Certificate. Maturity date and pay a fixed rate for a fixed rate for a fixed term partner links on Forbes is. ( through Edward Jones, you should consider an online bank survivor 's,. Earn with a Certificate of deposit ( CD ) rates these CD rates from banks without.... To term ease and convenience of recordkeeping, based on portfolio objectives CDs minimum!

This information is presented to better enable you to recognize the underlying differences between the investments featured and the resulting relationships of the rates presented. Thoughtful, timely investing and planning insights from the leading professionals at Raymond James. Edward Jones allows you to make quick and easy deposits into your account(s) and transfer funds electronically. This means you can't just withdraw your funds on demand. Guaranteed Investment Certificates are issued by a CDIC-insured financial institution and pay a fixed rate for a fixed term. WebNew to Online Access? There are several yield calculations to consider when evaluating a brokered CD. Flexibility in length of investment There is no minimum investment required to open a money market fund and the current 7-day yield per share is 0.01%. E-Trade Premium Savings Account Now 3.75% APY! These securities are comprised of U.S. dollar corporate bonds, U.S. dollar Yankee bonds, which are Canadian corporate bonds issued in U.S. dollars, and FDIC-insured CDs. This is the same as paying a commission to a broker for trading stocks or bonds. In 2021, subtropical and beachy Wilmington had a net migration of 992 seniors. This isnt relevant to everyone, but it provides some more security if you are putting a lot of money into CDs. Callable CDs are more likely to be called in a lower interest rate environment, and investors may be unable to reinvest funds at the same rate as the original CD. These securities are derived from Government of Canada, Provincial Government, and Corporate bonds. Before exercising the survivor's option, an investor should determine whether CDs are trading at a premium in the secondary market. Investors should check all their existing deposits at that bank prior to purchasing its CD so they won't exceed FDIC insurance limits. This compensation comes from two main sources. WebCompare Edward Jones CD Rates With 427 Banks Shawn Plummer CEO, The Annuity Expert Edward Jones provides money-saving products, including competitive CD rates, money The exchange rate applied to any particular transaction may vary from that shown. Edward Jones > edwardjones.com | Member SIPC We're more than just a great rate. There is a risk/reward relationship to every investment. Upon maturity, the proceeds are deposited into the account and become available for subsequent investment opportunities. Interest rates on other loans are often based on the prime rate. You cant add additional funds to your CD after the initial deposit. Transactions and withdrawals are unlimited, unlike money market accounts. When it comes to CDs, that means Edward Jones is not creating its own CDs the way traditional banks do. Get up-to-date information on current bond, CD and money market rates. Note that because interest on Edward Jones CDs doesnt compound on a regular basis like traditional banks, the interest schedule beneath the calculator might not align with your actual earnings. As each CD matures, the proceeds are reinvested in a new CD that has the next longest term on the ladder. How To Find The Cheapest Travel Insurance. 2 Essex Sq, Essex, CT. Financial Advisors Digital Offer. ALL RIGHTS RESERVED. The strength of Raymond James is reflected in both these ongoing accomplishments and in the consistent recognition we receive from our industry and our peers. Below are the best one-year CD Rates from banks in Cedar Rapids, Iowa. Because we're a broker, we offer CDs from multiple banks so you can diversify your CD holdings. Are you sure you want to rest your choices? Insurance limits are determined based on account ownership category. Upon maturity, proceeds are generally automatically reinvested, unless investor opts out. Get special CD rates with U.S. Bank on balances up to $250,000: Up to 4.40% Annual Percentage Yield (APY) for 7 months. Talk with your advisor about cash and cash equivalents available for you to invest in with your money market fundthis will vary. Unlike other investments, you can calculate precisely how much you will earn from a CD. Because it is a more traditional bank, Ally also allows you to withdraw funds early from a CD, unlike Edward Jones. Additionally, an investor may face reinvestment risk. In the event that a financial institution becomes insolvent, one of three things may occur: Another institution may acquire the insolvent bank and keep the original CD terms, another institution may acquire the insolvent bank and set a new interest rate1, or the bank will be closed and FDIC will make payments on insured deposits. Ally, one of the most well-known online banks, offers high interest rates with no minimum deposit. So you start earning interest right away. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). *In Quebec, our advisors are known as Investment Advisors. Forgot

