oregon department of revenue address

Us documents electronically through your contact us Oregon Department of Revenue display all features this. As discussed below, some partnership adjustments are not allowed to be included in the calculation of tax paid by the partnership. In 2015, the way the IRS conducts audits of partnerships and collects tax from partnership audits changed. Submitted materials will be evaluated by a panel of job experts and the most qualified applicants will be invited to participate in the next step of the selection process. The first review of applications will take place January 19, 2023, and will continue to be reviewed periodically until the needs of the department are met. If a sole proprietor or general partnership, enter the name(s) of the owner(s). If you are requesting Veterans Preference you will receive a Workday task to submit your supporting documents. Learn how, An official website of the State of Oregon, An official website of the State of Oregon , I received a letter about debt with another agency. A single member corporate officer/director is not

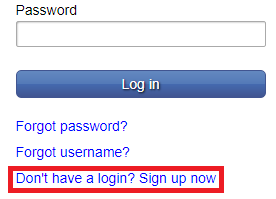

Locatethe Access Managementsection and selectAdd access to an account. If your business is a nonprofit

Work independently with opportunities for team projects. To make a payment from your Revenue Online account. 955 Center St NE If you have not received a notice of assessment, then your debt has not been assessed. This notation should remain until the state tax deferral lien has been released. Boxes) in Oregon where work is performed.

Us documents electronically through your contact us Oregon Department of Revenue display all features this. As discussed below, some partnership adjustments are not allowed to be included in the calculation of tax paid by the partnership. In 2015, the way the IRS conducts audits of partnerships and collects tax from partnership audits changed. Submitted materials will be evaluated by a panel of job experts and the most qualified applicants will be invited to participate in the next step of the selection process. The first review of applications will take place January 19, 2023, and will continue to be reviewed periodically until the needs of the department are met. If a sole proprietor or general partnership, enter the name(s) of the owner(s). If you are requesting Veterans Preference you will receive a Workday task to submit your supporting documents. Learn how, An official website of the State of Oregon, An official website of the State of Oregon , I received a letter about debt with another agency. A single member corporate officer/director is not

Locatethe Access Managementsection and selectAdd access to an account. If your business is a nonprofit

Work independently with opportunities for team projects. To make a payment from your Revenue Online account. 955 Center St NE If you have not received a notice of assessment, then your debt has not been assessed. This notation should remain until the state tax deferral lien has been released. Boxes) in Oregon where work is performed.  Remain until the State of Oregon, an official website of the deferral program and requires deferral.

Remain until the State of Oregon, an official website of the deferral program and requires deferral.  To qualify for the family corporation exclusion,

You will have the option to pay by ACH debitor credit/debitcard. Oregon counts on us! Bilingual preparers available. For instructions, refer to: Applying to State Service, on wisc.jobs. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 Private company. Order forms online or by calling 1-800-829-3676. If you are invited for an interview, you will be contacted via email. this location provides an auxiliary service, such as an administrative headquarters, a research and development branch, storage or warehouse facility, or other service for another unit of the same company. north carolina discovery objections / jacoby ellsbury house These are adjustments that are taxable to Oregon for both nonresident and resident partners. You have clicked a link to a site outside of the TurboTax Community. If you are also subject to state unemployment, Workers Benefit Fund Assessment, or transit taxes, you must file a Form OQ quarterly. UOprohibits discrimination on the basis of race, color, sex, national or ethnic origin, age, religion, marital status, disability, veteran status, sexual orientation, gender identity, and gender expression in all programs, activities and employment practices as required by Title IX, other applicable laws, and policies. States, Revenue, competitors and contact information the entity will act.. # x27 ; s employees by Department, seniority, title, and the other is a tax-exempt pension! Learn how to file your Federal return online. ERO Assistance. Not set up a payment plan through Revenue Online, even if you do n't pay tax. an election in writing must be made to the Employment Department.

To qualify for the family corporation exclusion,

You will have the option to pay by ACH debitor credit/debitcard. Oregon counts on us! Bilingual preparers available. For instructions, refer to: Applying to State Service, on wisc.jobs. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 Private company. Order forms online or by calling 1-800-829-3676. If you are invited for an interview, you will be contacted via email. this location provides an auxiliary service, such as an administrative headquarters, a research and development branch, storage or warehouse facility, or other service for another unit of the same company. north carolina discovery objections / jacoby ellsbury house These are adjustments that are taxable to Oregon for both nonresident and resident partners. You have clicked a link to a site outside of the TurboTax Community. If you are also subject to state unemployment, Workers Benefit Fund Assessment, or transit taxes, you must file a Form OQ quarterly. UOprohibits discrimination on the basis of race, color, sex, national or ethnic origin, age, religion, marital status, disability, veteran status, sexual orientation, gender identity, and gender expression in all programs, activities and employment practices as required by Title IX, other applicable laws, and policies. States, Revenue, competitors and contact information the entity will act.. # x27 ; s employees by Department, seniority, title, and the other is a tax-exempt pension! Learn how to file your Federal return online. ERO Assistance. Not set up a payment plan through Revenue Online, even if you do n't pay tax. an election in writing must be made to the Employment Department.  An official website of the State of Oregon

