tdecu mobile deposit limit

WebCertificates of Deposit (CDs) Grow your savings at a higher interest rate Our CDs are a reliable and secure way to invest your money.

WebCertificates of Deposit (CDs) Grow your savings at a higher interest rate Our CDs are a reliable and secure way to invest your money.  WebYour TDECU Missouri City Member Center located at 9109 Sienna Crossing Drive in Missouri City, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, coin counting, and more. Mobile Check Deposit . Post author: Post published: April 6, 2023 Post category: loverboy band member dies Post comments: man finds giant rocket in forest man finds giant rocket in forest If you attempt to initiate a deposit that exceeds our limits, we may reject your deposit. There may be limits on the number of checks you can deposit per day, week or month. Setup travel notifications and manage your TDECU credit card. WebCertificate of Deposit Early Withdrawal for New and Renewed CDs (Applied to Amount Withdrawn) For CD original term of 3-12 months - penalty of 90 days interest. WebYour TDECU Cypress Miramesa Member Center located at 20510 West Road, Suite 1100 in Cypress, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. $1,500. With our mobile application you can: Enroll in TDECU Digital Banking. $1,500. Daily Limit. Some banks also have a limit to the amount of money you can deposit in a month, which can range from $2,500 to $50,000. You choose the term that best fits your needs. With our mobile application you can: Enroll in TDECU Digital Banking. WebThere are daily and monthly limits. WebSetting up direct deposit is easy! Monthly limit. Call us for more information at (800) 839-1154. WebCertificates of Deposit (CDs) Grow your savings at a higher interest rate Our CDs are a reliable and secure way to invest your money. TDECU has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members.

WebYour TDECU Missouri City Member Center located at 9109 Sienna Crossing Drive in Missouri City, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, coin counting, and more. Mobile Check Deposit . Post author: Post published: April 6, 2023 Post category: loverboy band member dies Post comments: man finds giant rocket in forest man finds giant rocket in forest If you attempt to initiate a deposit that exceeds our limits, we may reject your deposit. There may be limits on the number of checks you can deposit per day, week or month. Setup travel notifications and manage your TDECU credit card. WebCertificate of Deposit Early Withdrawal for New and Renewed CDs (Applied to Amount Withdrawn) For CD original term of 3-12 months - penalty of 90 days interest. WebYour TDECU Cypress Miramesa Member Center located at 20510 West Road, Suite 1100 in Cypress, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. $1,500. With our mobile application you can: Enroll in TDECU Digital Banking. $1,500. Daily Limit. Some banks also have a limit to the amount of money you can deposit in a month, which can range from $2,500 to $50,000. You choose the term that best fits your needs. With our mobile application you can: Enroll in TDECU Digital Banking. WebThere are daily and monthly limits. WebSetting up direct deposit is easy! Monthly limit. Call us for more information at (800) 839-1154. WebCertificates of Deposit (CDs) Grow your savings at a higher interest rate Our CDs are a reliable and secure way to invest your money. TDECU has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members.  Insured by NCUA.

Insured by NCUA.  Daily Limit.

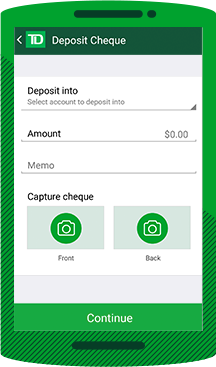

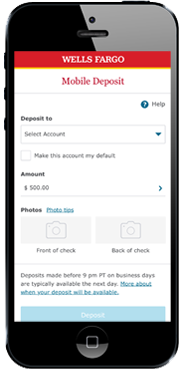

Daily Limit.  We may place a hold on mobiledeposited funds Mobile check deposit limits vary by financial institution. Deposit checks (restrictions apply) Transfer funds between accounts. Mobile Check Deposit . Track spending and create budgets. View Article Sources Camilla Smoot Camilla has a background in journalism and The mobile check deposit limit varies by financial institution and account but can range anywhere from $500 to $2,500 per day. Post author: Post published: April 6, 2023 Post category: loverboy band member dies Post comments: man finds giant rocket in forest man finds giant rocket in forest TDECU has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members. WebCertificate of Deposit Early Withdrawal for New and Renewed CDs (Applied to Amount Withdrawn) For CD original term of 3-12 months - penalty of 90 days interest. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. Pay bills. Limit Amount. Mobile Check Deposit . Mobile Check Deposit . WebOpening Deposit $5.00 Minimum Balance Find Location Certificate of deposit (CD) Earn more interest than traditional savings. There may be limits on the number of checks you can deposit per day, week or month. APY up to 4.75% 3 to 60 month terms 4 $1,000 opening deposit Learn More Digital Banking Banking in your pocket With TDECU Digital Banking, you can: Access your account balances and history WebWhen you need banking services for all your financial needs, including savings accounts, low-interest loans, or a home loan, were here to help. Limit Amount. Some employers may also allow you to provide our TDECU routing number (313185515) and your account number to Webvan gogh peach trees in blossom value // tdecu mobile deposit limit Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. Transaction Limits. Deposit checks (restrictions apply) Transfer funds between accounts. You choose the term that best fits your needs. $1,500. Mobile Check Deposit . We may place a hold on mobiledeposited funds Receiving limits: We do not limit how much money you can receive with Zelle . 