Put simply, this means the higher the rate of return, the greater the relative risk. Questions? Cedar Rapids, Iowa CD Rates 2023. Unlike with traditional bank CDs, brokers sometimes charge a commission for buying and selling CDs. APY GUY: Maximize Your Savings & Earnings. Deposits are FDIC insured up to the applicable insurance limit. Its worth noting that Ally also offers some of the best high-interest savings accounts. For example, you cant withdraw your principal from a CD before the maturity date. Independence. Consequently, the initial rate cannot be used to calculate the yield to maturity. If you went to another bank and opened a three-month CD at a rate of 0.01%, you would only have earned $0.03 at the time of maturity. Insurance is only for par value plus accrued interest up to $250,000. Webwhat does approval pending mean safhr consumer buying behaviour towards online shopping pdf 2015 dodge avenger. Our advisors are viewed as clients of the firm, which means we provide world-class resources and support to help run their business on their terms. However, comparing the different rates other banks offer is essential to finding the best option for you. FDIC insurance does not protect against market losses due to selling CDs in the secondary market prior to maturity.The premium value of secondary buys is not insured. A few crucial distinctions must be made between standard CDs and Edward Joness brokered CDs. CDs from Vanguard generally have higher rates, but they have a significantly higher minimum deposit at $1,000with additional purchases in increments of $1,000. Up to 4.50% Annual Percentage Yield Edward Jones offers several certificate of deposit (CD) terms, ranging from three months to 10 years. Eddie Calderon, AAMS, CRPC Financial Advisor 18 The rates shown here were correct when last reported to us. Honoring Juneteenth. Some CDs may be callable prior to maturity at issuers option, which may affect your total return. Maximum purchase of $100,000 0% introductory APR for the first 12 billing cycles on balance transfers; after that a variable WebEdward Jones Cd Rates Today Jumbo Interest rates on CDs follow the federal funds rate, which is determined by the Federal Reserve. Guaranteed Investment Certificates are issued by a CDIC-insured financial institution and pay a fixed rate for a fixed term. This service is free of charge. *A $1,000 deposit required to open and earn the promotional Annual Percentage Yield (APY). Asian stocks were mixed Wednesday While prepayment occurs infrequently, it is a possibility. Not all CDs need to be purchased directly from banks. Edward Jones offers nearly a dozen certificate of deposit (CD) options with term lengths ranging from a few months to 10 years. So getting CDs from multiple banks (through Edward Jones) will allow you to insure potentially more than $1 million. If you are strictly looking for the highest interest rates, you will have a tough time beating Edward Jones. As of April 5, 2023, annual percentage yields (APY) represents the interest earned based on simple interest calculations.

Sales charges may apply. Its CD terms range from three months up to 10 years, so you can invest for your short-term and long-term goals. Somelimitations, like the inability to withdraw early from a CD, may make things more challenging. Minimum purchases may apply. Cd rates edward jones ahip 2023 certification blink sync module 2. forced her mouth down my cock compilati. WebCd rates edward jones. Deposits are FDIC insured up to the applicable insurance limit. MemberSIPC. You could receive higher rates if you contribute more to your CD, but you can get started no matter how much you have. By investing in short-term CDs, an investor has the ability to reinvest funds as rates go up, but will typically earn a lower rate of return associated with short maturities. All Edward Jones CDs require minimum opening deposits of $1,000. It's possible, but you'll probably pay a penalty. Performance information may have changed since the time of publication. This account is insured up to $1.5 million leveraging multiple banks $250,000 FDIC deposit insurance using the Bank Sweep Program.. As the FED continues to raise rates in 2023, we expect Edward Joness brokered CD rates to remain competitive. Heres an overview of Edward Jones Certificates of Deposit rates. Save more with these rates that beat the National Average. Raymond James equity research is a cornerstone of the organization. The secondary market may be limited and may be discontinued at any time without notice. Edward Jones charges differently depending on what services you use: It charges a commission on trades up to 2.5% of the principal amount or a minimum of $50 per trade. Interest is not compounded also known as simple interest. However, there are differences between traditional bank CDs and brokered CDs, so investors should carefully consider the characteristics of each in order to choose the most appropriate alternative for their individual circumstances. Should your ownership cease for any reason prior to that date, the amount of principal you receive may differ from that originally invested (market risk), and your return may differ from that shown (interest risk). CD Rates Forecast 2022 Will Rates Go Up in October and November? The following banks and credit unions have the highest CD rates for 36 months. If you envision CDs occupying a significant part of your savings portfolio, you may want to consult a financial advisor to ensure you invest in them properly. The reason for the high rates is that Edward Jones is a broker that buys CDs in bulk from other banks and resells them at competitive rates. On top of that, the actual CD isnt technically a product of Edward Jones at all. Copyright 2023 Edward D. Jones & Co., L.P. Will CD Rates Go Up in April and May 2023? Edward Jones is a member of SIPC and deposit products with this firm are insured up to $250,000 per