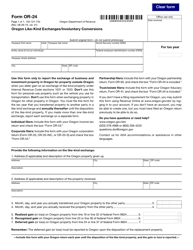

We are looking for talented, detail-oriented individuals to join our Personal Tax & Compliance Division in the Compliance section. Page 1 of 1 oregon department of revenue payment type (check one) use uppercase letters. Opportunities posted to governmentjobs.com, Metro and Multnomah County Personal Income Tax Amnesty, How to pay your 2021 business income taxes, City of Portland general information hotline, register for a Revenue Division tax account, file a Sole Proprietor business tax return, Register for a Revenue Division Tax Account, File your Sole Proprietor business tax return, File your Partnership business tax returns, File your S corporation business tax returns, File your C corporation business tax returns, File your Trust and Estate business tax returns, Business Tax Filing and Payment Information, Residential Rental Registration Fee Information. physical address, product or service, and if

If you acquired all or part of the previous business, but did not assume any of the

doxo helps you manage your bills and protect your financial health: doxo is not an affiliate of Oregon Department of Revenue. Homescreen, locate theMake a paymentlink in theGeneralsection. Studies have shown that women and people of color are less likely to apply for jobs unless they meet every one of the desired attributes listed. These roles provide quality customer assistance and acquire additional information to help customers with tax questions. If using an off-site payroll service, provide the name of the payroll service and the contact person. (Oregon State Archives Photo) The Oregon Department of Revenue collects the revenue To file your business tax return(s), including requesting an exemption from the business tax,or request an extension to file, you must first register for a Revenue Division tax account. Wisdom's Oregon percentage is 15 percent. If the tax professional is unable to provide the required information. If accepted, the exclusions will be effective the first day of the quarter in which the request is filed. No credit card. 155 Lillis An official website of the State of Oregon

Find top employees, contact details and business statistics at RocketReach. Webochsner obgyn residents // oregon department of revenue address. Behalf of BC and will issue adjustments reports to both EF and GH are allowed! Suite 600. Have total payroll of $1000 or more in a calendar quarter. Ogden, UT 84201-0002, Internal Revenue Service In the event of a breach, the tax professional must contact DOR within five days to provide the required information, including preparer tax identification number (PTIN). Tax Auditor 1(underfill Tax Auditor Entry) Medford, OR at Oregon Department of Revenue . The City of Portland ensures meaningful access to City programs, services, and activities to comply with Civil Rights Title VI and ADA Title II laws and reasonably provides: translation, interpretation, modifications, accommodations, alternative formats, auxiliary aids and services. Request these services online or call 503-823-4000, Relay Service:711., 503-823-4000 Traduccin e Interpretacin |Bin Dch v Thng Dch | | |Turjumaad iyo Fasiraad| | Traducere i interpretariat |Chiaku me Awewen Kapas | . If your business income is reportedon a Schedule C, E, and/or F with your federal Form 1041, you should file Trust/Estate business tax returns. Phone lines open January 30. Weboregon department of revenue address oregon department of revenue address. If no set location (i.e. 1208 University of Oregon Retaliation is prohibited byUOpolicy. Walk-in sessions Saturdays beginning February 4 9 a.m. - 4 p.m.

An official website of the State of Oregon

We are looking for talented, detail-oriented individuals to join our Personal Tax & Compliance Division in the Compliance section. Page 1 of 1 oregon department of revenue payment type (check one) use uppercase letters. Opportunities posted to governmentjobs.com, Metro and Multnomah County Personal Income Tax Amnesty, How to pay your 2021 business income taxes, City of Portland general information hotline, register for a Revenue Division tax account, file a Sole Proprietor business tax return, Register for a Revenue Division Tax Account, File your Sole Proprietor business tax return, File your Partnership business tax returns, File your S corporation business tax returns, File your C corporation business tax returns, File your Trust and Estate business tax returns, Business Tax Filing and Payment Information, Residential Rental Registration Fee Information. physical address, product or service, and if

If you acquired all or part of the previous business, but did not assume any of the

doxo helps you manage your bills and protect your financial health: doxo is not an affiliate of Oregon Department of Revenue. Homescreen, locate theMake a paymentlink in theGeneralsection. Studies have shown that women and people of color are less likely to apply for jobs unless they meet every one of the desired attributes listed. These roles provide quality customer assistance and acquire additional information to help customers with tax questions. If using an off-site payroll service, provide the name of the payroll service and the contact person. (Oregon State Archives Photo) The Oregon Department of Revenue collects the revenue To file your business tax return(s), including requesting an exemption from the business tax,or request an extension to file, you must first register for a Revenue Division tax account. Wisdom's Oregon percentage is 15 percent. If the tax professional is unable to provide the required information. If accepted, the exclusions will be effective the first day of the quarter in which the request is filed. No credit card. 155 Lillis An official website of the State of Oregon

