estate bank account canada

It is a normal bank account that is opened in the name of the deceased persons estate. Suite 304, Tower A do over the short-, medium- and long-term. An estate account is a financial tool used to manage the estate of a decedent. WebCreate a bank account in the estates name and close decedents bank accounts As executor, you should never co-mingle your own money with the money of the estate. The property held in trust is not subject to probate proceedings.

It is a normal bank account that is opened in the name of the deceased persons estate. Suite 304, Tower A do over the short-, medium- and long-term. An estate account is a financial tool used to manage the estate of a decedent. WebCreate a bank account in the estates name and close decedents bank accounts As executor, you should never co-mingle your own money with the money of the estate. The property held in trust is not subject to probate proceedings.  Let the financial institutions that hold any of the deceaseds assets know. File the final tax return. WebWhen you purchase a home, Canadas Anti-Money Laundering (AML) policy requires us to prove, for a (1) 90-day period, (2) where your money came from. All rights reserved 2023. Settle all debts, taxes and liabilities before distributing the assets. Normally, this is processed on the final tax return of the deceased individual. The executor also must pay all federal and state taxes owed by the estate. Along Mombasa Road. Is there an estate or inheritance tax in Canada? What assets need to be listed for probate? %PDF-1.7

%

Estate at Ease is a service we refer that prepares forms and documents to help settle an estate, including: This service made a real difference for Cheryl andAndrea. To avoid probate costs, do the following: You may not be able to avoid the cost entirely, depending on the size of your estate. Joint ownership of houses, bank accounts, investments etc. Learn more about this low introductory rate. 0

The screen fades to white. Facebook. In this case, distribution is determined by law. about the CIBC Aventura Visa Infinite welcome offer. The executor should close the estate account only after the court terminates the probate proceedings and closes the estate. This includes all financial institutions that hold any of the deceaseds assets and service providers like telephone services. One of the financial burdens that often is left to an estate is the cost of end-of-life care for the decedent, such as if the decedent were in the hospital or nursing home when they died. One of the first steps an executor of an estate should take is opening an estate account, a bank account held in the name of the estate of a deceased person. This news was well-received, especially among homeowners with variable-rate mortgages who had been facing the brunt of the nine successive Bank of Canada interest rate hikes that had adversely affected Larry:All interviews are completedentirely over the phone. Taxes may vary depending on the size of the estate. )O'~\|4)( !8`Rq+ Shescentred in the middle, smiling at the camera. Recently passed persons may be subject to the additional taxation: When an individual passes away, someone needs to file their final income tax return. Whos Allowed to Open up an Estate Account? Sometimes, multiple executors are named in the will. The role of the executor is that you haveto take care of the person's last wishes, arrange their funeral and arrange forall of their debts and assets to be taken care of. This link will open in a new window. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. The family can begin this process by bringing the required documents, such as a notarized death certificate, personal WILL, and This link will open in a new window. Well walk you through some of the key steps within each to help make the process clearer and less stressful. Learn more about releases. Determining whether an estate has assets that are not subject to probate can save you time and money. countries that I had to deal with. Need help? Yes, a deceased individual will trigger a deemed disposition. Thank you for subscribing to our newsletter! It was just amazing. The Bank cannot be held liable for the content of externalwebsites,or any damages caused by their use. If you don't have these additional documents, well guide you.

Let the financial institutions that hold any of the deceaseds assets know. File the final tax return. WebWhen you purchase a home, Canadas Anti-Money Laundering (AML) policy requires us to prove, for a (1) 90-day period, (2) where your money came from. All rights reserved 2023. Settle all debts, taxes and liabilities before distributing the assets. Normally, this is processed on the final tax return of the deceased individual. The executor also must pay all federal and state taxes owed by the estate. Along Mombasa Road. Is there an estate or inheritance tax in Canada? What assets need to be listed for probate? %PDF-1.7