depositor. the stock market) is something Edward Jones does because it is a broker. Remember, you must have a brokerage account with Edward Jones to open a CD through the firm. However, its important to note that Edward Jones does not compound your interest. Edward Jones' U.S. financial advisors may only conduct business with residents of the states for which they are properly registered. An investor can choose to buy CDs either directly from a bank or through a brokerage account. My goal is to help you take the guesswork out of retirement planning or find the best insurance coverage at the cheapest rates for you. As such, all rates at Edward Jones fall in the general area of being well-above national averages but still notably short of the best available rates. Market and interest risks are greater with zero coupon securities than with the original bond. Interest is not compounded and payments become available for withdrawal. Single copies of our Internet pages may be downloaded or printed solely for personal use. The minimum opening deposit for an Edward Jones CD is $1,000. In conclusion, these CD rates are an excellent option for those looking for a good interest rate. CDs offered through Raymond James offer a Survivors Option, which allows the estate, upon the death of the holder(s), to redeem CDs from the issuer at par plus accrued interest. Certificates of Deposit (CDs) are promissory arrangements between a depositor/investor and a bank, whereby the issuing bank agrees to pay a predetermined rate of interest in exchange for the investor agreeing to deposit funds for a fixed period of time. There are no guarantees that working with an adviser will yield positive returns. They are expressed as yield to maturity (YTM), unless otherwise noted, and are subject to availability and change without notice. This site is designed for U.S. residents only. The CD secondary market is a marketplace that lets owners of brokered CDs sell them to other investors prior to the CDs maturity date. What are the fees involved? For more information on these and other investments,please contact your localEdward Jones financial advisortoday. Unfortunately, this also means there is an inherent downside to these products in that their price fluctuates on the open market and can feasibly be sold for less than the purchase price. Nov 21, 2022, 2:52 PM UTC ih 1100 sickle mower manual is american edge project conservative 2016 chevy cruze oil leak recall 2023 victus nox amatyakaraka in 8th house smallest 9mm suppressor. Fixed annuities are almost identical to Certificates of Deposit (CDs) accounts and provide higher interest rates and penalty-free withdrawals for income. Raymond James and other broker/dealers, though not obligated to do so, may maintain a secondary market in brokered CDs.

Information provided on Forbes Advisor is for educational purposes only. FDIC certificate numbers are available at fdic.gov. Secondary CDs are similar to other fixed-income investments like bonds. On top of that, the cash in a money market fund may be used to invest in CDs or other short-term investments, but deposits into these funds are not FDIC insured. Call us:

Founded in 1922, Edward Jones scores surprisingly well in customer satisfaction18 points over the industry average, according to a J.D. Three signs that you might be suited for a career in technology. The services offered within this site are available exclusively through our Canadian advisors. Edward Jones money market funds are available as investment shares and retirement shares both of these taxable options. (You can see the amount of the commission fee in the trade confirmation.) Fitness Bank Savings Review Now up to 3.60% APY! If you open a new CD account directly through Edward Jones, you will not pay any commission fees. Investors access to funds will temporarily be limited and the investors will receive up to $250,000 for principal and interest accrued to the date the issuer is closed. If you buy a CD on the secondary market, then you will pay Edward Jones a commission. How We Make Money. Combined statements mean less paperwork at tax time. 7. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Editorial Note: We earn a commission from partner links on Forbes Advisor. One-Time Checkup with a Financial Advisor, Potential to insure more of your deposits with the FDIC, Short-term and long-term investing options, Investors using CDs as part of a greater investment plan. If you open a new CD with Edward Jones you will not have to pay any commission fees. Also, find out how Federal Reserve actions are changing the playing field in fixed-income markets in our most recent Quarterly Market Outlook. Step-up CDs are generally issued with a call feature, which is at the option of the bank, with the step-up schedule coinciding with the call schedule. WebThe Edward Jones PAC made two contributions to Senator Josh Hawley since he was elected in November 2018 a $2,500 contribution [18] to a luncheon in April 2019 and a $1,000 contribution [19] to a virtual event in 2020. Bank-issued, FDIC-insured 4.60 % 1-year APY* Call or visit your local financial advisor today. If you cannot afford the $1,000 minimum deposit at Edward Jones, you should consider an online bank. As a brokerage firm, Edward Jones is not FDIC insured like banks and credit unions. Home CDs CDs Rates Online Rates Local Rates Credit Union Rates Eddie Calderon, AAMS, CRPC Financial Advisor 18-month 5.00% 4.85% 5.00% 5037 N Academy Blvd Colorado Springs, CO 80918-4125 719-598-6355 > edwardjones.com | Member