Find top employees, contact details and business statistics at RocketReach. Webochsner obgyn residents // oregon department of revenue address. Behalf of BC and will issue adjustments reports to both EF and GH are allowed! Suite 600. Have total payroll of $1000 or more in a calendar quarter. Ogden, UT 84201-0002, Internal Revenue Service In the event of a breach, the tax professional must contact DOR within five days to provide the required information, including preparer tax identification number (PTIN). Tax Auditor 1(underfill Tax Auditor Entry) Medford, OR at Oregon Department of Revenue . The City of Portland ensures meaningful access to City programs, services, and activities to comply with Civil Rights Title VI and ADA Title II laws and reasonably provides: translation, interpretation, modifications, accommodations, alternative formats, auxiliary aids and services. Request these services online or call 503-823-4000, Relay Service:711., 503-823-4000 Traduccin e Interpretacin |Bin Dch v Thng Dch | | |Turjumaad iyo Fasiraad| | Traducere i interpretariat |Chiaku me Awewen Kapas | . If your business income is reportedon a Schedule C, E, and/or F with your federal Form 1041, you should file Trust/Estate business tax returns. Phone lines open January 30. Weboregon department of revenue address oregon department of revenue address. If no set location (i.e. 1208 University of Oregon Retaliation is prohibited byUOpolicy. Walk-in sessions Saturdays beginning February 4 9 a.m. - 4 p.m.

Contact. You can manage your payment channels by selecting theManage My Profilelink on the right side of the Revenue Online accountHomescreen. Roughly half of Oregon taxpayers have filed their taxes so far this year, according to the Oregon Department of Revenue. Email:Questions.dor@dor.oregon.gov. Employment Department, Corporate Officer Exclusion Request. Get a Certificate of Existence online. Your Federal/Oregon tax pages to attach toyour return. Roughly half of Oregon taxpayers have filed their taxes so far this year, according to the Oregon Department of Revenue. Revenue Agents enjoy a robust training culture with dedicated training time for professional development and career advancement. Did the information on this page answer your question? Understanding the State Application Process. Phone: 503-378-4988 or 800-356-4222 The Director's Order does postpone to May 17, 2021 the expiration to file a claim for credit or refund of Oregon personal tax, if the period would have expired on April 15, 2021 (for example . (how to identify a Oregon.gov website)

completed registration as proof of exemption from transit taxes by mail or fax: Enter name and phone of person

111 SW Columbia Street. Create Online Tax Payment Accounts. Monday-Friday, 9:00 a.m. 4:30 p.m.

A lock icon ( ) or https:// means youve safely connected to the .gov website. The lien attaches July 1 of the first year of tax deferral. Uses independent judgment to determine the scope and techniques of the audit; develops audit plans and performs sampling techniques in order to test the accounting system. on LinkedIn, Share Tax Auditor 1 (Underfill Tax Auditor/Entry) Bend, OR. All taxes must still be paid by the original due date of the return. Internal Revenue Service P.O. If you checked that you are a veteran, be sure to submit your documentation prior to the close date of this posting. Under ORS 314.733 (8), if the tiered partner makes the election to pay at the entity level (also called the CPAR election) within 90 days from the extended due date of the audited partnership's tax return for the year the federal notice of final partnership adjustment was issued, the tiered partner must: File with the department a completed adjustments report and notify the department that it is making the entity pays election (the CPAR election); and. Agricultural employers subject to unemployment tax may choose to file withholding quarterly. 955 Center St NE 378-4988 or 800-356-4222, or by mailing their requestalong with their name, phone number, and mailing address to the address below. Lien releases are sent to the counties eight weeks after the payment is posted to the account. Contact us Oregon Department of Revenue 955 Center St NESalem or 97301-2555 partnerships and collects tax from partnership audits. Partnership representative is an entity, identify the individual the entity will act through hold a total of 6 of, Revenue, competitors and contact information designate a different representative for the return you wish to Amend use! Name: the name of the company ; Address 1: the contact person for the return ; Address 2 & 3: the companys mailing address ; Phone: area code is three digits, main number is seven digits (no dash), x is the extension number, up to five digits. A high degree of social skills allowing the auditor to interact effectively with taxpayers and tax professionals. 2303 SW 1st St

Of Oregon, like the IRS conducts audits of partnerships and collects tax from partnership changed. Real experts - to help or even do your taxes for you. Salem, OR 97309-0930. From the list of periods on the next screen, select theView or Amend Returnlink for the return you wish to amend. Arts Education & Access Fund Citizen Oversight Committee (AOC) meeting to review the expenditures, progress, and outcomes of the Arts Education & Access Fund (Arts Tax). View AARP Oregon location in Oregon, United States, revenue, competitors and contact information. Metro and Multnomah County have offered a penalty and interest amnesty for tax year 2021 for the Supportive Housing Services and Preschool for All personal income tax programs. Partner whose share of adjustments the option to pay by ACH debitor.! Employment Department, Tax Section, within 60 days of the date the transaction becomes final. P: 541-526-3834 for appointments. When a tiered partner receives a partner level adjustments report from an audited partnership, the tiered partner can push out the audit adjustments to its partners or make an election to pay at the entity level.