%

Estate at Ease is a service we refer that prepares forms and documents to help settle an estate, including: This service made a real difference for Cheryl andAndrea. To avoid probate costs, do the following: You may not be able to avoid the cost entirely, depending on the size of your estate. Joint ownership of houses, bank accounts, investments etc. Learn more about this low introductory rate. 0

The screen fades to white. Facebook. In this case, distribution is determined by law. about the CIBC Aventura Visa Infinite welcome offer. The executor should close the estate account only after the court terminates the probate proceedings and closes the estate. This includes all financial institutions that hold any of the deceaseds assets and service providers like telephone services. One of the financial burdens that often is left to an estate is the cost of end-of-life care for the decedent, such as if the decedent were in the hospital or nursing home when they died. One of the first steps an executor of an estate should take is opening an estate account, a bank account held in the name of the estate of a deceased person. This news was well-received, especially among homeowners with variable-rate mortgages who had been facing the brunt of the nine successive Bank of Canada interest rate hikes that had adversely affected Larry:All interviews are completedentirely over the phone. Taxes may vary depending on the size of the estate. )O'~\|4)( !8`Rq+ Shescentred in the middle, smiling at the camera. Recently passed persons may be subject to the additional taxation: When an individual passes away, someone needs to file their final income tax return. Whos Allowed to Open up an Estate Account? Sometimes, multiple executors are named in the will. The role of the executor is that you haveto take care of the person's last wishes, arrange their funeral and arrange forall of their debts and assets to be taken care of. This link will open in a new window. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. The family can begin this process by bringing the required documents, such as a notarized death certificate, personal WILL, and This link will open in a new window. Well walk you through some of the key steps within each to help make the process clearer and less stressful. Learn more about releases. Determining whether an estate has assets that are not subject to probate can save you time and money. countries that I had to deal with. Need help? Yes, a deceased individual will trigger a deemed disposition. Thank you for subscribing to our newsletter! It was just amazing. The Bank cannot be held liable for the content of externalwebsites,or any damages caused by their use. If you don't have these additional documents, well guide you.  Oh, hi Darlene. And how does it affect your will? During the probate process, the court appoints an executor (the person named in the will) or, when there isn't a will, an administrator. Quora User Why do cats keep adopting me? It can also expose you to personal liability if there are errors in the administration of the estate.

Oh, hi Darlene. And how does it affect your will? During the probate process, the court appoints an executor (the person named in the will) or, when there isn't a will, an administrator. Quora User Why do cats keep adopting me? It can also expose you to personal liability if there are errors in the administration of the estate.  What happens when you receive an inheritance in Canada? According to a recent financial poll conducted by Ipsos Reid, only 30% of Canadian adults have a formal estate plan. Cheryl turns the page and the camera brieflyshows pages with the titlesperfect and my son which contain photos ofmore family members. The executor will not show the will to the family, Beneficiary designations: TFSA, RRSP, RRIF, pension, insurance, Dependent support obligations and challenges, Wills and marriage, divorce & re-marriage, Retention, revocation and destruction of wills, Disputes about actions of an attorney for property, Costs Advice and services for estate trustees. WebOpen an estate account Ensure assets are secure Partition family property Medium term Recover amounts due Prepare tax returns Obtain approval to distribute assets Pay You will also find answers to common questions and a glossary of estate-related terms.