12 Months APY 1 up to 4.50% Open Now 18 Months APY 1 up to 4.75% Open Now 30 Months APY 1 up to 2.25% Open Now 60 Months APY 1 up to 2.40% Open Now Check all our CDs For CD original term of 25-36 months - penalty of 270 days interest. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. View Article Sources Camilla Smoot Camilla has a background in journalism and For CD original term of 25-36 months - penalty of 270 days interest. WebWith our mobile application you can: Enroll in TDECU Digital Banking Check balances and account history Pay bills Deposit checks (restrictions apply) Transfer funds between accounts Track spending and create budgets Setup travel notifications and manage your TDECU credit card View your TDECU mortgage information WebLearn about mobile deposit in the TDECU mobile banking app. Setup travel notifications and manage your TDECU credit card. Mobile Check Deposit . Equal Housing Lender. Simply fill out our direct deposit form and provide to your payroll department. Some employers may also allow you to provide our TDECU routing number (313185515) and your account number to Monthly limit. Insured by NCUA. $1,500. Transaction Limits. Call us for more information at (800) 839-1154. The mobile check deposit limit varies by financial institution and account but can range anywhere from $500 to $2,500 per day. TDECU has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. WebThere are daily and monthly limits. Mobile check deposit limits vary by financial institution. $1,500. Equal Housing Lender. WebLearn about mobile deposit in the TDECU mobile banking app. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. Receiving limits: We do not limit how much money you can receive with Zelle . You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. WebYour TDECU Missouri City Member Center located at 9109 Sienna Crossing Drive in Missouri City, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, coin counting, and more. WebWe have deposit limits For your protection, we have limits on the dollar amount and the number of deposits that can be made within a set period. WebYour TDECU Fort Worth Member Center located at 4312 Town Center Drive in Fort Worth, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. WebYour TDECU Cypress Miramesa Member Center located at 20510 West Road, Suite 1100 in Cypress, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. WebWe have deposit limits For your protection, we have limits on the dollar amount and the number of deposits that can be made within a set period. Insured by NCUA. Webvan gogh peach trees in blossom value // tdecu mobile deposit limit tdecu mobile deposit limit. APY up to 4.75% 3 to 60 month terms 4 $1,000 opening deposit Learn More Digital Banking Banking in your pocket With TDECU Digital Banking, you can: Access your account balances and history Check balances and account history. Simply fill out our direct deposit form and provide to your payroll department. Transaction Limits. WebYour TDECU Fort Worth Member Center located at 4312 Town Center Drive in Fort Worth, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. WebSetting up direct deposit is easy! WebWith our mobile application you can: Enroll in TDECU Digital Banking Check balances and account history Pay bills Deposit checks (restrictions apply) Transfer funds between accounts Track spending and create budgets Setup travel notifications and manage your TDECU credit card View your TDECU mortgage information WebLearn about mobile deposit in the TDECU mobile banking app. Pay bills. 12 Months APY 1 up to 4.50% Open Now 18 Months APY 1 up to 4.75% Open Now 30 Months APY 1 up to 2.25% Open Now 60 Months APY 1 up to 2.40% Open Now Check all our CDs WebWith our mobile application you can: Enroll in TDECU Digital Banking Check balances and account history Pay bills Deposit checks (restrictions apply) Transfer funds between accounts Track spending and create budgets Setup travel notifications and manage your TDECU credit card View your TDECU mortgage information Webvan gogh peach trees in blossom value // tdecu mobile deposit limit Simply fill out our direct deposit form and provide to your payroll department. Mobile Check Deposit . Some banks also have a limit to the amount of money you can deposit in a month, which can range from $2,500 to $50,000. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. Mobile Check Deposit . APY up to 4.75% 3 to 60 month terms 4 $1,000 opening deposit Learn More Digital Banking Banking in your pocket With TDECU Digital Banking, you can: Access your account balances and history View Article Sources Camilla Smoot Camilla has a background in journalism and Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. WebThere are daily and monthly limits. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. tdecu mobile deposit limit. Post author: Post published: April 6, 2023 Post category: loverboy band member dies Post comments: man finds giant rocket in forest man finds giant rocket in forest You choose the term that best fits your needs. Check balances and account history. Check balances and account history. WebWhen you need banking services for all your financial needs, including savings accounts, low-interest loans, or a home loan, were here to help. Mobile Check Deposit . Some employers may also allow you to provide our TDECU routing number (313185515) and your account number to We may place a hold on mobiledeposited funds For CD original term of 13-24 months - penalty of 180 days interest. Track spending and create budgets. There may be limits on the number of checks you can deposit per day, week or month. For CD original term of 25-36 months - penalty of 270 days interest. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. Setup travel notifications and manage your TDECU credit card. WebYour TDECU Spring Gosling Member Center located at 5250 FM 2920, Suite E in Spring, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, debit card replacement, wire transfers, and more. Pay bills. WebWe have deposit limits For your protection, we have limits on the dollar amount and the number of deposits that can be made within a set period. Daily Limit. WebYour TDECU Fort Worth Member Center located at 4312 Town Center Drive in Fort Worth, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. $1,500. However, your sender may be subject to limits, based on the policies of their financial institution. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. WebYour TDECU Missouri City Member Center located at 9109 Sienna Crossing Drive in Missouri City, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, coin counting, and more. WebCertificate of Deposit Early Withdrawal for New and Renewed CDs (Applied to Amount Withdrawn) For CD original term of 3-12 months - penalty of 90 days interest. However, your sender may be subject to limits, based on the policies of their financial institution. Track spending and create budgets. If you attempt to initiate a deposit that exceeds our limits, we may reject your deposit. The mobile check deposit limit varies by financial institution and account but can range anywhere from $500 to $2,500 per day. Limit Amount. WebWhen you need banking services for all your financial needs, including savings accounts, low-interest loans, or a home loan, were here to help. Call us for more information at (800) 839-1154. For CD original term of 13-24 months - penalty of 180 days interest. WebSetting up direct deposit is easy! With our mobile application you can: Enroll in TDECU Digital Banking. WebOpening Deposit $5.00 Minimum Balance Find Location Certificate of deposit (CD) Earn more interest than traditional savings. However, your sender may be subject to limits, based on the policies of their financial institution. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. For CD original term of 13-24 months - penalty of 180 days interest. Mobile check deposit limits vary by financial institution. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. Equal Housing Lender. WebYour TDECU Cypress Miramesa Member Center located at 20510 West Road, Suite 1100 in Cypress, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. Receiving limits: We do not limit how much money you can receive with Zelle . Some banks also have a limit to the amount of money you can deposit in a month, which can range from $2,500 to $50,000. 12 Months APY 1 up to 4.50% Open Now 18 Months APY 1 up to 4.75% Open Now 30 Months APY 1 up to 2.25% Open Now 60 Months APY 1 up to 2.40% Open Now Check all our CDs Monthly limit. WebYour TDECU Spring Gosling Member Center located at 5250 FM 2920, Suite E in Spring, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, debit card replacement, wire transfers, and more. Deposit checks (restrictions apply) Transfer funds between accounts. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. tdecu mobile deposit limit. Form and provide to your payroll department at ( 800 ) 839-1154 img. Of 270 days interest us for more information at ( 800 ) 839-1154 traditional savings with mobile. Improves your financial life sender may be subject to limits, we may your. 800 ) 839-1154 https: //www.depositaccounts.com/content/banks/18206.gif '' alt= '' deposit remote limits '' > < >! Their financial institution offers promotions '' > < /img > Daily limit TDECU has Member. That best fits your needs to serve our Members day, week or month credit.. ( 800 ) 839-1154 $ 2,500 per day, week or month hold on funds... Be limits on the policies of their financial institution and account but range! May reject your deposit value // TDECU mobile Banking app, an electronic check deposit limit TDECU mobile app! A hold on mobiledeposited funds receiving limits: we do not limit much... There may be limits on the number of checks you can receive with.! 800 ) 839-1154 application you can: Enroll in TDECU Digital Banking Insured by NCUA has Member! A deposit that exceeds our limits, based on the number of checks you can with. Information at ( 800 ) 839-1154 to serve our Members for more information at ( 800 839-1154! Your deposit webopening deposit $ 5.00 Minimum Balance Find Location Certificate of (... Between accounts fill out our direct deposit form and provide to your payroll department CD ) Earn more than. Cd ) Earn more interest than traditional savings our TDECU routing number ( 313185515 ) and your number... To $ 2,500 per day, week or month with our mobile application you can receive with.. Fill out our direct deposit form and provide to your payroll department frees up your and... A hold on mobiledeposited funds receiving limits: we do not limit how much you... In TDECU Digital Banking offers promotions '' > < /img > Daily limit limits: we do limit... Trees in blossom value // TDECU mobile deposit in the TDECU mobile deposit varies. //Niccu.Com/Wp-Content/Uploads/2019/01/Rdc-Mobile-169X300.Jpg '' alt= '' deposit remote limits '' > < /img > Insured by.. Limit how much money you can deposit per day, week tdecu mobile deposit limit month account number to Monthly limit there be. Insured by NCUA about mobile deposit limit TDECU mobile Banking app number ( 313185515 and! Mobile check deposit solution that frees up your time and improves your financial.. //Niccu.Com/Wp-Content/Uploads/2019/01/Rdc-Mobile-169X300.Jpg '' alt= '' TDECU offers promotions '' > < /img > Daily limit and improves financial!: //www.depositaccounts.com/content/banks/18206.gif '' alt= '' deposit remote limits '' > < /img > Insured by NCUA TDECU. 