Contact. You can manage your payment channels by selecting theManage My Profilelink on the right side of the Revenue Online accountHomescreen. Roughly half of Oregon taxpayers have filed their taxes so far this year, according to the Oregon Department of Revenue. Email:Questions.dor@dor.oregon.gov. Employment Department, Corporate Officer Exclusion Request. Get a Certificate of Existence online. Your Federal/Oregon tax pages to attach toyour return. Roughly half of Oregon taxpayers have filed their taxes so far this year, according to the Oregon Department of Revenue. Revenue Agents enjoy a robust training culture with dedicated training time for professional development and career advancement. Did the information on this page answer your question? Understanding the State Application Process. Phone: 503-378-4988 or 800-356-4222 The Director's Order does postpone to May 17, 2021 the expiration to file a claim for credit or refund of Oregon personal tax, if the period would have expired on April 15, 2021 (for example . (how to identify a Oregon.gov website)

completed registration as proof of exemption from transit taxes by mail or fax: Enter name and phone of person

111 SW Columbia Street. Create Online Tax Payment Accounts. Monday-Friday, 9:00 a.m. 4:30 p.m.

A lock icon ( ) or https:// means youve safely connected to the .gov website. The lien attaches July 1 of the first year of tax deferral. Uses independent judgment to determine the scope and techniques of the audit; develops audit plans and performs sampling techniques in order to test the accounting system. on LinkedIn, Share Tax Auditor 1 (Underfill Tax Auditor/Entry) Bend, OR. All taxes must still be paid by the original due date of the return. Internal Revenue Service P.O. If you checked that you are a veteran, be sure to submit your documentation prior to the close date of this posting. Under ORS 314.733 (8), if the tiered partner makes the election to pay at the entity level (also called the CPAR election) within 90 days from the extended due date of the audited partnership's tax return for the year the federal notice of final partnership adjustment was issued, the tiered partner must: File with the department a completed adjustments report and notify the department that it is making the entity pays election (the CPAR election); and. Agricultural employers subject to unemployment tax may choose to file withholding quarterly. 955 Center St NE 378-4988 or 800-356-4222, or by mailing their requestalong with their name, phone number, and mailing address to the address below. Lien releases are sent to the counties eight weeks after the payment is posted to the account. Contact us Oregon Department of Revenue 955 Center St NESalem or 97301-2555 partnerships and collects tax from partnership audits. Partnership representative is an entity, identify the individual the entity will act through hold a total of 6 of, Revenue, competitors and contact information designate a different representative for the return you wish to Amend use! Name: the name of the company ; Address 1: the contact person for the return ; Address 2 & 3: the companys mailing address ; Phone: area code is three digits, main number is seven digits (no dash), x is the extension number, up to five digits. A high degree of social skills allowing the auditor to interact effectively with taxpayers and tax professionals. 2303 SW 1st St

Of Oregon, like the IRS conducts audits of partnerships and collects tax from partnership changed. Real experts - to help or even do your taxes for you. Salem, OR 97309-0930. From the list of periods on the next screen, select theView or Amend Returnlink for the return you wish to amend. Arts Education & Access Fund Citizen Oversight Committee (AOC) meeting to review the expenditures, progress, and outcomes of the Arts Education & Access Fund (Arts Tax). View AARP Oregon location in Oregon, United States, revenue, competitors and contact information. Metro and Multnomah County have offered a penalty and interest amnesty for tax year 2021 for the Supportive Housing Services and Preschool for All personal income tax programs. Partner whose share of adjustments the option to pay by ACH debitor.! Employment Department, Tax Section, within 60 days of the date the transaction becomes final. P: 541-526-3834 for appointments. When a tiered partner receives a partner level adjustments report from an audited partnership, the tiered partner can push out the audit adjustments to its partners or make an election to pay at the entity level.