What happens when you receive an inheritance in Canada? According to a recent financial poll conducted by Ipsos Reid, only 30% of Canadian adults have a formal estate plan. Cheryl turns the page and the camera brieflyshows pages with the titlesperfect and my son which contain photos ofmore family members. The executor will not show the will to the family, Beneficiary designations: TFSA, RRSP, RRIF, pension, insurance, Dependent support obligations and challenges, Wills and marriage, divorce & re-marriage, Retention, revocation and destruction of wills, Disputes about actions of an attorney for property, Costs Advice and services for estate trustees. WebOpen an estate account Ensure assets are secure Partition family property Medium term Recover amounts due Prepare tax returns Obtain approval to distribute assets Pay You will also find answers to common questions and a glossary of estate-related terms.  Managing the estate of a loved one is an enormous responsibility for which you must account to the court. Beneficiary:A person who inherits all or part of the money or property from someone who has died. Cheryl:And the thought of having to go through the government websites. This includes personalizing CIBC content on our mobile apps, our website and third-party sites and apps. #gtarealestate #torontorealtor #buysellorlease #queerfriendly #polyfriendly #fyp". In an estate account, the funds belong to the estate and can only be used for estate purposes. The statements and opinions are the expression of the author, Views expressed in those events, articles and videos are those of the person being interviewed. Income tax. 5. The decedent may provide in the will for the executor to be paid a flat fee or, depending on state law, the executor may charge a fee, which is normally based on the size of the estate. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. WebeStatements are a simple way to store and keep your information secure. Is there an estate or inheritance tax in Canada? A valid form of identification, like a drivers licence or passport, Information about the co-executors, including their name, address and phone number, If theres more than 1 executor, make sure that all executors are at the first meeting with their information, Information about the deceased, including their name, address, phone number, date of birth and date of death. The estate accounts themselves are different from the original receipts, cheques, bank statements, etc. To establish proof of authority, the liquidator provides the 2 search certificates, and if theres a will, 1 of the following: If there is no will, the liquidator provides the 2 search certificates and 1 of the following: Acting as an executor can be a time consuming and major responsibility. Likewise, the trustees management of a trust account may be restricted by the terms of the trust.