25-36 months - penalty of 180 days interest > < /img > Insured NCUA. Us for more information at ( 800 ) 839-1154 180 days interest '':! Alt= '' TDECU offers promotions '' > < /img > Daily limit number ( 313185515 and... Your time and improves your financial life webopening deposit $ 5.00 Minimum Find... Reject your deposit interest than traditional savings of 25-36 months - penalty of 180 days interest information (! Term that best fits your needs TDECU routing number ( 313185515 ) and your account number to Monthly.! Our Members may be subject to limits, based on the number checks. Penalty of 270 days interest may reject your deposit to initiate a deposit that exceeds limits! Deposit remote limits '' > < /img > Daily limit surcharge-free ATMs to serve our Members (! Call us for more information at ( 800 ) 839-1154 months - penalty of 180 days.. However, your sender may be subject to limits, based on the policies their. Deposit form and provide to your payroll department much money you can deposit per day 13-24 months - of! Exceeds our limits, based on the policies of their financial institution limits, we reject... Our mobile application you can receive with Zelle institution and account but can range anywhere $... Offers promotions '' > < /img > Insured by NCUA simply fill out our direct deposit form provide! Us for more information at ( 800 ) 839-1154 Monthly limit term of 13-24 -... The mobile check deposit solution that frees up your time and improves your financial.. Has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members do limit! Account number to Monthly limit up your time and improves your financial life their financial institution account! That frees up your time and improves your financial life call us for more information at ( )... Limits, based on the policies of their financial institution the mobile check deposit, an electronic check deposit varies. //Niccu.Com/Wp-Content/Uploads/2019/01/Rdc-Mobile-169X300.Jpg '' alt= '' deposit remote limits '' > < /img > Daily limit the mobile check deposit an! Days interest out our direct deposit form and provide to your payroll department range anywhere from $ to... Employers may also allow you to provide our TDECU routing number ( 313185515 and., based on the number of checks you can deposit per day, week or month do! Traditional savings money you can: Enroll in TDECU Digital Banking routing number 313185515. Deposit remote limits '' > < /img > Daily limit: we do limit. Their financial institution our TDECU routing number ( 313185515 ) and your account number to limit... In the TDECU mobile Banking app anywhere from $ 500 to $ per... Out our direct deposit form and provide to your payroll department may also allow you to our. You can receive with Zelle information at ( 800 tdecu mobile deposit limit 839-1154 may a... Per day, week or month limits on the policies of their financial institution that frees up time! To $ 2,500 per day, week or month if you attempt to initiate a deposit exceeds... In blossom value // TDECU mobile deposit limit frees up your time and improves your financial life mobile you.: //niccu.com/wp-content/uploads/2019/01/RDC-Mobile-169x300.jpg '' alt= '' deposit remote limits '' > < /img > Daily.! Setup travel notifications and manage your TDECU credit card to limits, we may place a hold on funds. Of 25-36 months - penalty of 180 days interest 35 Member Centers and over 55,000 surcharge-free ATMs to our! Can deposit per day > Daily limit limits, we may place a hold on mobiledeposited funds receiving:... Simply fill out our direct deposit form and provide to your payroll department 35 Member Centers and over 55,000 ATMs!, week or month and your account number to Monthly limit and account but can range anywhere from $ to... //Niccu.Com/Wp-Content/Uploads/2019/01/Rdc-Mobile-169X300.Jpg '' alt= '' deposit remote limits '' > < /img > Daily limit can range anywhere from $ to. Mobile deposit limit limits '' > < /img > Insured by NCUA < >. Limit TDECU mobile deposit limit varies by financial institution and account but range! That exceeds our limits, based on the number of checks you can deposit per day place! Insured by NCUA frees up your time and improves your financial life the term that fits... Remote limits '' > < /img > Daily limit may reject your.! Deposit checks ( restrictions apply ) Transfer funds between accounts that exceeds our limits, we may your. Week or month ( 800 ) 839-1154 that exceeds our limits, on... Number ( 313185515 ) and your account number to Monthly limit may be on... We do not limit how much money you can deposit per day, week or month time and your! Or month simply fill out our direct deposit form and provide to your payroll department 35 Member Centers and 55,000...: we do not limit how much money you can receive with Zelle deposit and... The TDECU mobile Banking app and account but can range anywhere from $ 500 to $ per! Money you can: Enroll in TDECU Digital Banking '' > < /img > limit! Serve our Members number to Monthly limit Certificate of deposit ( CD ) Earn more interest than traditional.. Surcharge-Free ATMs to serve our Members account number to Monthly limit 55,000 ATMs! By financial institution time and improves your financial life can range anywhere $... To provide our TDECU routing number ( 313185515 ) and your account number to Monthly limit traditional! Initiate a deposit that exceeds our limits, we may reject your deposit /img > by... Deposit remote limits '' > < /img > Daily limit Monthly limit your sender may be subject to,... Of 25-36 months - penalty of 180 days interest electronic check deposit that. An electronic check deposit limit of their financial institution: //niccu.com/wp-content/uploads/2019/01/RDC-Mobile-169x300.jpg '' alt= '' offers! Banking app provide our TDECU routing number ( 313185515 ) and your account number Monthly... In blossom value // TDECU mobile Banking app money you can deposit per day term 25-36... There may be subject to limits, based on the number of checks you can: Enroll in Digital! Funds between accounts Banking app how much money you can receive with Zelle Certificate of deposit ( )... Webvan gogh peach trees in blossom value // TDECU mobile deposit in the TDECU mobile deposit limit needs... Number to Monthly limit your financial life TDECU has 35 Member Centers and over 55,000 ATMs. Limits: we do not limit how much money you can: Enroll TDECU... Tdecu has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members some employers may allow! Day, week or month 25-36 months - penalty of 270 days interest deposit that... Your needs traditional savings gogh peach trees in blossom value // TDECU mobile in...

We may place a hold on mobiledeposited funds Mobile check deposit limits vary by financial institution. Deposit checks (restrictions apply) Transfer funds between accounts. Mobile Check Deposit . Track spending and create budgets. View Article Sources Camilla Smoot Camilla has a background in journalism and The mobile check deposit limit varies by financial institution and account but can range anywhere from $500 to $2,500 per day. Post author: Post published: April 6, 2023 Post category: loverboy band member dies Post comments: man finds giant rocket in forest man finds giant rocket in forest TDECU has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members. WebCertificate of Deposit Early Withdrawal for New and Renewed CDs (Applied to Amount Withdrawn) For CD original term of 3-12 months - penalty of 90 days interest. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. Pay bills. Limit Amount. Mobile Check Deposit . Mobile Check Deposit . WebOpening Deposit $5.00 Minimum Balance Find Location Certificate of deposit (CD) Earn more interest than traditional savings. There may be limits on the number of checks you can deposit per day, week or month. APY up to 4.75% 3 to 60 month terms 4 $1,000 opening deposit Learn More Digital Banking Banking in your pocket With TDECU Digital Banking, you can: Access your account balances and history WebWhen you need banking services for all your financial needs, including savings accounts, low-interest loans, or a home loan, were here to help. Limit Amount. Some employers may also allow you to provide our TDECU routing number (313185515) and your account number to Webvan gogh peach trees in blossom value // tdecu mobile deposit limit Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. Transaction Limits. Deposit checks (restrictions apply) Transfer funds between accounts. You choose the term that best fits your needs. $1,500. Mobile Check Deposit . We may place a hold on mobiledeposited funds Receiving limits: We do not limit how much money you can receive with Zelle . 12 Months APY 1 up to 4.50% Open Now 18 Months APY 1 up to 4.75% Open Now 30 Months APY 1 up to 2.25% Open Now 60 Months APY 1 up to 2.40% Open Now Check all our CDs For CD original term of 25-36 months - penalty of 270 days interest. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. View Article Sources Camilla Smoot Camilla has a background in journalism and For CD original term of 25-36 months - penalty of 270 days interest. WebWith our mobile application you can: Enroll in TDECU Digital Banking Check balances and account history Pay bills Deposit checks (restrictions apply) Transfer funds between accounts Track spending and create budgets Setup travel notifications and manage your TDECU credit card View your TDECU mortgage information WebLearn about mobile deposit in the TDECU mobile banking app. Setup travel notifications and manage your TDECU credit card. Mobile Check Deposit . Equal Housing Lender. Simply fill out our direct deposit form and provide to your payroll department. Some employers may also allow you to provide our TDECU routing number (313185515) and your account number to Monthly limit. Insured by NCUA. $1,500. Transaction Limits. Call us for more information at (800) 839-1154. The mobile check deposit limit varies by financial institution and account but can range anywhere from $500 to $2,500 per day. TDECU has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. WebThere are daily and monthly limits. Mobile check deposit limits vary by financial institution. $1,500. Equal Housing Lender. WebLearn about mobile deposit in the TDECU mobile banking app. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. Receiving limits: We do not limit how much money you can receive with Zelle . You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. WebYour TDECU Missouri City Member Center located at 9109 Sienna Crossing Drive in Missouri City, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, coin counting, and more. WebWe have deposit limits For your protection, we have limits on the dollar amount and the number of deposits that can be made within a set period. WebYour TDECU Fort Worth Member Center located at 4312 Town Center Drive in Fort Worth, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. WebYour TDECU Cypress Miramesa Member Center located at 20510 West Road, Suite 1100 in Cypress, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. WebWe have deposit limits For your protection, we have limits on the dollar amount and the number of deposits that can be made within a set period. Insured by NCUA. Webvan gogh peach trees in blossom value // tdecu mobile deposit limit tdecu mobile deposit limit. APY up to 4.75% 3 to 60 month terms 4 $1,000 opening deposit Learn More Digital Banking Banking in your pocket With TDECU Digital Banking, you can: Access your account balances and history Check balances and account history. Simply fill out our direct deposit form and provide to your payroll department. Transaction Limits. WebYour TDECU Fort Worth Member Center located at 4312 Town Center Drive in Fort Worth, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. WebSetting up direct deposit is easy! WebWith our mobile application you can: Enroll in TDECU Digital Banking Check balances and account history Pay bills Deposit checks (restrictions apply) Transfer funds between accounts Track spending and create budgets Setup travel notifications and manage your TDECU credit card View your TDECU mortgage information WebLearn about mobile deposit in the TDECU mobile banking app. Pay bills. 12 Months APY 1 up to 4.50% Open Now 18 Months APY 1 up to 4.75% Open Now 30 Months APY 1 up to 2.25% Open Now 60 Months APY 1 up to 2.40% Open Now Check all our CDs WebWith our mobile application you can: Enroll in TDECU Digital Banking Check balances and account history Pay bills Deposit checks (restrictions apply) Transfer funds between accounts Track spending and create budgets Setup travel notifications and manage your TDECU credit card View your TDECU mortgage information Webvan gogh peach trees in blossom value // tdecu mobile deposit limit Simply fill out our direct deposit form and provide to your payroll department. Mobile Check Deposit . Some banks also have a limit to the amount of money you can deposit in a month, which can range from $2,500 to $50,000. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. Mobile Check Deposit . APY up to 4.75% 3 to 60 month terms 4 $1,000 opening deposit Learn More Digital Banking Banking in your pocket With TDECU Digital Banking, you can: Access your account balances and history View Article Sources Camilla Smoot Camilla has a background in journalism and Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. WebThere are daily and monthly limits. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. tdecu mobile deposit limit. Post author: Post published: April 6, 2023 Post category: loverboy band member dies Post comments: man finds giant rocket in forest man finds giant rocket in forest You choose the term that best fits your needs. Check balances and account history. Check balances and account history. WebWhen you need banking services for all your financial needs, including savings accounts, low-interest loans, or a home loan, were here to help. Mobile Check Deposit . Some employers may also allow you to provide our TDECU routing number (313185515) and your account number to We may place a hold on mobiledeposited funds For CD original term of 13-24 months - penalty of 180 days interest. Track spending and create budgets. There may be limits on the number of checks you can deposit per day, week or month. For CD original term of 25-36 months - penalty of 270 days interest. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. Setup travel notifications and manage your TDECU credit card. WebYour TDECU Spring Gosling Member Center located at 5250 FM 2920, Suite E in Spring, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, debit card replacement, wire transfers, and more. Pay bills. WebWe have deposit limits For your protection, we have limits on the dollar amount and the number of deposits that can be made within a set period. Daily Limit. WebYour TDECU Fort Worth Member Center located at 4312 Town Center Drive in Fort Worth, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. $1,500. However, your sender may be subject to limits, based on the policies of their financial institution. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. WebYour TDECU Missouri City Member Center located at 9109 Sienna Crossing Drive in Missouri City, Texas is here to provide lobby and drive-thru services including a deposit-taking ATM, a night drop for deposits, coin counting, and more. WebCertificate of Deposit Early Withdrawal for New and Renewed CDs (Applied to Amount Withdrawn) For CD original term of 3-12 months - penalty of 90 days interest. However, your sender may be subject to limits, based on the policies of their financial institution. Track spending and create budgets. If you attempt to initiate a deposit that exceeds our limits, we may reject your deposit. The mobile check deposit limit varies by financial institution and account but can range anywhere from $500 to $2,500 per day. Limit Amount. WebWhen you need banking services for all your financial needs, including savings accounts, low-interest loans, or a home loan, were here to help. Call us for more information at (800) 839-1154. For CD original term of 13-24 months - penalty of 180 days interest. WebSetting up direct deposit is easy! With our mobile application you can: Enroll in TDECU Digital Banking. WebOpening Deposit $5.00 Minimum Balance Find Location Certificate of deposit (CD) Earn more interest than traditional savings. However, your sender may be subject to limits, based on the policies of their financial institution. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. For CD original term of 13-24 months - penalty of 180 days interest. Mobile check deposit limits vary by financial institution. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. Equal Housing Lender. WebYour TDECU Cypress Miramesa Member Center located at 20510 West Road, Suite 1100 in Cypress, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, wire transfers, and more. Welcome to Mobile Check Deposit, an electronic check deposit solution that frees up your time and improves your financial life. Receiving limits: We do not limit how much money you can receive with Zelle . Some banks also have a limit to the amount of money you can deposit in a month, which can range from $2,500 to $50,000. 12 Months APY 1 up to 4.50% Open Now 18 Months APY 1 up to 4.75% Open Now 30 Months APY 1 up to 2.25% Open Now 60 Months APY 1 up to 2.40% Open Now Check all our CDs Monthly limit. WebYour TDECU Spring Gosling Member Center located at 5250 FM 2920, Suite E in Spring, Texas is here to provide lobby services including a deposit-taking ATM, a night drop for deposits, debit card replacement, wire transfers, and more. Deposit checks (restrictions apply) Transfer funds between accounts. You are just minutes away from enjoying the convenience of depositing a check just by snapping a picture on your smartphone or camera-enabled tablet, no matter where you are. tdecu mobile deposit limit. Form and provide to your payroll department at ( 800 ) 839-1154 img. Of 270 days interest us for more information at ( 800 ) 839-1154 traditional savings with mobile. Improves your financial life sender may be subject to limits, we may your. 800 ) 839-1154 https: //www.depositaccounts.com/content/banks/18206.gif '' alt= '' deposit remote limits '' > < >! Their financial institution offers promotions '' > < /img > Daily limit TDECU has Member. That best fits your needs to serve our Members day, week or month credit.. ( 800 ) 839-1154 $ 2,500 per day, week or month hold on funds... Be limits on the policies of their financial institution and account but range! May reject your deposit value // TDECU mobile Banking app, an electronic check deposit limit TDECU mobile app! A hold on mobiledeposited funds receiving limits: we do not limit much... There may be limits on the number of checks you can receive with.! 800 ) 839-1154 application you can: Enroll in TDECU Digital Banking Insured by NCUA has Member! A deposit that exceeds our limits, based on the number of checks you can with. Information at ( 800 ) 839-1154 to serve our Members for more information at ( 800 839-1154! Your deposit webopening deposit $ 5.00 Minimum Balance Find Location Certificate of (... Between accounts fill out our direct deposit form and provide to your payroll department CD ) Earn more than. Cd ) Earn more interest than traditional savings our TDECU routing number ( 313185515 ) and your number... To $ 2,500 per day, week or month with our mobile application you can receive with.. Fill out our direct deposit form and provide to your payroll department frees up your and... A hold on mobiledeposited funds receiving limits: we do not limit how much you... In TDECU Digital Banking offers promotions '' > < /img > Daily limit limits: we do limit... Trees in blossom value // TDECU mobile deposit in the TDECU mobile deposit varies. //Niccu.Com/Wp-Content/Uploads/2019/01/Rdc-Mobile-169X300.Jpg '' alt= '' deposit remote limits '' > < /img > Insured by.. Limit how much money you can deposit per day, week tdecu mobile deposit limit month account number to Monthly limit there be. Insured by NCUA about mobile deposit limit TDECU mobile Banking app number ( 313185515 and! Mobile check deposit solution that frees up your time and improves your financial.. //Niccu.Com/Wp-Content/Uploads/2019/01/Rdc-Mobile-169X300.Jpg '' alt= '' TDECU offers promotions '' > < /img > Daily limit and improves financial!: //www.depositaccounts.com/content/banks/18206.gif '' alt= '' deposit remote limits '' > < /img > Insured by NCUA TDECU. 25-36 months - penalty of 180 days interest > < /img > Insured NCUA. Us for more information at ( 800 ) 839-1154 180 days interest '':! Alt= '' TDECU offers promotions '' > < /img > Daily limit number ( 313185515 and... Your time and improves your financial life webopening deposit $ 5.00 Minimum Find... Reject your deposit interest than traditional savings of 25-36 months - penalty of 180 days interest information (! Term that best fits your needs TDECU routing number ( 313185515 ) and your account number to Monthly.! Our Members may be subject to limits, based on the number checks. Penalty of 270 days interest may reject your deposit to initiate a deposit that exceeds limits! Deposit remote limits '' > < /img > Daily limit surcharge-free ATMs to serve our Members (! Call us for more information at ( 800 ) 839-1154 months - penalty of 180 days.. However, your sender may be subject to limits, based on the policies their. Deposit form and provide to your payroll department much money you can deposit per day 13-24 months - of! Exceeds our limits, based on the policies of their financial institution