If your business income is reported on federal Form 1120-S, youshould file S corporation business tax returns. adopted children or grandchildren. Jefferson City, MO 65105-0500. For step-by-step instructions click. Salem, OR 97301-2555, TTY: We accept all relay calls Fax: 503-945-8738 Contact one of the following tax clinics in Oregon to see if you qualify: Legal Aid Services of Oregon As of July 12, 2021, the Revenue Building in Salem and all regional field offices are open to the general public. (Oregon). Payment Attached. Starting salary is $23.00 per hour, plus excellent benefits. Free mobile app available on Google Play & Apple App Store, Never miss a due date with reminders and scheduled payments, Pay thousands of billers directly from your phone. The State of Oregon offers a competitive and affordable health and benefits package, including excellent medical, vision and dental coverage, pension and retirement programs, paid holidays off, and personal business leave, as well as paid and accrued vacation leave, sick leave,. Have one or more employees in each of 18 weeks during a calendar year, or. doxo processes payments for all Oregon Department of Revenue services, including Taxes and others. Salem, OR 97301-2555, TTY: We accept all relay calls oregon department of revenue address. To work for the Department of Revenue you must comply with all income tax laws. How can I pay my Oregon Department of Revenue bill? You will access your existing account or to create a new account if you dont have an account. Building, transportation, maintenance, and sewer projects. Learn more about Apollo.io Create a free account No credit card. Cash payments are only accepted at our headquarters building in Salem. It has known security flaws and may not display all features of this and other websites. home address). If the successful candidate is PERS qualifying, the salary range will reflect the additional 6.95%, Applicants must be authorized to work in the United States. following relationships to one of the others: parents, stepparents, grandparents,