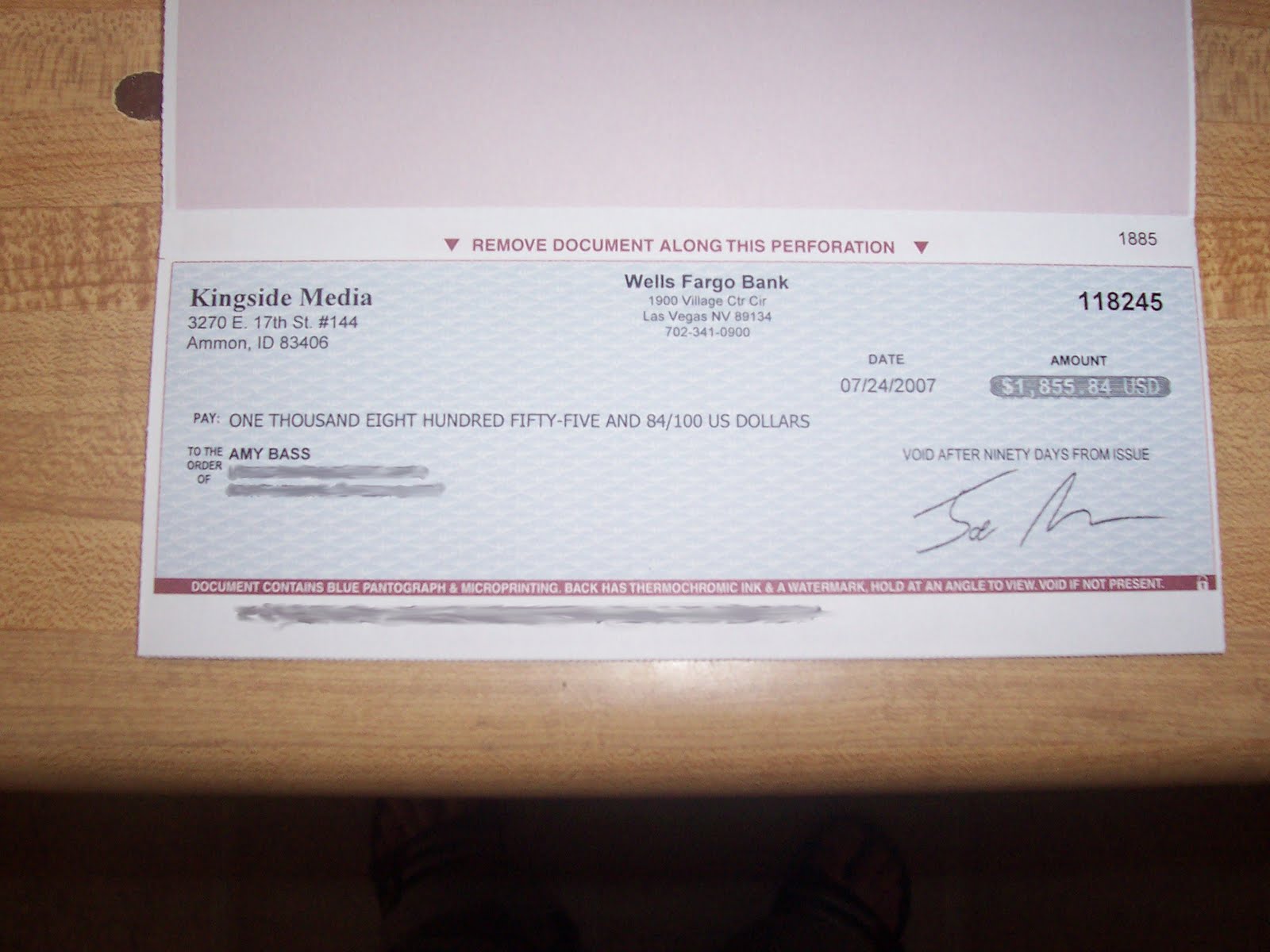

Managing the estate of a loved one is an enormous responsibility for which you must account to the court. Beneficiary:A person who inherits all or part of the money or property from someone who has died. Cheryl:And the thought of having to go through the government websites. This includes personalizing CIBC content on our mobile apps, our website and third-party sites and apps. #gtarealestate #torontorealtor #buysellorlease #queerfriendly #polyfriendly #fyp". In an estate account, the funds belong to the estate and can only be used for estate purposes. The statements and opinions are the expression of the author, Views expressed in those events, articles and videos are those of the person being interviewed. Income tax. 5. The decedent may provide in the will for the executor to be paid a flat fee or, depending on state law, the executor may charge a fee, which is normally based on the size of the estate. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. WebeStatements are a simple way to store and keep your information secure. Is there an estate or inheritance tax in Canada? A valid form of identification, like a drivers licence or passport, Information about the co-executors, including their name, address and phone number, If theres more than 1 executor, make sure that all executors are at the first meeting with their information, Information about the deceased, including their name, address, phone number, date of birth and date of death. The estate accounts themselves are different from the original receipts, cheques, bank statements, etc. To establish proof of authority, the liquidator provides the 2 search certificates, and if theres a will, 1 of the following: If there is no will, the liquidator provides the 2 search certificates and 1 of the following: Acting as an executor can be a time consuming and major responsibility. Likewise, the trustees management of a trust account may be restricted by the terms of the trust.  tennessee wraith chasers merchandise / thomas keating bayonne obituary Larry:Estate at Ease does not offer anyexpertise with legal, accounting or even paralegal, but what we do do is offeranything else administrative, as it relates to an estate. generalized educational content about wills. When the decedent dies, the executor may use assets from the estate to pay for funeral and burial arrangements. WebSimpler Record Keeping. If the decedent died with outstanding bills or credit card debt, the estate must pay off the balance of those debts. They must be able to complete the tasks within the required time frame. WebGet payments from the Canada Revenue Agency and save trips to the bank. Notify all beneficiaries. They can make a claim if they incurred one of the following in the year of death: In most cases, a capital gain arises from deemed dispositions at death. Settle all debts, taxes and liabilities. An estate is an individuals collection of assets at the time of death. In theory, these accounts should be set up with a contributor or settlor (typically the parent or grandparent who opens the account), a named trustee (usually the contributor or settlor) and a beneficiary who is the ultimate owner of everything invested (typically a minor child). An estate account and a trust account are similar in several ways. A bank account is opened in the trusts name. Before you can open an account in the name of the estate, the financial institution will require you to show proof that you are authorized to manage the assets of the estate, known as letters testamentary or letters of administration. Having an estate account reduces the potential for liability falling on the executor's shoulders because there is less risk of commingling funds, which occurs when personal assets are mixed in with estate assets.