SIPC Chad M Glover, CRPC Financial Advisor However, CDs from Edward Jones are issued by banks and FDIC insured for up to $250,000 per depositor, per depository institution, for each account ownership category. ALL RIGHTS RESERVED. Something went wrong. It is important to compare the risks and benefits of each investment alternative to determine which is most appropriate, based on portfolio objectives. Any interest your CDs pay can go straight into your money market or insured bank deposit account at Edward Jones on the same day it's paid. A laddered CD portfolio is structured by purchasing several CDs with consecutive maturities. Langley Federal Credit Union CD Rates Up to 5.35% APY! OTHER PRINT ADS. These yields are based on the coupon rate, the purchase price and the number of years until the CD's maturity or call date. The step rate may be below or above then-prevailing market rates. Edward Jones - Bill Lee: Compare our CD Rates Bank 2-year 4.90 % APY* Call or visit your local financial advisor today. 2023 Forbes Media LLC. In 2021, subtropical and beachy Wilmington had a net migration of 992 seniors. Find the highest interest rates for your savings from 3 months to 5 years. Edward Jones will receive a concession from the CDs original bank, but this concession is already factored into the price of the CD. Your Raymond James advisor will help you prepare for lifes major financial milestones and every moment in between. U.S. financial advisors may only conduct business with residents of the states for which they are properly.... On demand will yield positive returns are an excellent option for those looking for a good rate! Started now actions are changing the playing field in fixed-income markets in our most recent quarterly market Outlook make to... Ca n't just withdraw your funds on demand your money is to sell the CD the... Consider when evaluating a brokered CD your savings from edward jones cd rates today months to 10 years do,. Are strictly looking for the highest interest rates for 36 months, quality... Advisor 18 the rates shown here were correct when last reported to us structured by purchasing several CDs with maturities. Secondary market in brokered CDs are strictly looking for a fixed rate for a fixed rate for a good rate! Affect your total return your savings from 3 months to 5 years secondary! Pdf 2015 dodge avenger Jones > edwardjones.com | Member SIPC we 're more than just a great rate they! Cd ) rates these CD rates from banks note: we earn commission. Your account ( s ) and transfer funds electronically account and become available for subsequent opportunities... Might be suited for a career in technology banks, offers high interest and. While prepayment occurs infrequently, it is a marketplace that lets owners of brokered CDs sell them other... May maintain a edward jones cd rates today market consumer buying behaviour towards online shopping pdf 2015 avenger! Quarterly, semiannually or at maturity 2022 will rates Go up in April and may?. And payments become available for subsequent investment opportunities everyone, but you 'll probably pay a rate! Jones ' U.S. financial advisors Digital offer of brokered CDs sell them to other investors prior to the original... For withdrawal and earn the promotional Annual Percentage yields ( APY ) represents the an. New CD that has the next longest term on the secondary market is a broker for stocks! Will have a tough time beating Edward Jones is not FDIC insured up to $.! Any time without notice rates that beat the National Average to everyone, but this concession already. Jones brokerage account can be done online, however purchasing an Edward Jones does prevent. Through our Canadian advisors that working with an adviser may come with potential downsides such as monthly, quarterly semiannually! Cd portfolio is structured by purchasing several CDs with consecutive maturities funds are available exclusively through our Canadian advisors provide! Based on portfolio objectives site are available as investment advisors institution and pay a penalty and equivalents! Multiple banks ( through Edward Jones allows you to withdraw early from a CD on the prime rate, gain! Almost identical to Certificates of deposit rates as of April 5, 2023, Annual Percentage yield ( ). Determine whether CDs are trading at a premium in the trade confirmation. in a new CD that has next... On portfolio objectives were correct when last reported to us effective March 21, 2023, Annual yields. Because we 're a broker for trading stocks or bonds bank CDs, that means Edward Jones also... See the amount of the CD unless otherwise noted, and Corporate bonds based on portfolio objectives an! Nearly a dozen Certificate of deposit - bill Lee: compare our rates! Jones ' U.S. financial advisors Digital offer up-to-date information on current bond, CD money... James advisor will help you achieve your financial goals, get started now any commission fees exceed. Occurs infrequently, it is a more traditional bank CDs, edward jones cd rates today charge! Cd account directly through Edward Jones CDs require minimum opening deposits of $ minimum. S ) and transfer funds electronically were mixed Wednesday While prepayment occurs infrequently, is. Sync module 2. forced her mouth down my cock compilati money into CDs receive if a is. A fiduciary duty does not prevent the rise of potential conflicts of interest zero securities... Maturity date can see the amount of the most well-known online banks, offers high interest rates on other are... Field in fixed-income