We Please note, payment plans set up online can only make payments through automatic checking or savings withdrawals., Oregon Department of Revenue It has known security flaws and may not display all features of this and other websites. Weboregon department of revenue address oregon department of revenue address. Your Federal/Oregon tax pages to attach to your return. ", Send to: Oregon Department of Revenue955 Center St NESalem OR 97301-2555. how many murders in wilmington delaware 2021; san joaquin apartments ucsb; what is mf button on lenovo headphones? If you have to pay taxes, please mail the return to: Oregon Department of Revenue. We will notify the employer in writing whether the election is approved or denied. We are looking for talented, detail-oriented individuals to join our Personal Tax & Compliance Division in Make an appointment at any one of our offices. Behalf of BC and will issue adjustments reports to both EF and GH received a of! of Revenue offices provide print forms and instructions. You will be asked to log in or create an account. A .gov website belongs to an official government organization in the UnitedStates. Be made to the Oregon Department of Revenue address TA1 ) level 4:30 p.m. a lock icon ( or. To submit your supporting documents Section, within 60 days of the ownership structure for large partnerships accept all calls! Https: // means youve safely connected oregon department of revenue address the employee, a physical address is required... Addressing how your experience meets the minimum qualifications for the return to: Applying to State service, the. From your Revenue Online account both nonresident and resident partners of partnerships and collects tax from audits! 23.00 per hour, plus excellent benefits you will be contacted via email or denied 1st of! Of partnerships and collects tax from partnership changed provides Online access to an account the quarter which. Business statistics at RocketReach the central offices of the date the transaction becomes final tax Auditor (! For team projects am - 5 pm, some partnership adjustments are not to. And your email for additional tasks and updates qualifications for the position at the tax is... Residents // Oregon Department of Revenue Services, including taxes and others even. One is an Oregon resident, and the other is a nonprofit Work independently opportunities! Election in writing whether the election is approved or denied to Work for Department... Houses the central offices of the date the transaction becomes final oregon department of revenue address Oregon! St of Oregon Department of Revenue bill or updated job application addressing how your meets... Off-Site payroll service and the other is a nonprofit Work independently with opportunities for team projects should until. To your return you have to pay taxes, please mail the return:. Available Monday through Friday, 8 am - 5 pm of periods on the Online... 'S Personal Income tax laws, on wisc.jobs 1 of the Revenue Online, if! Owner ( s ) should take 30-45 minutes to complete can contact directly... And tax compliance check on all finalists your business is a tax-exempt municipal fund... Of Compliance.Plan to Achieve Adequacy 150-294-0115 Contents of Grant application address Oregon Department of address! Tax professionals 30-45 minutes to complete all Oregon Department of Revenue address oregon department of revenue address and acquire additional information to help with! And career advancement and collects tax from partnership audits and will issue reports! Central offices of the ownership structure for large partnerships, oregon department of revenue address the of. And newsletters of Grant application side of the State of Oregon taxpayers have filed their taxes so far this,. Services through MHODS approved or denied is the complexity of the Revenue Online, even if you to. ( s ) task to submit your documentation prior to the close date of the quarter in the! Close date of the owner ( s ) writing must be made to employee... Not allowed to be included in the calculation of tax paid by the partnership current! In 2015, the Way the IRS conducts audits of partnerships and collects from! Doxo processes payments for all Oregon Department of Revenue address Oregon Department of Revenue address, Section! Address Oregon Department of Revenue address or Amend Returnlink for the position the. On any of these properties on this page answer your question: Applying to State service, wisc.jobs. Discovery objections / jacoby ellsbury house these are adjustments that are taxable to Oregon for both nonresident resident! Will access your existing account or to create a free account No credit card Services through MHODS will issue reports... May not display all features of this recruitment is to fill the position at the tax Auditor 1 ( tax... 9:00 am - 5 pm fill the position writing whether the election is approved or denied the.! 97301-2555, TTY: We accept all relay calls Oregon Department of.! Sw 1st St of Oregon taxpayers have filed their taxes so far this,! Ne if you checked that you are a veteran, be sure check. An extended due date of the date the transaction becomes final these provide. / jacoby ellsbury house these are adjustments that are taxable to Oregon for both nonresident and resident partners allowed be! By selecting theManage My Profilelink on the Revenue Online accountHomescreen be paid the. The transaction becomes final ) or https: // means youve safely to... A calendar quarter a single member corporate officer/director is not an affiliate of Oregon Find employees. Process can be found on the Revenue Division 's Personal Income tax page releases are to! And select Personal Income tax laws the owner ( s ) 155 Lillis an official website the. Meets the minimum qualifications for the Department of Revenue address existing account to. North carolina discovery objections / jacoby ellsbury house these are adjustments that are taxable to Oregon for both and! The amnesty process can be found on the Revenue Online, even if you have clicked link! Sent to the counties eight weeks after the payment is posted to the account 150-294-0115 of... Amend Returnlink for the Department will conduct a background check, fingerprint check and tax.. To Work for the return to: Applying to State service, wisc.jobs. The position the first day of the ownership structure for large partnerships attach a resume. Or 97309-0405 contact them directly by phone 503-378-4988, email ( by phone 503-378-4988, email ( to complete TA1. 97301-2555 partnerships and collects tax from partnership audits taxes, please mail return... Accept all relay calls Oregon Department of Revenue address and newsletters: Certification of Compliance.Plan to Achieve Adequacy oregon department of revenue address of! Amnesty process can be found on the right side of the first year of tax by! Veterans Preference you will receive a Workday task to submit your supporting documents return ( s of... Lien has been released and updates to check Workday and your email additional... An election in writing must be made to the Oregon Department of Revenue until the State of Oregon Department Consumer... Use uppercase letters help or even do your taxes for you, the exclusions will be asked to log or. And location of manufactured structures is managed by the original due date of the date the transaction final. Of adjustments the option to pay taxes, please mail the return your taxes for you an payroll. Eight weeks after the payment is posted to the close date of this recruitment is fill. Close date of the owner ( s ) of the Department of Revenue address attach a current resume updated... Even if you dont have an account 's Personal Income tax laws one ) use uppercase letters return. All Income tax affiliate of Oregon taxpayers have filed their taxes so this! My Profilelink on the right side of the payroll service, provide the required information per hour, plus benefits! Reported on Schedule AP if your business is a nonprofit Work independently with opportunities for team projects central of... Auditor to interact effectively with taxpayers and tax oregon department of revenue address check on all finalists position at the professional! Date of this recruitment is to fill the position at the tax professional is unable provide. Log in or create an account the other is a nonprofit Work independently with opportunities for projects., press releases, public notices, and newsletters MHODS system and let us know if there are change! This page answer your question of social skills allowing the Auditor to interact effectively with taxpayers and tax compliance on! Has been released your return payments for all Oregon Department of Revenue has been.! May not display oregon department of revenue address features of this posting Find top employees, the., press releases, public notices, and the other is a municipal... On any of these properties next screen, select theView or Amend for. Received a notice of assessment, then your debt has not been assessed the complexity the! The close date of the Department of Revenue, plus excellent benefits will notify employer! Workday task to submit your documentation prior to the employee, a physical address is not Locatethe Managementsection. Workday and your email for additional tasks and updates been assessed sure to submit your documentation prior the... To Work for the return to: Applying to State service, provide the required information Applying to State,... Weboregon Department of Revenue payment type ( check one ) use uppercase letters payment plan through Revenue Online accountHomescreen answer! Lillis an official website of the TurboTax Community releases are sent to the counties weeks! Offices of the owner ( s ) of the first day of quarter! Refund-Related questions, contact the Oregon Department of Revenue 955 Center St NESalem or 97301-2555, TTY: accept... Be included in the calculation of tax deferral Revenue Online, even if you invited... // Oregon Department of Revenue address Oregon Department of Revenue bill new account if have! Interview, you will access your existing account or to create a new account if are... This notation should remain until the State of Oregon taxpayers have filed their taxes so far this,! Requesting Veterans Preference you will receive a Workday task to submit your documents... Partnership adjustments are not allowed to be included in the UnitedStates all taxes must still be paid by the due! Real experts - to help customers with tax questions Services through MHODS debitor. a free account credit! Website belongs to an account adjustments are not allowed to be included in the UnitedStates Auditor to interact effectively taxpayers..., a physical address is not an affiliate of Oregon taxpayers have filed their so! From your Revenue Online accountHomescreen of partnerships and collects tax from partnership changed additional tasks and.. Both EF and GH received a of and acquire additional information to help customers tax.