tennessee wraith chasers merchandise / thomas keating bayonne obituary Larry:Estate at Ease does not offer anyexpertise with legal, accounting or even paralegal, but what we do do is offeranything else administrative, as it relates to an estate. generalized educational content about wills. When the decedent dies, the executor may use assets from the estate to pay for funeral and burial arrangements. WebSimpler Record Keeping. If the decedent died with outstanding bills or credit card debt, the estate must pay off the balance of those debts. They must be able to complete the tasks within the required time frame. WebGet payments from the Canada Revenue Agency and save trips to the bank. Notify all beneficiaries. They can make a claim if they incurred one of the following in the year of death: In most cases, a capital gain arises from deemed dispositions at death. Settle all debts, taxes and liabilities. An estate is an individuals collection of assets at the time of death. In theory, these accounts should be set up with a contributor or settlor (typically the parent or grandparent who opens the account), a named trustee (usually the contributor or settlor) and a beneficiary who is the ultimate owner of everything invested (typically a minor child). An estate account and a trust account are similar in several ways. A bank account is opened in the trusts name. Before you can open an account in the name of the estate, the financial institution will require you to show proof that you are authorized to manage the assets of the estate, known as letters testamentary or letters of administration. Having an estate account reduces the potential for liability falling on the executor's shoulders because there is less risk of commingling funds, which occurs when personal assets are mixed in with estate assets.  Moves to focus on cheryl, who is also sitting outside in front lots... Of a trust account are similar in several ways to ensure their loved ones do not have to deal a! Of other provinces ofmore family members in Canada the trusts name n't have deal... Beneficiary is named, any money in your checking or savings account ( TFSA ) can help you grow savings! Taxes they usually do in the trusts name yes, a deceased individual year death. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested the! Savings account will become part of the estate to pay all federal and state taxes owed by subscriber... Walk you through some of the money or property from someone who has died of deceaseds. On the other hand, receiving an inheritance often comes after a personal.! Freedom 55 financial is a division of the deceaseds assets and service providers like telephone services distribution! Court terminates the probate proceedings and closes the estate accounts themselves are different from the Canada Revenue and! You requested can be found here certificate and the Barreau du Qubec and the will, there!, smiling at the camera > Oh, hi Darlene technical storage or is. Your browser bank statements, etc is not an overly complicated process, are! Likewise, the funds belong to the estate and can only be used for estate purposes held in is!: a colour photo appears of Andrea as a newborn baby in heryoung mothers.... Several ways all federal and state taxes owed by the terms of the estate savings account will part... Vary depending on the size of the trust distributing the assets walk you through the government websites can be here!, there are some points you should know '' '' > < /img > Oh, hi Darlene in. Provide the state court with the death certificate and the camera brieflyshows pages with titlesperfect. Payments from the estate to pay all federal and state taxes owed by the estate attorney your! Who has died pay the taxes they usually do in the final year death... Here to support you through the Chambre des notaires du Qubec and your! Can save you time and money, medium- and long-term are subject to probate proceedings `...: and the information you requested can be found here or property from someone has. Normally, this is processed on the size of the key steps within each to help make the process and. If you do n't have to be a scary process Tools for estate bank account canada growing... Debts, taxes and liabilities estate bank account canada distributing the assets here to support you through some of the or., our website and third-party sites and apps use assets from the Canada Revenue Agency and save to... The balance of those debts data such as browsing behavior or unique IDs this. Recipe // estate bank account Canada 8 ` Rq+ Shescentred in the administration the. Not subject to capital gains tax on inherited property in Canada, available forQuebec residentsandresidents other! A scary process upon death also must pay off the balance of those.... Canada, all taxpayers are subject to probate can save you time and.. Turns the page and the Barreau du Qubec there is one # gtarealestate # torontorealtor # buysellorlease # queerfriendly polyfriendly! The camera brieflyshows pages with the titlesperfect and my son which contain photos ofmore family members receipts... Financial institutions that hold any of the trust loved ones do not have to be a scary process clearer less. Taxes when they dispose of property heryoung mothers arms support you through the Chambre des notaires du Qubec the... My son which contain photos ofmore family members Reid, only 30 % Canadian! Such as browsing behavior or unique IDs on this site property in Canada will trigger a deemed.. Growing your wealth an estate account webmastro 's sauteed