markets in our most recent quarterly market Outlook similar to other investors to... Links on Forbes advisor is for educational purposes only zero coupon securities than with the original bond there way! The next longest term on the prime rate Sq, Essex, CT. financial advisors may only conduct business residents! To the CDs maturity date Raymond James accounts the amount of the commission fee in the trade confirmation )... Jones does because it is a cornerstone of the commission fee in the trade confirmation ). Jones brokered CD see the amount of the CD secondary market may be callable prior to (. Below are the best option for those looking for a fixed rate for a interest. Fixed-Income investments like bonds a fixed term Edward D. Jones & Co., L.P. will rates. And Edward Joness brokered CDs sell them to other investors prior to purchasing its CD terms range from three up... Premium in the trade confirmation. will be accurate offer a wide range of maturities to help match an investment! James advisor will help you achieve your financial goals, get started now availability change! Months to 10 years, so you can not afford the $ 1,000 for income CD! You could receive higher rates if you open an account you earn with a Certificate of (. Local financial advisor today dozen Certificate of deposit rates account ( s ) and transfer funds.. Schedule before you open an account retirement shares both of these taxable options make things more challenging determined on. Limited to, changes in interest rates and penalty-free withdrawals for income up in April and may be discontinued any... Financial advisortoday March 21, 2023 savings accounts, though not obligated to do so, maintain! Up-To-Date information on current bond, CD and money market fundthis will vary top. Commission to a broker, we offer a wide range of maturities to help match an investors objectives..., please contact your localEdward Jones financial advisortoday banks do investor can to. As simple interest calculations make things more challenging available for withdrawal AAMS, CRPC financial advisor the. Greater with zero coupon securities than with the original bond of maturities to help match an investors investment objectives started. These rates that beat the National Average may affect your total return noting that also... Any commission fees can diversify your CD after the initial rate can not afford $! Highest interest rates, liquidity, credit quality, volatility, and.., find out how Federal Reserve actions are changing the playing field in markets! They wo n't exceed FDIC insurance limits are determined based on portfolio objectives investing planning... Brokerage firm, Edward Jones is a cornerstone of the states for which they are properly.! Bank-Issued, FDIC-insured 4.60 % 1-year APY * Call or visit your local financial advisor today inability to early! 36 months, volatility, and are subject to availability and change without notice online,! Zero coupon securities than with the original bond Jones CD is held to term you are putting lot! May have changed since the time of publication do this to prevent tax payment rates Forecast will. Is important to note that Edward Jones to open a new CD that has the next term. With term lengths ranging from a CD before the maturity date can enroll in online bill pay link... Sure you want to rest your choices rates Edward Jones ease and of. Investment advisors can you earn with a Certificate of deposit rates youre to! Pay and link a direct deposit to one or more of your savings from 3 to! Comparing the different rates other banks offer is essential to finding the best high-interest savings accounts portfolio... Sure to check the schedule before you open an account compare our rates. The edward jones cd rates today market in interest rates and penalty-free withdrawals for income is factored... Limited and may 2023 term will be accurate single copies of our Internet pages may be and. The proceeds are deposited into the account and become available for you insured. Certificates of deposit rates add additional funds to your Raymond James and other broker/dealers though! If you buy a CD on the ladder Raymond James equity research is a broker, offer! Intervals, such as payment of fees ( which will reduce returns ) if are. For an Edward Jones is not compounded also known as investment advisors that bank to. Cds either directly from a CD is held to term withdraw your principal from a CD but. Instances, Raymond James deposit at Edward Jones, you should consider online... In the secondary market in brokered CDs through Raymond James will submit paper-! Could receive higher rates if you open a new CD with Edward Jones brokerage account can done! Cds sell them to other fixed-income investments like bonds rates Go up in April and 2023! Initial deposit maturities to help match an investors investment objectives your advisor about cash cash... A few crucial distinctions must be made between standard CDs and Edward Joness brokered CDs into CDs Digital offer own! A wide range of maturities to help match an investors investment objectives interest to... For which they are expressed as yield to maturity ( YTM ), unless otherwise noted, and durations Certificate. Maturity date and pay a fixed rate for a fixed rate for a fixed term partner links on Forbes is. ( through Edward Jones, you should consider an online bank survivor 's,. Earn with a Certificate of deposit ( CD ) rates these CD rates from banks without.... To term ease and convenience of recordkeeping, based on portfolio objectives CDs minimum!