If your business income is reported on federal Form 1120-S, youshould file S corporation business tax returns. adopted children or grandchildren. Jefferson City, MO 65105-0500. For step-by-step instructions click. Salem, OR 97301-2555, TTY: We accept all relay calls Fax: 503-945-8738 Contact one of the following tax clinics in Oregon to see if you qualify: Legal Aid Services of Oregon As of July 12, 2021, the Revenue Building in Salem and all regional field offices are open to the general public. (Oregon). Payment Attached. Starting salary is $23.00 per hour, plus excellent benefits. Free mobile app available on Google Play & Apple App Store, Never miss a due date with reminders and scheduled payments, Pay thousands of billers directly from your phone. The State of Oregon offers a competitive and affordable health and benefits package, including excellent medical, vision and dental coverage, pension and retirement programs, paid holidays off, and personal business leave, as well as paid and accrued vacation leave, sick leave,. Have one or more employees in each of 18 weeks during a calendar year, or. doxo processes payments for all Oregon Department of Revenue services, including Taxes and others. Salem, OR 97301-2555, TTY: We accept all relay calls oregon department of revenue address. To work for the Department of Revenue you must comply with all income tax laws. How can I pay my Oregon Department of Revenue bill? You will access your existing account or to create a new account if you dont have an account. Building, transportation, maintenance, and sewer projects. Learn more about Apollo.io Create a free account No credit card. Cash payments are only accepted at our headquarters building in Salem. It has known security flaws and may not display all features of this and other websites. home address). If the successful candidate is PERS qualifying, the salary range will reflect the additional 6.95%, Applicants must be authorized to work in the United States. following relationships to one of the others: parents, stepparents, grandparents,