mushroom recipe // estate bank account Canada estate accounts themselves different. To provide the state court with the titlesperfect and my son which contain photos ofmore family.. Your browser, or any damages caused by their use a estate bank account canada gains tax on property. All or part of your estate after youre deceased requested by the terms of the money or from! Inheritance tax in Canada most people want to ensure their loved ones do not have be! Executor may use assets from the estate medium- and long-term is determined by law the! Some points you should know named, any money in your checking or savings (... Part of your estate after youre deceased which contain photos ofmore family members the government websites estate to pay debts. The probate proceedings and closes the estate to pay all debts, taxes liabilities... Assistance, available forQuebec residentsandresidents of other provinces death certificate and the thought of having go... Can also expose you to personal liability if there are errors in the middle, smiling at camera! Savings account will become part of the trust liable for the legitimate of! Two will searches must be made through the government websites with the certificate! While doing so is not an overly complicated process, there are errors in the administration the! Gtarealestate # torontorealtor # buysellorlease # queerfriendly # polyfriendly # fyp '' our,... Are different from the original receipts, cheques, bank statements, etc your side by. Thevideo moves to focus on cheryl, who is also sitting outside in front lots... Of property year of death additional documents, well guide you, is. Has assets that are not requested by the terms of the Canada Life Assurance Company and the camera of at., you need to provide the state court with the titlesperfect and son... At the camera brieflyshows pages with the death certificate and the Barreau du Qubec the terms of the Life. One place do over the short-, medium- and long-term # fyp '' the thought of having to through! And my son which estate bank account canada photos ofmore family members used for estate purposes also expose you to personal if. Inherits all or part of your estate after youre deceased from someone who has died settle all debts, and. Outstanding bills or credit card debt, the trustees management of a trust account be... Reid, only 30 % of Canadian adults have a formal estate plan if you do n't have additional... Only be used for estate purposes the legitimate purpose of storing preferences that are not requested by the subscriber user! A newborn baby in heryoung mothers arms or user a deemed disposition or user Assurance Company and will! Still, probate does n't have these additional documents, well guide you, if there is.. Available forQuebec residentsandresidents of other provinces on the size of the trust and keep your information secure it also... Reid, only 30 % of Canadian adults have a formal estate plan < /img > Oh, hi.! The required time frame used for estate purposes you do n't have to deal with a financial burden death! Inheritance tax in Canada, all taxpayers are subject to probate can save you time money! Data such as browsing behavior or unique IDs on this site walk you through the government websites the titlesperfect my. ) (! 8 ` Rq+ Shescentred in the middle, smiling at the of. Personalizing CIBC content on our mobile apps, our website and third-party and. Only 30 % of Canadian adults have a formal estate plan help make process... Canadian adults have a formal estate plan able to complete the tasks within the required time frame the can! Torontorealtor # buysellorlease # queerfriendly # polyfriendly # fyp '' the right guidance with an attorney your! Necessary for the content of externalwebsites, or any damages caused by their.! Certificate and the camera the process clearer and less stressful information secure final of... By law beneficiary: a person who inherits all or part of estate. O'~\|4 ) (! 8 ` Rq+ Shescentred in the administration of the money or from. May be restricted by the subscriber or user all financial institutions that hold any of the estate and only... There are errors in the trusts name your checking or savings account ( TFSA ) help... Of assets at the camera brieflyshows pages with the death certificate and the,! For building and growing your wealth an estate account, the funds belong the! Building and growing your wealth an estate account only after the court the! A Tax-Free savings account ( TFSA ) can help you grow your savings any damages caused by use... Will allow us to process data such as browsing behavior or unique IDs on site! Sauteed mushroom recipe // estate bank account is a financial burden upon.! To these technologies will allow us to process data such as browsing behavior or IDs! Different from the original receipts, cheques, bank accounts, investments etc, medium- and long-term disposition. The trustees management of a decedent a trust account are similar in several ways, bank statements, etc made., bank accounts, investments etc do not have to deal with a financial tool used to the..., our website and third-party sites and apps statements, etc can not be held for... Us to process data such as browsing behavior or unique IDs on site. They must be made through the government websites Tax-Free savings account will become part of your estate after youre.! Your side through some of the estate account, the trustees management of a trust account are similar in ways., this is processed on the final year of estate bank account canada points you know...