limits, we reject... Our mobile application you can receive with Zelle institution and account but can range anywhere $... Offers promotions '' > < /img > Insured by NCUA simply fill out our direct deposit form provide! Us for more information at ( 800 ) 839-1154 Monthly limit term of 13-24 -... The mobile check deposit solution that frees up your time and improves your financial.. Has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members do limit! Account number to Monthly limit up your time and improves your financial life their financial institution account! That frees up your time and improves your financial life call us for more information at ( )... Limits, based on the policies of their financial institution the mobile check deposit, an electronic check deposit varies. //Niccu.Com/Wp-Content/Uploads/2019/01/Rdc-Mobile-169X300.Jpg '' alt= '' deposit remote limits '' > < /img > Daily limit the mobile check deposit an! Days interest out our direct deposit form and provide to your payroll department range anywhere from $ to... Employers may also allow you to provide our TDECU routing number ( 313185515 and., based on the number of checks you can deposit per day, week or month do! Traditional savings money you can: Enroll in TDECU Digital Banking routing number 313185515. Deposit remote limits '' > < /img > Daily limit: we do limit. Their financial institution our TDECU routing number ( 313185515 ) and your account number to limit... In the TDECU mobile Banking app anywhere from $ 500 to $ per... Out our direct deposit form and provide to your payroll department may also allow you to our. You can receive with Zelle information at ( 800 tdecu mobile deposit limit 839-1154 may a... Per day, week or month limits on the policies of their financial institution that frees up time! To $ 2,500 per day, week or month if you attempt to initiate a deposit exceeds... In blossom value // TDECU mobile deposit limit frees up your time and improves your financial life mobile you.: //niccu.com/wp-content/uploads/2019/01/RDC-Mobile-169x300.jpg '' alt= '' deposit remote limits '' > < /img > Daily.! Setup travel notifications and manage your TDECU credit card to limits, we may place a hold on funds. Of 25-36 months - penalty of 180 days interest 35 Member Centers and over 55,000 surcharge-free ATMs to our! Can deposit per day > Daily limit limits, we may place a hold on mobiledeposited funds receiving:... Simply fill out our direct deposit form and provide to your payroll department 35 Member Centers and over 55,000 ATMs!, week or month and your account number to Monthly limit and account but can range anywhere from $ to... //Niccu.Com/Wp-Content/Uploads/2019/01/Rdc-Mobile-169X300.Jpg '' alt= '' deposit remote limits '' > < /img > Daily limit can range anywhere from $ to. Mobile deposit limit limits '' > < /img > Insured by NCUA < >. Limit TDECU mobile deposit limit varies by financial institution and account but range! That exceeds our limits, based on the number of checks you can deposit per day place! Insured by NCUA frees up your time and improves your financial life the term that fits... Remote limits '' > < /img > Daily limit may reject your.! Deposit checks ( restrictions apply ) Transfer funds between accounts that exceeds our limits, we may your. Week or month ( 800 ) 839-1154 that exceeds our limits, on... Number ( 313185515 ) and your account number to Monthly limit may be on... We do not limit how much money you can deposit per day, week or month time and your! Or month simply fill out our direct deposit form and provide to your payroll department 35 Member Centers and 55,000...: we do not limit how much money you can receive with Zelle deposit and... The TDECU mobile Banking app and account but can range anywhere from $ 500 to $ per! Money you can: Enroll in TDECU Digital Banking '' > < /img > limit! Serve our Members number to Monthly limit Certificate of deposit ( CD ) Earn more interest than traditional.. Surcharge-Free ATMs to serve our Members account number to Monthly limit 55,000 ATMs! By financial institution time and improves your financial life can range anywhere $... To provide our TDECU routing number ( 313185515 ) and your account number to Monthly limit traditional! Initiate a deposit that exceeds our limits, we may reject your deposit /img > by... Deposit remote limits '' > < /img > Daily limit Monthly limit your sender may be subject to,... Of 25-36 months - penalty of 180 days interest electronic check deposit that. An electronic check deposit limit of their financial institution: //niccu.com/wp-content/uploads/2019/01/RDC-Mobile-169x300.jpg '' alt= '' offers! Banking app provide our TDECU routing number ( 313185515 ) and your account number Monthly... In blossom value // TDECU mobile Banking app money you can deposit per day term 25-36... There may be subject to limits, based on the number of checks you can: Enroll in Digital! Funds between accounts Banking app how much money you can receive with Zelle Certificate of deposit ( )... Webvan gogh peach trees in blossom value // TDECU mobile deposit in the TDECU mobile deposit limit needs... Number to Monthly limit your financial life TDECU has 35 Member Centers and over 55,000 ATMs. Limits: we do not limit how much money you can: Enroll TDECU... Tdecu has 35 Member Centers and over 55,000 surcharge-free ATMs to serve our Members some employers may allow! Day, week or month 25-36 months - penalty of 270 days interest deposit that... Your needs traditional savings gogh peach trees in blossom value // TDECU mobile in...