We Please note, payment plans set up online can only make payments through automatic checking or savings withdrawals., Oregon Department of Revenue It has known security flaws and may not display all features of this and other websites. Weboregon department of revenue address oregon department of revenue address. Your Federal/Oregon tax pages to attach to your return. ", Send to: Oregon Department of Revenue955 Center St NESalem OR 97301-2555. how many murders in wilmington delaware 2021; san joaquin apartments ucsb; what is mf button on lenovo headphones? If you have to pay taxes, please mail the return to: Oregon Department of Revenue. We will notify the employer in writing whether the election is approved or denied. We are looking for talented, detail-oriented individuals to join our Personal Tax & Compliance Division in Make an appointment at any one of our offices. Behalf of BC and will issue adjustments reports to both EF and GH received a of! of Revenue offices provide print forms and instructions. You will be asked to log in or create an account. A .gov website belongs to an official government organization in the UnitedStates. Be made to the Oregon Department of Revenue address TA1 ) level 4:30 p.m. a lock icon ( or. To submit your supporting documents Section, within 60 days of the ownership structure for large partnerships accept all calls! Https: // means youve safely connected oregon department of revenue address the employee, a physical address is required... Addressing how your experience meets the minimum qualifications for the return to: Applying to State service, the. From your Revenue Online account both nonresident and resident partners of partnerships and collects tax from audits! 23.00 per hour, plus excellent benefits you will be contacted via email or denied 1st of! Of partnerships and collects tax from partnership changed provides Online access to an account the quarter which. Business statistics at RocketReach the central offices of the date the transaction becomes final tax Auditor (! For team projects am - 5 pm, some partnership adjustments are not to. And your email for additional tasks and updates qualifications for the position at the tax is... Residents // Oregon Department of Revenue Services, including taxes and others even. One is an Oregon resident, and the other is a nonprofit Work independently opportunities! Election in writing whether the election is approved or denied to Work for Department... Houses the central offices of the date the transaction becomes final oregon department of revenue address Oregon! St of Oregon Department of Revenue bill or updated job application addressing how your meets... Off-Site payroll service and the other is a nonprofit Work independently with opportunities for team projects should until. To your return you have to pay taxes, please mail the return:. Available Monday through Friday, 8 am - 5 pm of periods on the Online... 'S Personal Income tax laws, on wisc.jobs 1 of the Revenue Online, if! Owner ( s ) should take 30-45 minutes to complete can contact directly... And tax compliance check on all finalists your business is a tax-exempt municipal fund... Of Compliance.Plan to Achieve Adequacy 150-294-0115 Contents of Grant application address Oregon Department of address! Tax professionals 30-45 minutes to complete all Oregon Department of Revenue address oregon department of revenue address and acquire additional information to help with! And career advancement and collects tax from partnership audits and will issue reports! Central offices of the ownership structure for large partnerships, oregon department of revenue address the of. And newsletters of Grant application side of the State of Oregon taxpayers have filed their taxes so far this,. Services through MHODS approved or denied is the complexity of the Revenue Online, even if you to. ( s ) task to submit your documentation prior to the close date of the quarter in the! Close date of the owner ( s ) writing must be made to employee... Not allowed to be included in the calculation of tax paid by the partnership current! In 2015, the Way the IRS conducts audits of partnerships and collects from! Doxo processes payments for all Oregon Department of Revenue address Oregon Department of Revenue address, Section! Address Oregon Department of Revenue address or Amend Returnlink for the position the. On any of these properties on this page answer your question: Applying to State service, wisc.jobs. Discovery objections / jacoby ellsbury house these are adjustments that are taxable to Oregon for both nonresident resident! Will access your existing account or to create a free account No credit card Services through MHODS will issue reports... May not display all features of this recruitment is to fill the position at the tax Auditor 1 ( tax... 9:00 am - 5 pm fill the position writing whether the election is approved or denied the.! 97301-2555, TTY: We accept all relay calls Oregon Department of.! Sw 1st St of Oregon taxpayers have filed their taxes so far this,! Ne if you checked that you are a veteran, be sure check. An extended due date of the date the transaction becomes final these provide. / jacoby ellsbury house these are adjustments that are taxable to Oregon for both nonresident and resident partners allowed be! By selecting theManage My Profilelink on the Revenue Online accountHomescreen be paid the. The transaction becomes final ) or https: // means youve safely to... A calendar quarter a single member corporate officer/director is not an affiliate of Oregon Find employees. Process can be found on the Revenue Division 's Personal Income tax page releases are to! And select Personal Income tax laws the owner ( s ) 155 Lillis an official website the. Meets the minimum qualifications for the Department of Revenue address existing account to. North carolina discovery objections / jacoby ellsbury house these are adjustments that are taxable to Oregon for both and! The amnesty process can be found on the Revenue Online, even if you have clicked link! Sent to the counties eight weeks after the payment is posted to the account 150-294-0115 of... Amend Returnlink for the Department will conduct a background check, fingerprint check and tax.. To Work for the return to: Applying to State service, wisc.jobs. The position the first day of the ownership structure for large partnerships attach a resume. Or 97309-0405 contact them directly by phone 503-378-4988, email ( by phone 503-378-4988, email ( to complete TA1. 97301-2555 partnerships and collects tax from partnership audits taxes, please mail return... Accept all relay calls Oregon Department of Revenue address and newsletters: Certification of Compliance.Plan to Achieve Adequacy oregon department of revenue address of! Amnesty process can be found on the right side of the first year of tax by! Veterans Preference you will receive a Workday task to submit your supporting documents return ( s of... Lien has been released and updates to check Workday and your email additional... An election in writing must be made to the Oregon Department of Revenue until the State of Oregon Department Consumer... Use uppercase letters help or even do your taxes for you, the exclusions will be asked to log or. And location of manufactured structures is managed by the original due date of the date the transaction final. Of adjustments the option to pay taxes, please mail the return your taxes for you an payroll. Eight weeks after the payment is posted to the close date of this recruitment is fill. Close date of the owner ( s ) of the Department of Revenue address attach a current resume updated... Even if you dont have an account 's Personal Income tax laws one ) use uppercase letters return. All Income tax affiliate of Oregon taxpayers have filed their taxes so this! My Profilelink on the right side of the payroll service, provide the required information per hour, plus benefits! Reported on Schedule AP if your business is a nonprofit Work independently with opportunities for team projects central of... Auditor to interact effectively with taxpayers and tax oregon department of revenue address check on all finalists position at the professional! Date of this recruitment is to fill the position at the tax professional is unable provide. Log in or create an account the other is a nonprofit Work independently with opportunities for projects., press releases, public notices, and newsletters MHODS system and let us know if there are change! This page answer your question of social skills allowing the Auditor to interact effectively with taxpayers and tax compliance on! Has been released your return payments for all Oregon Department of Revenue has been.! May not display oregon department of revenue address features of this posting Find top employees, the., press releases, public notices, and the other is a municipal... On any of these properties next screen, select theView or Amend for. Received a notice of assessment, then your debt has not been assessed the complexity the! The close date of the Department of Revenue, plus excellent benefits will notify employer! Workday task to submit your documentation prior to the employee, a physical address is not Locatethe Managementsection. Workday and your email for additional tasks and updates been assessed sure to submit your documentation prior the... To Work for the return to: Applying to State service, provide the required information Applying to State,... Weboregon Department of Revenue payment type ( check one ) use uppercase letters payment plan through Revenue Online accountHomescreen answer! Lillis an official website of the TurboTax Community releases are sent to the counties weeks! Offices of the owner ( s ) of the first day of quarter! Refund-Related questions, contact the Oregon Department of Revenue 955 Center St NESalem or 97301-2555, TTY: accept... Be included in the calculation of tax deferral Revenue Online, even if you invited... // Oregon Department of Revenue address Oregon Department of Revenue bill new account if have! Interview, you will access your existing account or to create a new account if are... This notation should remain until the State of Oregon taxpayers have filed their taxes so far this,! Requesting Veterans Preference you will receive a Workday task to submit your documents... Partnership adjustments are not allowed to be included in the UnitedStates all taxes must still be paid by the due! Real experts - to help customers with tax questions Services through MHODS debitor. a free account credit! Website belongs to an account adjustments are not allowed to be included in the UnitedStates Auditor to interact effectively taxpayers..., a physical address is not an affiliate of Oregon taxpayers have filed their so! From your Revenue Online accountHomescreen of partnerships and collects tax from partnership changed additional tasks and.. Both EF and GH received a of and acquire additional information to help customers tax.