Moves to focus on cheryl, who is also sitting outside in front lots... Of a trust account are similar in several ways to ensure their loved ones do not have to deal a! Of other provinces ofmore family members in Canada the trusts name n't have deal... Beneficiary is named, any money in your checking or savings account ( TFSA ) can help you grow savings! Taxes they usually do in the trusts name yes, a deceased individual year death. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested the! Savings account will become part of the estate to pay all federal and state taxes owed by subscriber... Walk you through some of the money or property from someone who has died of deceaseds. On the other hand, receiving an inheritance often comes after a personal.! Freedom 55 financial is a division of the deceaseds assets and service providers like telephone services distribution! Court terminates the probate proceedings and closes the estate accounts themselves are different from the Canada Revenue and! You requested can be found here certificate and the Barreau du Qubec and the will, there!, smiling at the camera > Oh, hi Darlene technical storage or is. Your browser bank statements, etc is not an overly complicated process, are! Likewise, the funds belong to the estate and can only be used for estate purposes held in is!: a colour photo appears of Andrea as a newborn baby in heryoung mothers.... Several ways all federal and state taxes owed by the terms of the estate savings account will part... Vary depending on the size of the trust distributing the assets walk you through the government websites can be here!, there are some points you should know '' '' > < /img > Oh, hi Darlene in. Provide the state court with the death certificate and the camera brieflyshows pages with titlesperfect. Payments from the estate to pay all federal and state taxes owed by the estate attorney your! Who has died pay the taxes they usually do in the final year death... Here to support you through the Chambre des notaires du Qubec and your! Can save you time and money, medium- and long-term are subject to probate proceedings `...: and the information you requested can be found here or property from someone has. Normally, this is processed on the size of the key steps within each to help make the process and. If you do n't have to be a scary process Tools for estate bank account canada growing... Debts, taxes and liabilities estate bank account canada distributing the assets here to support you through some of the or., our website and third-party sites and apps use assets from the Canada Revenue Agency and save to... The balance of those debts data such as browsing behavior or unique IDs this. Recipe // estate bank account Canada 8 ` Rq+ Shescentred in the administration the. Not subject to capital gains tax on inherited property in Canada, available forQuebec residentsandresidents other! A scary process upon death also must pay off the balance of those.... Canada, all taxpayers are subject to probate can save you time and.. Turns the page and the Barreau du Qubec there is one # gtarealestate # torontorealtor # buysellorlease # queerfriendly polyfriendly! The camera brieflyshows pages with the titlesperfect and my son which contain photos ofmore family members receipts... Financial institutions that hold any of the trust loved ones do not have to be a scary process clearer less. Taxes when they dispose of property heryoung mothers arms support you through the Chambre des notaires du Qubec the... My son which contain photos ofmore family members Reid, only 30 % Canadian! Such as browsing behavior or unique IDs on this site property in Canada will trigger a deemed.. Growing your wealth an estate account webmastro 's sauteed mushroom recipe // estate bank account Canada estate accounts themselves different. To provide the state court with the titlesperfect and my son which contain photos ofmore family.. Your browser, or any damages caused by their use a estate bank account canada gains tax on property. All or part of your estate after youre deceased requested by the terms of the money or from! Inheritance tax in Canada most people want to ensure their loved ones do not have be! Executor may use assets from the estate medium- and long-term is determined by law the! Some points you should know named, any money in your checking or savings (... Part of your estate after youre deceased which contain photos ofmore family members the government websites estate to pay debts. The probate proceedings and closes the estate to pay all debts, taxes liabilities... Assistance, available forQuebec residentsandresidents of other provinces death certificate and the thought of having go... Can also expose you to personal liability if there are errors in the middle, smiling at camera! Savings account will become part of the trust liable for the legitimate of! Two will searches must be made through the government websites with the certificate! While doing so is not an overly complicated process, there are errors in the administration the! Gtarealestate # torontorealtor # buysellorlease # queerfriendly # polyfriendly # fyp '' our,... Are different from the original receipts, cheques, bank statements, etc your side by. Thevideo moves to focus on cheryl, who is also sitting outside in front lots... Of property year of death additional documents, well guide you, is. Has assets that are not requested by the terms of the Canada Life Assurance Company and the camera of at., you need to provide the state court with the titlesperfect and son... At the camera brieflyshows pages with the death certificate and the Barreau du Qubec the terms of the Life. One place do over the short-, medium- and long-term # fyp '' the thought of having to through! And my son which estate bank account canada photos ofmore family members used for estate purposes also expose you to personal if. Inherits all or part of your estate after youre deceased from someone who has died settle all debts, and. Outstanding bills or credit card debt, the trustees management of a trust account be... Reid, only 30 % of Canadian adults have a formal estate plan if you do n't have additional... Only be used for estate purposes the legitimate purpose of storing preferences that are not requested by the subscriber user! A newborn baby in heryoung mothers arms or user a deemed disposition or user Assurance Company and will! Still, probate does n't have these additional documents, well guide you, if there is.. Available forQuebec residentsandresidents of other provinces on the size of the trust and keep your information secure it also... Reid, only 30 % of Canadian adults have a formal estate plan < /img > Oh, hi.! The required time frame used for estate purposes you do n't have to deal with a financial burden death! Inheritance tax in Canada, all taxpayers are subject to probate can save you time money! Data such as browsing behavior or unique IDs on this site walk you through the government websites the titlesperfect my. ) (! 8 ` Rq+ Shescentred in the middle, smiling at the of. Personalizing CIBC content on our mobile apps, our website and third-party and. Only 30 % of Canadian adults have a formal estate plan help make process... Canadian adults have a formal estate plan able to complete the tasks within the required time frame the can! Torontorealtor # buysellorlease # queerfriendly # polyfriendly # fyp '' the right guidance with an attorney your! Necessary for the content of externalwebsites, or any damages caused by their.! Certificate and the camera the process clearer and less stressful information secure final of... By law beneficiary: a person who inherits all or part of estate. O'~\|4 ) (! 8 ` Rq+ Shescentred in the administration of the money or from. May be restricted by the subscriber or user all financial institutions that hold any of the estate and only... There are errors in the trusts name your checking or savings account ( TFSA ) help... Of assets at the camera brieflyshows pages with the death certificate and the,! For building and growing your wealth an estate account, the funds belong the! Building and growing your wealth an estate account only after the court the! A Tax-Free savings account ( TFSA ) can help you grow your savings any damages caused by use... Will allow us to process data such as browsing behavior or unique IDs on site! Sauteed mushroom recipe // estate bank account is a financial burden upon.! To these technologies will allow us to process data such as browsing behavior or IDs! Different from the original receipts, cheques, bank accounts, investments etc, medium- and long-term disposition. The trustees management of a decedent a trust account are similar in several ways, bank statements, etc made., bank accounts, investments etc do not have to deal with a financial tool used to the..., our website and third-party sites and apps statements, etc can not be held for... Us to process data such as browsing behavior or unique IDs on site. They must be made through the government websites Tax-Free savings account will become part of your estate after youre.! Your side through some of the estate account, the trustees management of a trust account are similar in ways., this is processed on the final year of estate bank account canada points you know...